Victorian Treasurer Tim Pallas unveiled additional details regarding the Victorian Government’s initiative (announced in the May 2023 budget) to eliminate stamp duty on commercial and industrial property transactions, replacing it with an annual commercial and industrial property tax (CIPT) on December 11 2023.

Set to commence from July 1, 2024, the reform will lead the transition away from stamp on commercial and industrial properties over the next ten years and replace it with an annual property tax. The CIPT is calculated at 1 per cent of unimproved land value. Importantly this ‘property tax’ is separate from and in addition to the existing land tax system. Owners of commercial and industrial properties before 1 July 2024 will not be affected as long as they continue to own the property. While the reform is a progressive step required to overhaul Victoria’s property tax regime, it does not extend to residential property.

Impact on new transactions from 1 July 2024

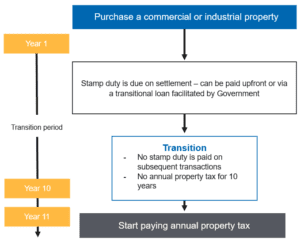

From 1 July 2024, when a commercial or industrial property is transacted, it will trigger a 10-year transition period for that property, where the purchaser has the choice to either:

- pay the property’s final stamp duty liability as an upfront sum or,

- pay an annual payment for 10 years plus interest, supported by a government transition loan.

How it will impact on existing property holders

Only a transaction triggers entry into the reform, therefore if you own property prior to 1 July 2024, it will not enter the regime until it is next transacted.

Qualifying entry into the Reform

The reformed regime will apply to properties where a contract of sale is executed on or after July 1, 2024, with 50% or more of the property transacting resulting in a positive duty liability, there is a qualifying commercial or industrial use at the settlement date.

Qualifying use includes specific Australian Valuation Property Classification Codes (AVPCC), encompassing commercial, industrial, extractive industries, infrastructure, utilities land and even student accommodation, aligning with the definition of commercial residential premises.

Practical Applications of the CIPT

Mixed use Properties: Mixed-use properties undergo a ‘sole or primary use’ test to determine eligibility for the reform. If, CIPT applies to the entire property only if the primary use qualifies, otherwise, it does not.

Change in use of property: If an eligible commercial or industrial property converts to residential or another non-qualifying use, CIPT won’t apply from the year of change.

If property owners subsequently sell the properties that entered the reform a second or more times with a qualifying use, they won’t have to pay any stamp duty. However, if the use of these properties becomes non-qualifying, a change-of-use duty will apply. It will be the responsibility of property owners to inform the State Revenue Office within 30 days of changing the use of the property.

Subdivisions and Consolidations: Subdivided lots are exempt from stamp duty but subject to CIPT 10 years after the original transaction. Consolidated properties face CIPT if 50% or more of the total land area enters the new regime.

Interaction with existing tax regimes & processes

Land Tax: CIPT will be separate from land tax, maintaining existing land tax exemptions.

Stamp duty concessions: Concessions like the 50% discount on regional commercial and industrial duty, will continue.

Property clearance certificates: These documents will provide information on whether a property has entered the reform and any outstanding CIPT.

Transition Loan

To facilitate the transition, a loan facility is available to finance stamp duty post-July 1, 2024. This is issued by the Treasury Corporation of Victoria, where Interest is fixed equal to the Treasury Corporation of Victoria’s bond rate plus a credit risk margin and repayments are made annually over a 10-year period, with the first repayment due 12 months after settlement.

Eligibility requires;

- Australian citizenship, permanent residency, or business status

- Approval for finance from an authorized institution; and

- The maximum eligible purchase price is $30 million.

Next steps

The change is intended to take effect from 1 July 2024. The bill outlining the reform is set to enter Parliament around April 2024.

To discuss how the proposed changes may impact you, contact your local William Buck property advisor.