“I wish I did that to begin with”. Too often we hear those words from founders looking to expand their business or exit, only to realise that they could have (and should have) structured their business in a different way.

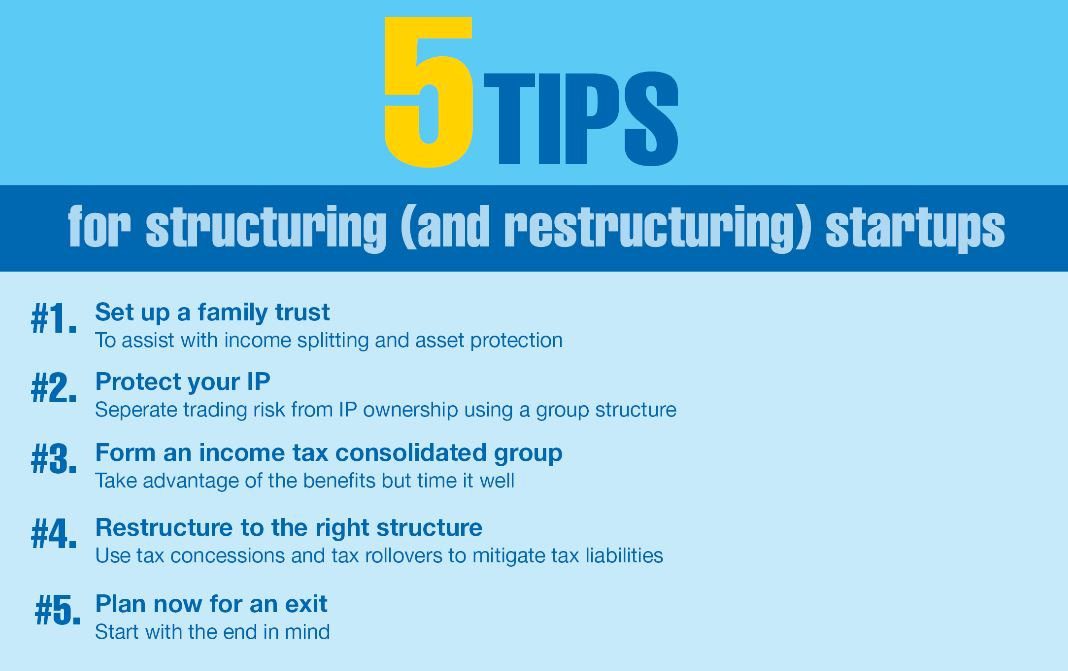

We know that for founders, funds are tight at the beginning so spending money to get proper tax advice is probably not at the top of the list of priorities for many. With this in mind, this article provides 5 tips founders need to know when structuring (and restructuring) their startup. These tips are distilled from our years of experience working with startups and scaleups – so here’s a great chance to learn from the patterns that emerge time and again.

Note: the following are general tax and commercial observations and should not be considered as legal advice. Always consult a qualified lawyer for legal advice.

Tip 1: Set up a family trust

It’s quite common to see founders holding the company shares personally. This is quick and simple to do but provides no flexibility to split income for tax purposes – not to mention the missed opportunity to set up a structure that protects the founder’s interest in their startup from many forms of personal risks.

Setting up a family trust has an upfront cost, but this can be thought of as an insurance policy for asset protection. In many cases, accounts and tax returns for the trust aren’t needed until the trust is receiving income (either via company dividends or the sale of shares on exit). Finally, setting up a family trust from the start prevents the need to face potentially large capital gains tax hurdles which could arise down the track if the founder decides to move shares into a family trust after all.

Tip 2: Protect your IP

It makes sense for founders to protect themselves where possible from legal proceedings – so then why not protect the company as well?

When a company gets sued, all its assets are potentially up for grabs, including IP. So incorporating a separate company to hold the IP is a very common and simple strategy for protection.

| HoldingCo (IP) |

| ↓ |

| TradingCo

|

| HoldingCo

|

| ↓ | ↓ | |

| TradingCo | IPCo (IP) |

In both scenarios, the employee, supplier and customer contracts would be in TradingCo, with the IP sitting separately in HoldingCo or IPCo. The key concept here is to keep as much of the trading risks of the business (customers, suppliers, competitors and employees) quarantined within a company that does not hold valuable IP.

Tip 3: Form an income tax consolidated group

When there are at least two companies in a corporate group (e.g. as per the above scenarios), tax consolidation becomes very useful:

- Intercompany transactions (e.g. licencing and management fees) are ignored for tax purposes and so do not cause any tax liability

- No tax implications arise when assets are transferred within the group

- Tax losses of one entity are offset against any profits of the other

- The R&D tax incentive is assessed at the tax consolidated group level, so there’s a lower chance of eligible R&D expenditure being missed

In most cases, the sooner a tax consolidated group is formed, the better. This is due to the ability to access the above benefits as early as possible, as well as certain peculiarities in the way the tax consolidation rules work.

Tip 4: The sooner you restructure into the right structure, the better

In many instances, the ideal structure has not been established at the outset, so a restructure is required later down the track. A restructure will typically involve the founder/company disposing of an asset (e.g. founder sells the company shares to a family trust, or TradingCo sells the IP to IPCo).

Even though under a restructure the ultimate beneficial ownership of the assets may not have changed, for tax purposes the founder or company is deemed to dispose of the asset at market value, which will likely result in a tax liability depending on the market value at that time.

If a company has been trading for a period of time, there’s a good chance its market value is higher now than what it was in the early days. This value can climb very rapidly, in a way that reflects the rapid scaling of the business. Since tax is usually calculated on the market value of a transaction, the earlier the restructure is done, generally the better.

When the right tax concession or tax rollover is skilfully used by a tax advisor, a restructure may in fact result in little to no tax to pay.

Tip 5: Plan now for an exit

When it comes to structuring a startup, the adage “Start with the end in mind” holds true. Even though an exit may be some years away, decisions made early on about the corporate structure will have a significant impact on whether founders achieve a desirable tax outcome on exit. Some questions to consider:

- When do you plan to exit?

- How will you exit – IPO, PE or trade sale?

- Where will you exit – Australia or overseas?

- How many discrete businesses are there inside the startup and will they exit together or separately?

The answers to these questions will have a bearing on whether any pre-exit restructuring is required. At William Buck, the most common types of restructure we undertake for startups, scaleups and founders tend to include:

- Flip-ups and establishing overseas subsidiary companies

- Cessation of Australian tax residency

- Consolidating businesses or assets into a single group structure

- Separating out different businesses or assets into their own structures; and

- Separating corporate assets and personal assets

Other considerations

Decisions about structuring and restructuring have natural flow-on effects to other tax and commercial matters including:

- Employee share schemes

- Eligibility for the Early Stage Innovation Company (ESIC) concessions

- GST implications of the restructure and GST grouping

- ASIC, ATO and other reporting requirements

Each group has its own individual set of facts and circumstances, so personalised and holistic tax advice is always recommended.

To find out more contact: Tax Services Director Jack Qi and Manager Alex Zinzopoulos