Salary packaging can be an excellent way for employees to save tax. Medical professionals in hospitals, for example, often overlook, salary packaging, a fantastic perk of their jobs due to their busy schedules. Maximising salary packaging each year is important, and it can be a great tool to get ahead financially. Here’s why it’s crucial to make the most of salary packaging –

What is salary packaging?

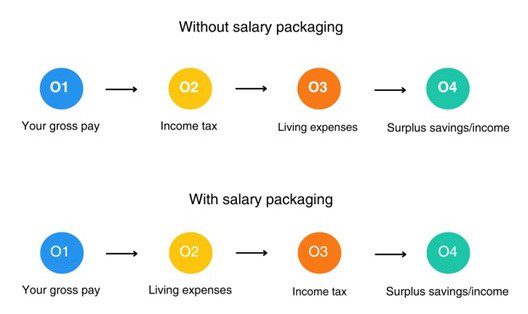

Simply put, salary packaging is a process where you restructure your salary to save tax. The ‘packaging’ involves paying for certain items in pre-tax dollars, with the balance of your salary paid like normal wages into your bank account, minus your regular superannuation contributions and tax withheld. This approach can potentially reduce your taxable income, increase your take-home pay and allow more disposable income for personal expenditure as well as future investment opportunities.

Depending on your employer, there are limits to how much you may salary sacrifice. Most hospitals, for example, have a tax-free limit of $9,010 per annum while many not-for-profit organisations have a limit of $15,900. Crucially, should you work for two different employers, such as private & public hospitals, you can salary package both employer thresholds. This creates unique structuring opportunities to optimise household budgets.

How does salary packaging work?

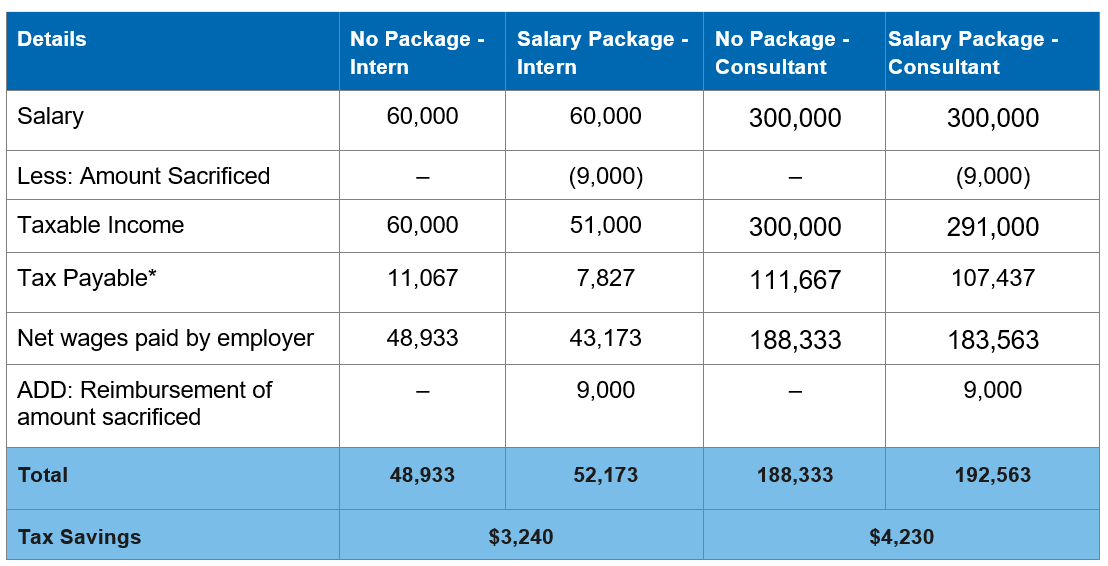

You can package your salary towards specific expenses, like vehicle lease payments, electronic devices or mortgage/rent repayments. This redirection happens before income tax is deducted, potentially lowering your taxable income. An example of such a structure is highlighted below:

If done correctly, salary packaging means you save tax, leaving more money in your pocket at the end of the year. Paying for certain items in ‘pre-tax dollars’ reduces your taxable income, and a reduced taxable income equates to less income tax and increased savings.

A good way of packaging your salary might be to package part of your salary to cover the cost of your mortgage payments. Instead of paying your mortgage completely using post-tax income, your employer can pay up to $9,010 of your payments using pre-tax dollars. Two major upsides to this strategy are that you not only reduce your taxable income but also package mortgage payments, which would not usually be allowable as a personal tax deduction.

