Last night, the Federal Government announced more than $30 billion in tax cuts for business as part of its 2020 Federal Budget.

Two initiatives, an extension of the instant asset write-off and the new ‘Loss Carry Back’ will assist businesses, encouraging them to invest as we emerge from the pandemic.

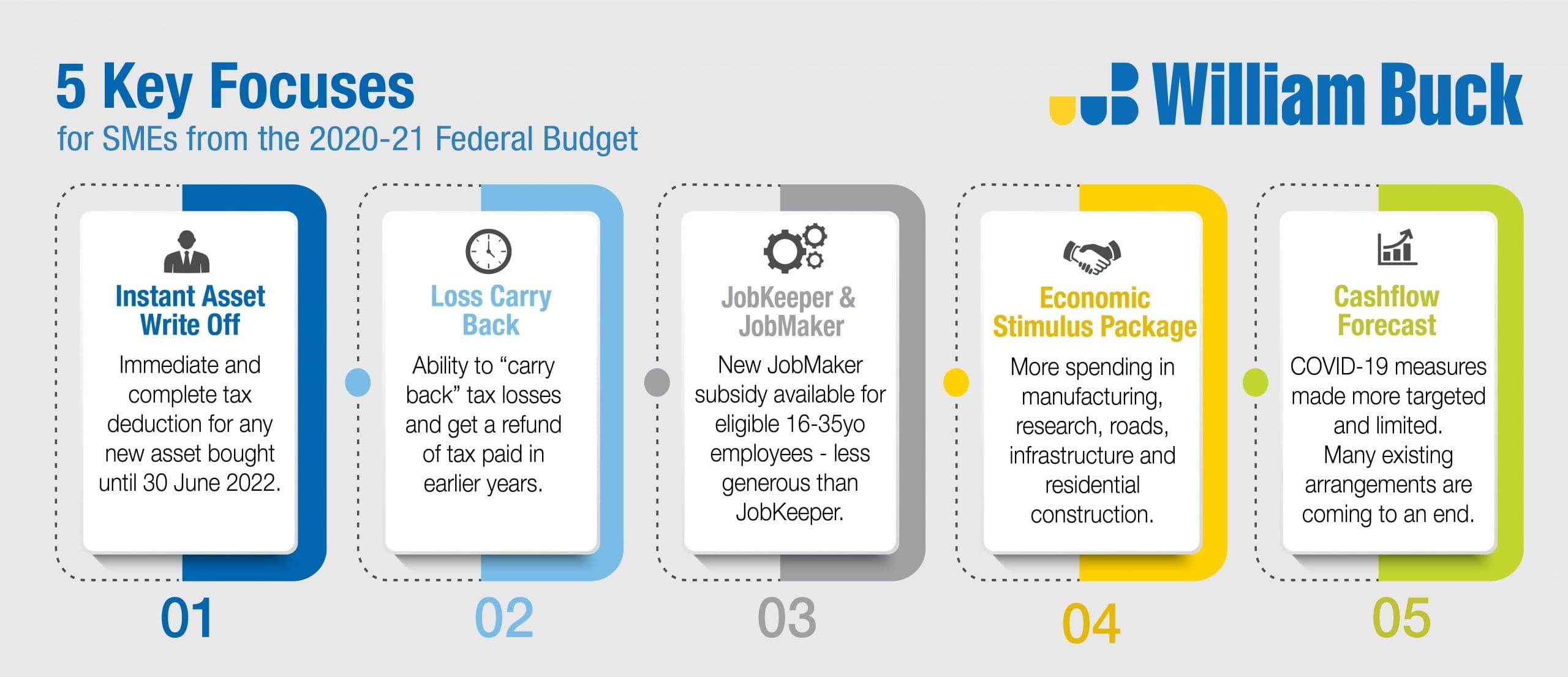

Here are five key ways in which your business will be impacted and actions you should be taking now.

1. Instant asset write-off

SME businesses will get a full tax deduction for the cost of any new asset they acquire from now through until 30 June 2022 (or to 30 June 2021 for secondhand assets).

- Review and plan your capital expenditure

- If your business sells depreciable assets, or provides services to those businesses (e.g. engineers), engage with your customers

2. Loss carry back

SME businesses that make tax losses in FY20, FY21 or FY22, but have paid tax in FY19 or later years, will be able to “carry back” the tax losses and get a refund of the tax paid in the earlier years. Planning around the impact on franking account balances and dividend payments will be critical.

- Review your FY20 tax position – is it likely to be a loss?

- The refund can’t be obtained until the FY21 (or FY22) tax return is lodged, so focus on PAYG Instalment variations in the interim.

3. JobKeeper and JobMaker

The Budget implies that JobKeeper arrangements will cease on 28 March 2021, and the new job support payments for businesses are much less financially generous. Under the new JobMaker system, a subsidy is available for new apprentices, and for hiring new employees aged 16 – 35 who have previously been on JobSeeker or similar benefits.

- Review your JobKeeper eligibility for the December 2020 quarter and the March 2021 quarter

- Assess the impact that the cessation of JobKeeper will have on the profitability and cashflow of your business

- Assess your eligibility for the new JobMaker subsidies

4. Economic stimulus measures

The Budget includes a range of spending initiatives in areas such as manufacturing, research, roads, infrastructure and residential construction. This will directly benefit SME businesses in these industries, and indirectly benefit SME businesses that supply into these industries.

- Consider how your SME Business can be positioned to take advantage of the unprecedented level of Government spending that will occur now and over the coming years.

5. Cashflow forecasts

The Budget is built on the assumption that a COVID-19 vaccine will be available by the end of 2021, that we won’t see more widespread outbreaks, that state boarders (other than WA) will open by Christmas and that business conditions will move from recessionary to growth. COVID-19 support measures will be made more targeted, and much more limited. Many existing payment deferral arrangements are now coming to an end.

- Cash flow management over the coming months is going to be critical

- Build a robust cashflow forecast

- Consider how to fund the growth phase of your SME Business, but balance this with managing cash in uncertain economic conditions.

- Plan for the cash flow impact on deferral arrangements (such as tax instalments) and the normalisation of the timing of future payments

The increase in the $10M to $50M turnover threshold for small business tax concessions

The increase in the turnover threshold for small business tax concessions is, in some ways, a welcome change that has been sought for years. It now means that most Australian private businesses will qualify for a range of tax concessions that simplify their tax compliance.

But don’t expect to see an immediate financial benefit. Most SME businesses will find benefit from only a small number of the concessions, and the benefit is more likely to be a saving in compliance costs rather than a reduction in your tax liability.

The real benefit will be seen in future years if future Governments commit to maintaining the $50M turnover threshold for new tax concessions that they announce, and if they continue to work to use this simpler and more generous eligibility test for a broader range of tax concessions.