Four in ten startups fail in the first five years of business. CB Insights recently dug into the “post mortems” of 101 failed startups and found that the second most cited reason for failure was that the company ran out of cash. Similarly, the Victorian Government recently announced that 80% of businesses fail because of cash flow problems.

While cash flow is the lifeblood of any and every business, it’s particularly important for startups.

In the initial phases of a business (for example the research and development (R&D) phase), startups struggle with cash flow because the process can be lengthy and involve large amounts of cash outflow. This outflow is experienced prior to sales, so to continue operating and enable growth, securing cash inflow becomes crucial.

Here are four tips to help you ensure adequate cash flow for your startup:

1. Create a budget of income and expenses

Creating a cash flow first requires a budget of income and expenses. There are free online tools available to help you create a budget such as Capterra and Business Victoria’s Cash Flow Forecasting tool.

When creating your budget, consider the following:

- Your budget will need to include the expected timings on each inflow and outflow – remember that this will never be perfect and is an ‘educated guess’ that generally gets more accurate each time you revisit it.

- Budgeted ins and outs should be realistic and conservative so as not to overestimate your finances and fall short.

While a budget details where your finances will go over a 12-month period, it won’t monitor your cash flow. For this, you need a cash flow forecast.

2. Forecast for the future

Create a cash flow forecast to estimate the amount of money you expect to flow into and out of the business. This will allow you to plan for times when you might fall short. Knowing what’s ahead will also benefit your relationships with suppliers and other stakeholders. While a forecast usually looks ahead 12 months, it can also cover shorter periods like a week or a month. Your forecast is the foundation for a steady stream of cash, sales, and overall income.

When creating your cash flow forecast, consider the following:

- How often should you forecast cash flow? Will once a year be adequate or should you be revising the forecast on a weekly, monthly, or even daily basis?

- Will you need to show the forecast to lenders such as investors or banks? This will determine how you present the forecast.

- Is your forecasting achievable? Being overly optimistic leads to surprised business owners that run out of cash much earlier than expected, causing their company to become insolvent. Ensure that your cash flow forecasting is realistic and that your predicted inflow is on the conservative side.

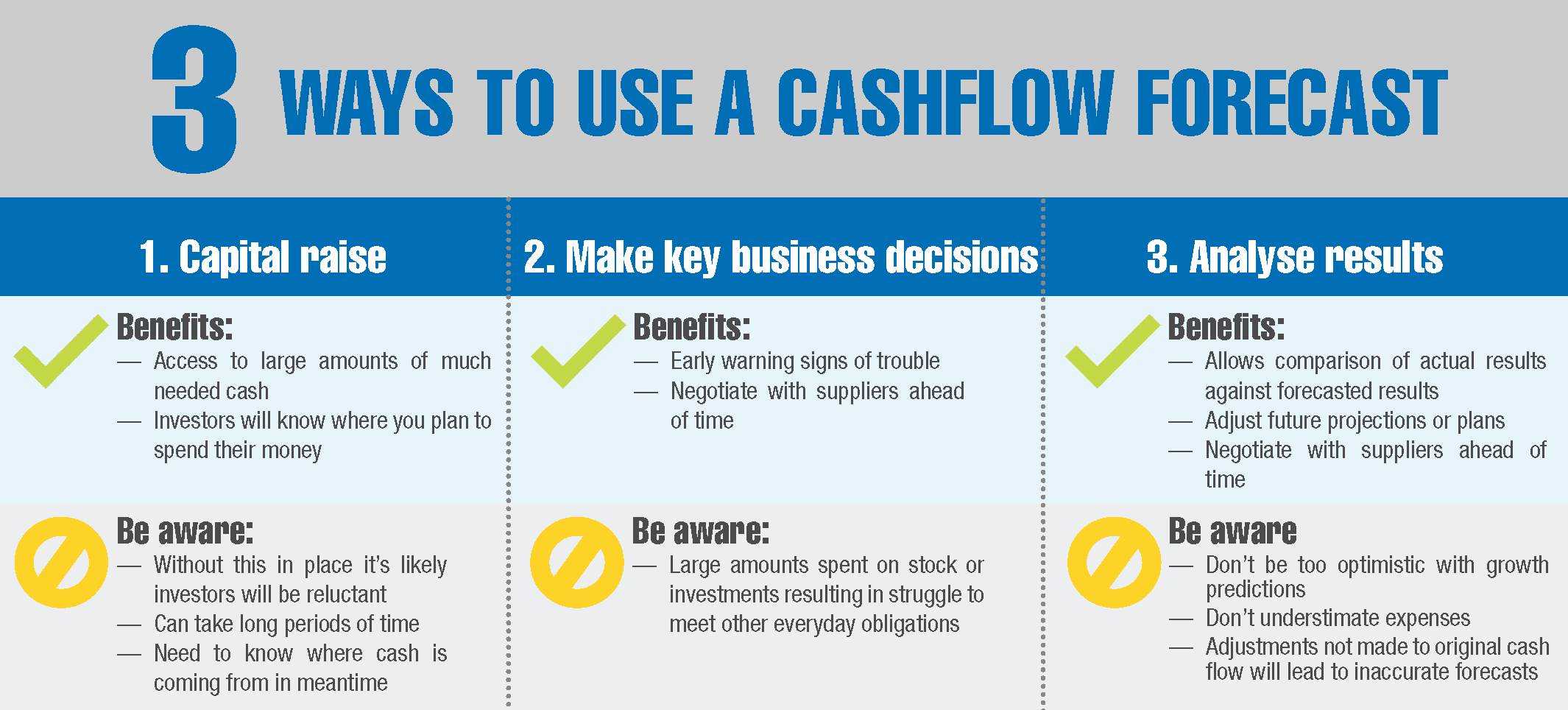

Below, we share three key ways a cash flow forecast can be used by business owners.

3. Where possible, use the Federal Government’s Research and Development Tax Incentive to boost your startup’s cash balance

The R&D tax incentive is the government’s key instrument to encourage industry investment in R&D.

According to the Department of Industry, Innovation and Services, R&D is often the first step in innovation and drives technological improvements which lead to productivity improvements and increased economic growth.

The R&D tax incentive reduces company costs by offering tax offsets for eligible R&D expenditure.

To access these funds, the business must first determine whether it is eligible, then complete an application and lodge a company income tax return. This process can take time and organisation is key.

Jack Qi, Director, Tax Services at William Buck says that there is real value in receiving the R&D incentive as early as possible “because it could mean a few months of extra runway prior to the next raise.”

“Equally important though, is being confident that the submission complies with tax law.”

When applying for the offset, consider the following:

- Is your startup eligible? To be eligible, the company must be incorporated under Australian law, or under foreign law but an Australian resident for income purposes. Or, it could be a resident of a country with which Australia has a double tax agreement. You can access a list of these countries on the Treasury’s website here.

- Have you registered your R&D activities with the Department of Industry, Innovation and Science? You must register before you can apply for the offset.

- What documentation is required to apply and what does the lodgement process entail? Familiarise yourself with the process first to streamline the application.

- Is cash required sooner than you expect to receive the offset? If so, it might be possible to obtain finance from the bank as a lend against the expected R&D offset.

4. Talk to a Business Advisory expert

William Buck’s Business Advisory Team regularly works with business owners to assist in accessing the R&D Tax Incentive. We can also work with you to evaluate the best financing strategy for your startup and develop your budget and cash flow forecast.

Additionally, business advisory experts and chartered accountants can assist you to manage your money which can be difficult and time-consuming. Hiring help allows you to focus on your product and growth.

For more information, visit our Startups page here to find the team or professional that can help you.