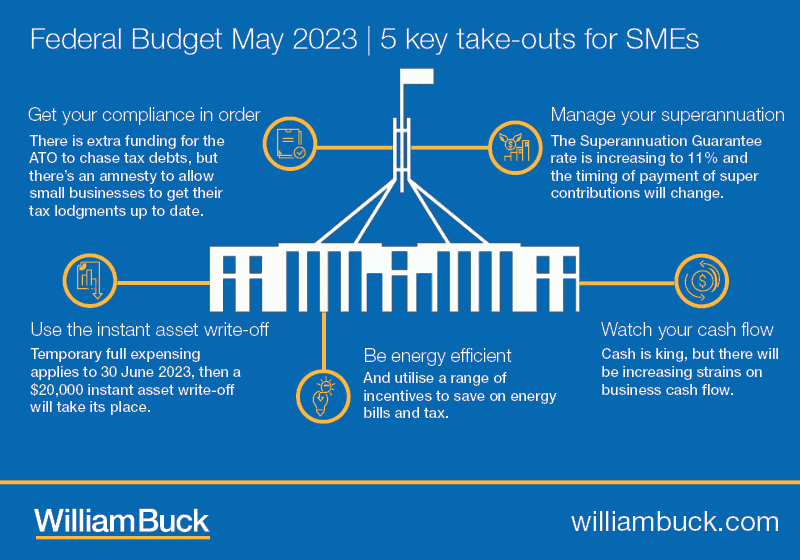

1. Get your compliance in order

The ATO is focusing on high value debts over $100,000 and debts more than 2 years old. These taxpayers should expect more robust debt collection activity.

For business with turnover of less than $10m, no late lodgement penalties will be applied for outstanding tax filings that are lodged before 31 December 2023. This applies where the original due date was after 1 December 2019.

2. Be energy efficient

SME businesses with turnover of less than $50m will be able to claim up to $20,000 additional depreciation deductions on assets acquired to support more efficient use of energy.

The FBT exemption for electric cars will continue, but the exemption for plug in hybrids will be phased out from 1 April 2025.

Small businesses will also be eligible for a once off $650 offset on their energy bill.

3. Use the instant asset write off

Temporary full expensing is available to all businesses with less than $5bn in turnover. There is no cap on the cost of assets that are eligible, but the assets need to be held ready for use by 30 June 2023.

From 1 July 2023 to 30 June 2024 businesses with turnover of less than $10m can claim a deduction for the cost of acquiring depreciating assets costing less than $20,000 each.

4. Manage your superannuation

The Superannuation Guarantee rate will increase to 11% from 1 July 2023, then 11.5% from 1 July 2024 and finally to 12% from 1 July 2025. Payroll arrangements will need to be revised to allow for this.

From 1 July 2026, the timing of payment of superannuation contributions will change from quarterly to be aligned with the timing of the payroll.

5. Watch your cash flow

Economic activity is forecast to decrease in FY23-24 and inflation is expected to peak. Covid era incentives and concessions have been wound back.

The ATO will be increasingly focused on chasing outstanding lodgements and collecting tax debts.

Businesses need to be particularly prudent in their cash flow management and forecasting for this coming year.