With so many grants up for grabs, you may not even realise that you’re eligible to apply.

There are a number of government incentives that you could be eligible to access either at a Federal, State or local level. Australia has over 3000+ grants, funding programs, tax incentives and assistance measures to help SMEs.

Many businesses have turned to government grants and funding programs as relief from the hardship of COVID-19. There’s a good chance that most SMEs are eligible for a grant they don’t know exists. In addition to the latest coronavirus measures, if you’re considering updating your equipment or wanting to expand your business, there are countless grants available.

Receiving a government grant is seen as a highly prestigious opportunity and attracts attention from investors and other funding providers. For startups in particular, being seen as ‘validated’ by the government has a positive impact on the legitimacy and influence of your business.

The facts

- Grants can be in the form of R&D tax incentives, wage subsidies, loan deferrals or cash

- Business applicant criteria is commonly small to medium enterprises (SME)

- You can claim for a range of activities including research and development, marketing, training, and exporting

- You’ll be surprised at how many industry specific grants are available

- Grants are also available from companies such as Coles, Woolworths and Mars

- Most grants have a firm deadline for application submission

You can find a grant or support program to help your business either by searching on the Australian Government Business website or speaking with your local William Buck advisor.

Our Top Pick

Research and Development (R&D) Tax Incentive

Details: This is a Federal grant providing eligible applicants with a tax offset of up to 43.5% for costs incurred conducting eligible R&D activities. The tax offset is received upon lodgement of the applicant’s Income Tax Return with the Australian Taxation Office.

Who can apply? Companies incorporated in Australia that engage in eligible R&D activities and have R&D expenditure of at least $20,000 in an income year.

Deadline to apply: Companies must submit their R&D application with AusIndustry within 10 months of the end of their income year. As a result of the COVID-19 pandemic there are extensions. If your accounting period is from 1 January 2019 to 31 December 2019, you can lodge your application up to 31 March 2021. If your substituted accounting period ends before 31 December 2019, you can lodge your application up to 15 months after it closes. If you can’t lodge your application by the relevant date, you can request an extension of time. You should do this in the usual way.

Tip: Don’t wait until after the end of the income year to determine whether your company qualifies for the R&D tax incentive. Contemporaneous documentation is crucial and now is the time to implement comprehensive record keeping.

Click here for more information on the R&D Tax Incentive. Make sure you’re not missing out on the R&D tax break.

At a glance – other grants to consider

- There are a number of Grants, loans and financial assistance available, visit the Service NSW for information.

- The Cooperative Research Centre Grant for medium to long-term projects (three-ten years). They fund up to 50% of eligible grant project costs for an industry-led research collaboration between at least one Australian industry organisation and one Australian research organisation (e.g. university). Previous grants range between $7 million and $75 million. The next round is expected to open early 2021.

- Business owners experiencing difficulties due to COVID-19 can find the benefits, rebates and concessions available to them on the NSW Government website. There are a number of government grants available as well as government guarantees for loans.

- The Export Market Development Grant for Australian exporters is a cash grant of up to 50% of promotional expenses incurred to a maximum of $150,000. Applications are due by 30 November each year.

- Recycling Equipment Rebates for NSW businesses of between $1,000 and $50,000 to cover up to 50% of the capital costs of installing small-scale, on-site recycling equipment.

- Digital Adaptation and Innovation Grants are available through most local councils to assist with website development, online presence and online sales ordering. Eligibility and amounts available for funding vary between councils. Check your local council website for more information.

- The NSW Minimum Viable Product Grant is a cash grant of up to $25,000 for NSW startups to progress from a proof of concept stage to an MVP.

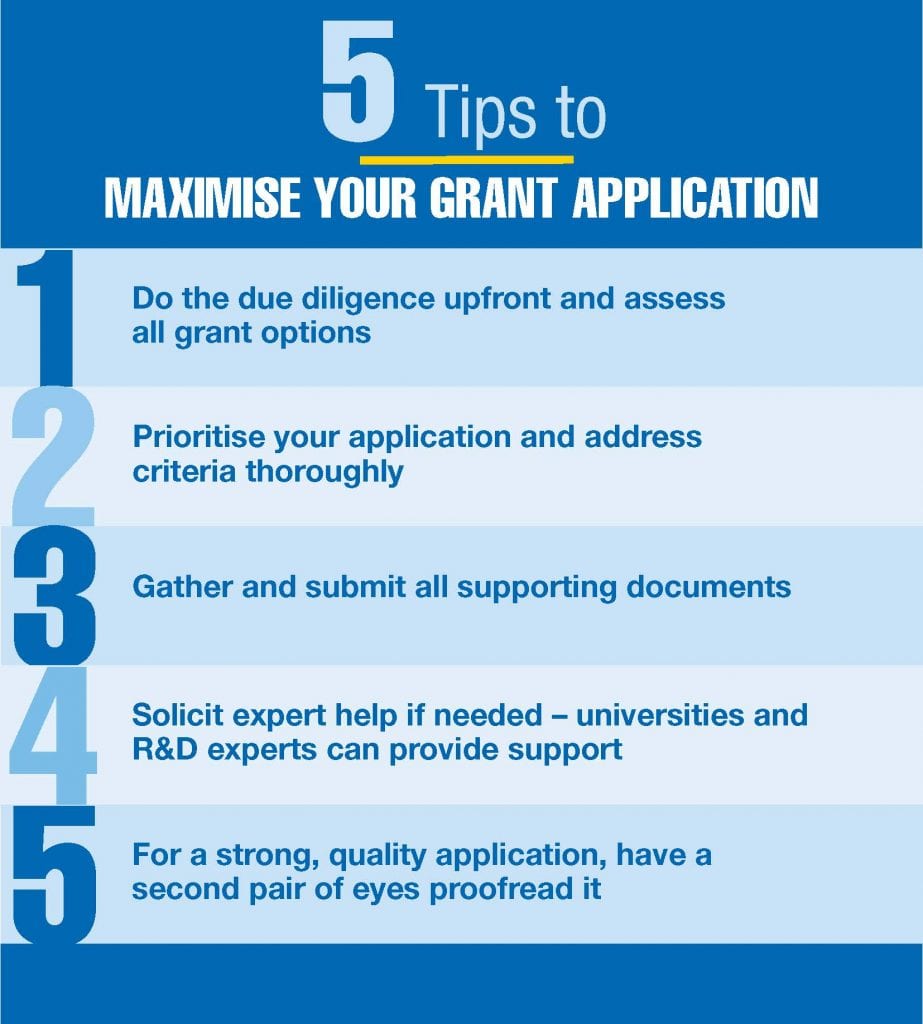

Insight tips from our Experts