In our experience, your packaging strategy should be to package benefits that are not allowable as a personal tax deduction. When claiming a benefit at tax time, packaging it might not prove beneficial to your overall financial position. To understand how salary packaging works and how it can be structured to best suit your financial affairs, it is important to consult with a specialist financial adviser and/or tax professional.

Examples of working multiple Jobs/changing jobs throughout the Salary Packaging year

Unlike the regular financial year, the salary packaging calendar starts on the 1st of April and ends on the 31st of March, creating unique opportunities to maximise two employer salary packaging caps. Here are a couple of examples we have come across recently.

Changing employers:

In November, a client notified us that they would be moving interstate in January and would be ceasing employment with their current employer, a public hospital. After reviewing the client’s new employment and salary packaging contract, we found that they had the opportunity to package $9,010 before March 31. This meant we could maximise their current $9,010 package before their employment ceased in January and put in place an arrangement to maximise their new $9,010 package before March 31. From April 1, we will then optimise their package to maximise over the new salary packaging year significantly reducing their taxable income and thus, increasing personal cashflow.

Starting a second job:

A client notified us in January that they would be commencing part time VMO work at a public hospital while they would maintain their current arrangement at their private hospital. Like the previous example, their employment contract specified they could package $9,010 tax-free. This means we can continue our packaging arrangement with the private hospital as well as optimise a structure to maximise her new $9,010 cap between January and March 31.

Crucially to note, if you work between different hospitals, but your employer remains the same (i.e. QLD Health, NSW Health), you will only have access to the one tax-free threshold.

Buying a car/electric car with salary packaging

If a car is provided to an employee by their employer and it is not a “tool of the trade” (a certain vehicle predominantly used for employment) and instead the vehicle is made available for the employee’s personal use and enjoyment, then the employer would be liable for fringe benefits tax (FBT).

While FBT is payable by the employer, most arrangements such as novated leases, are structured with after-tax contribution payments that eliminate the requirement for the company to pay FBT. However, having to pay for some of the lease from after-tax earnings means less in an employee’s take-home pay.

There is no need for this after-tax payment with the new FBT exemption on electronic vehicles, allowing employees to fund the purchase and running costs of the vehicle wholly from their pre-tax salary.

It is important to note that plug-in hybrid vehicles were also part of the FBT exemption on electronic vehicles in Australia, However, the exemption for plug-in hybrid vehicles is currently only available up until the 2025 FBT year, ending on 31 March 2025.

As of March 2024, the Climate Change Minister Chris Bowen announced that the government was mulling over an extension of the exemption for buyers of leased plug-in hybrid vehicles.

Salary Sacrifice to Super

Salary sacrificing to superannuation can be an excellent way to build wealth in a tax friendly environment while reducing taxable income. Most employers will allow additional contributions to super which are contributed pre-tax, and, in some instances, employers will provide additional contributions if you take up this option. Contributing through salary packaging can also be a great way to stick to your long-term superannuation goals as this is money you won’t ‘see’. To maximise your yearly $27,500 concessional contribution cap, we recommend pairing long-term wealth accumulation inside superannuation with personal tax-deductible contributions. It’s best to discuss superannuation strategies in detail with your advisers to ensure they are suitable for your personal circumstances and goals.

Case Studies

The following examples outline the tax savings and additional disposable income available to a first-year intern as well as a staff specialist consultant.

As the table above showcases, salary packaging is improving the financial position of both doctors.

It is important to note that in most salary sacrifice situations for interns, employers do not consider the HELP debt because, in their eyes, the salary may be below the relevant threshold which in turn, could give rise to a tax debt at the end of the financial year.

When proceeding with a salary sacrifice arrangement, we work with our clients to calculate their HELP repayment amount manually, based on the relevant repayment income thresholds. We then ask either their employer to withhold that specific amount from each pay as an “upwards variation” or allocate the correct amounts ourselves, ensuring we set the right amounts aside for no surprises during the income tax return lodgement.

In a lot of instances, taxpayers with a HELP debt can benefit from repaying their HELP debt early. Many people may choose to use their salary sacrifice tax savings as voluntary repayments, especially considering the current high inflation rates that the government uses to “index” the value of the loan repayable at a certain point in time. In addition, paying back HELP debt early could help secure a home loan as banks now closely examine the variety of debts that individuals may hold before offering them any finance arrangement.

Start making the most of salary packaging today

It’s important to ensure you have effectively structured your salary packaging arrangement to suit your situation as, without proper guidance, there is a risk that an unexpected tax bill could negate any potential tax savings.

You can also learn more about how to provide your employees with salary packaging for electric cars here.

As this article is general and all personal circumstances are different, you will need to seek advice that is tailored to your situation. If you would like to find out more about salary packaging and how it can benefit you, contact your local William Buck advisor today.