Treasurer Josh Frydenberg and Senator and Finance Minister Mathias Cormann today announced some unsurprising numbers as part of an Economic and Fiscal Update ahead of the Federal Budget, to be handed down on 6 October 2020.

These include:

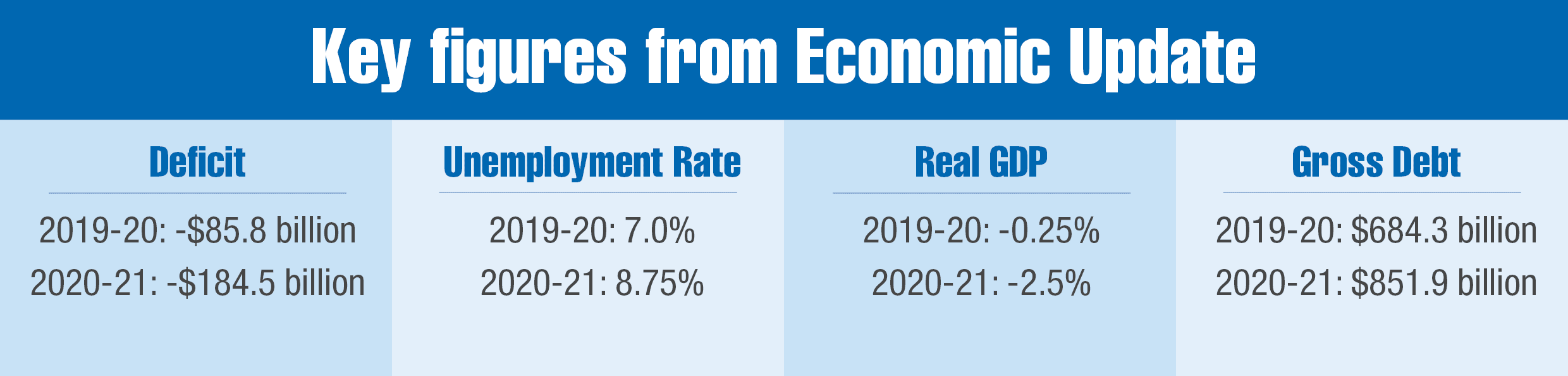

- An $85.8 billion deficit in the 2019-20 financial year financial year

- An expected $184.5 billion deficit in 2020-21

- Gross debt expected to increase to $851.9 billion by the end the 2020-21 financial year

Coronavirus support measures and a reduction in revenue due to lockdowns and social distancing regulations have impacted Australia’s economic position significantly.

And while these forecasts remain for now, they could change depending on additional lockdowns that might further stall the economy.

“How we manage future cases of coronavirus will be absolutely key to the economic recovery, both the speed and trajectory,” said Mr Frydenberg.

Small-to-Medium Business

The COVID-19 SME Guarantee Scheme will be extended until 30 June 2021, albeit with targeted amendments.

While the finer details of the second phase of the Scheme are being finalised, it is proposed that from 1 October:

- Loans can be used for a broader range of business purposes including to support investment

- The maximum loan size will increase from $250,000 to $1 million per borrower

- Loans can be offered for terms of up to five years, rather than the current three year term, with a potential six month repayment holiday at the discretion of the lender

- A loan can be secured or unsecured (excluding commercial or residential property).

Superannuation

The Government has also announced an extension for individuals accessing their superannuation early. The application period has been extended from 24 September to 31 December 2020.

JobKeeper Payment Extension

On Tuesday, 21 July, the Government announced that the JobKeeper Payment Scheme would be extended to 28 March 2021. While there will be changes to eligibility for the Scheme and the payment amounts, these will only apply from 28 September 2020, meaning that those businesses currently eligible for the JobKeeper Payments Scheme, will remain eligible until the first phase ends on 27 September 2020.

From 28 September 2020, businesses will need to re-test their eligibility to remain in the JobKeeper Payment Scheme, with those eligible receiving different tiers of payments based on the hours the eligible employee worked.

The finer details of this second phase of JobKeeper Payments are yet to be released, however some of the key details known at this stage are as set out below.

Subsidy Rates

From 28 September 2020, the $1500 wage subsidy will be reduced to:

- $1200 per fortnight for ‘full-time’ workers, and

- $750 for part ‘part-time’ workers.

From 4 January 2021, it will be further reduced to:

- $1000 per fortnight for full-time workers

- $650 per fortnight for part-time workers

Importantly, an employee will be considered ‘full-time’ where they were actively engaged in the business for 20 hours or more per week (on average) during the month of February 2020. If they don’t meet this requirement, they will be considered ‘part-time’ and thus the lower JobKeeper Payment amount would apply.

Continued eligibility

There are also changes to the way in which eligibility for the Scheme will be assessed.

From 28 September 2020:

- Business and not-for-profits seeking to continue claiming the JobKeeper Payment will be required to demonstrate that they have suffered an ongoing significant decline in turnover based on their actual GST turnover in recent periods (rather than projected GST turnover).

- They will be required to reassess their eligibility with reference to their actual GST turnover in the June and September quarters 2020. They will need to demonstrate that they have met the relevant decline in turnover test in both of those quarters to be eligible for JobKeeper Payments from 28 September to 3 January 2021.

From 4 January 2021:

- Business and not-for-profits will need to further reassess their turnover for eligibility. They will need to demonstrate that they have met the relevant decline in turnover test with reference to their actual GST turnover in each of the June, September and December 2020 quarters to remain eligible from 4 January 2021.

William Buck expects more details on JobKeeper to be announced in the coming weeks and we will be updating information as these occur.

Please join us on 6 October for coverage on the Federal Budget and how it will affect you.