How well do you know your customer renewal rate?

Also referenced as the ‘Customer Retention Rate’, this is one of the best indicators to understanding how much your business is valued by customers. A renewal or retention rate measures the percentage of customers who will extend their relationship with your business and generate long term revenue. It not only reflects existing customer interest but also measures how the business deals with its new customers.

By having a few strategies in place, you’ll not only increase renewals but be surprised by the revenue you could save.

Which business should worry about the customer renewal rate?

Knowing this measure is important to any entity with a subscription-based business model e.g. SaaS (Xero), Publishing websites (news, magazines), TV broadcasting (Netflix), meal delivery services, pay as you go (wine club), paid telephone or internet plans.

With more and more tech businesses setting up subscription-based business models, the customer renewal rate makes it easier to measure engagement, spot any unexpected changes and act as a ‘warning sign’ for any issues.

The real benefits of a high customer renewal rate

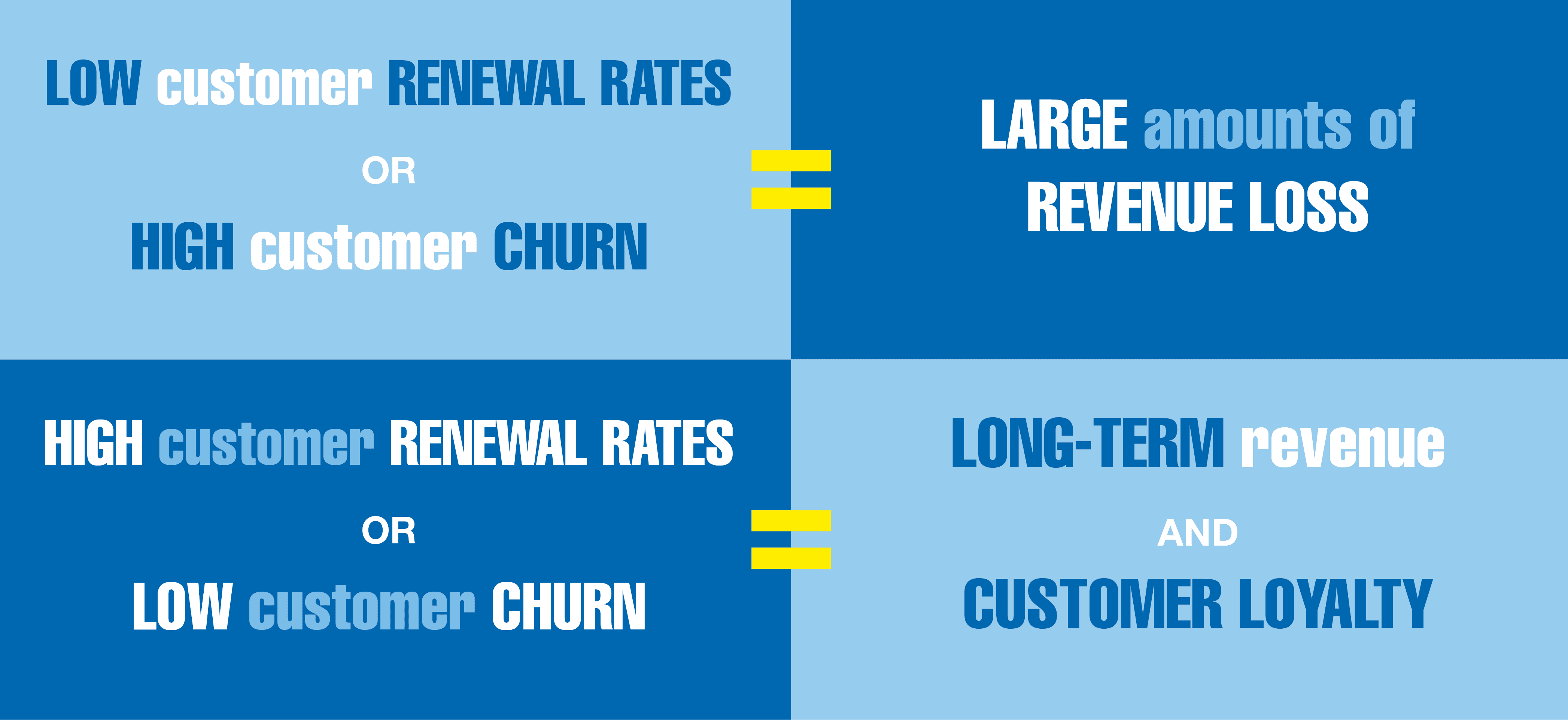

Essentially your customer renewal rate measures your overall customer satisfaction. Having an effective renewal or retention strategy gives you the ability to identify and track customer trends and revenue drivers. This measure is often underestimated but can be critical to helping a business with accurate revenue projections.

A subscription-based business model gives you the ability to grow a recurring revenue base, shifting the focus to the ‘lifetime value of customers’ or LCV. This is the best way to predict the future relationship with a customer and will guide important business decisions.

To grow a recurring revenue base, you need to be able to retain or renew your customers and know what keeps them coming back for more, so that you can maximise the impact of your new customer wins.

For recurring customers, a higher value is applied as it is much cheaper to retain the customers you already have than to acquire new customers (think about the costs of sales staff, sales commissions etc.). As a result, the customer renewal rate is an important indicator of the growth prospects of a subscription-based business and the reputation of that business within their marketplace.

Getting to know your customers is key to retaining them – understanding their needs and renewal drivers can help inform decisions such as the best pricing structures to maximise value.

Given its importance, the customer renewal rate will be a key metric that is analysed by a potential investor / acquirer in the context of Due Diligence for an Equity Capital Raising / Exit.

What is considered a ‘good’ customer renewal rate?

A favourable renewal rate depends on the particular market / niche in consideration (e.g. level of competition, ease of switching etc.). Rule of thumb – a customer renewal rate of above 80% is considered positive.

How can you measure your customer renewal rate?

There are two primary ways to measure customer renewal rate:

1. By customer ‘count’ e.g. closing customers divided by opening customers; and

2. By ‘value’ e.g. Annual Recurring Revenue (“ARR”) – which is particularly useful where your business has customer contracts of varying values;

The customer renewal rate analysis can be done month-on-month, quarter-on-quarter or year-on-year, although more frequent measurement will provide a better ‘pulse’ for a business.

When analysing customer renewal rate by value, it is helpful to reconcile the movement between the Opening ARR and Closing ARR by breaking the analysis into:

- Lost clients;

- Net client upsell (impact of upsells less downsells);

- Net client expansion (impact of price increases less price decreases); and

- New clients.

It’s also useful for subscription-based businesses with multiple product lines to understand renewal rates by product. The same analysis can be applied in this regard.

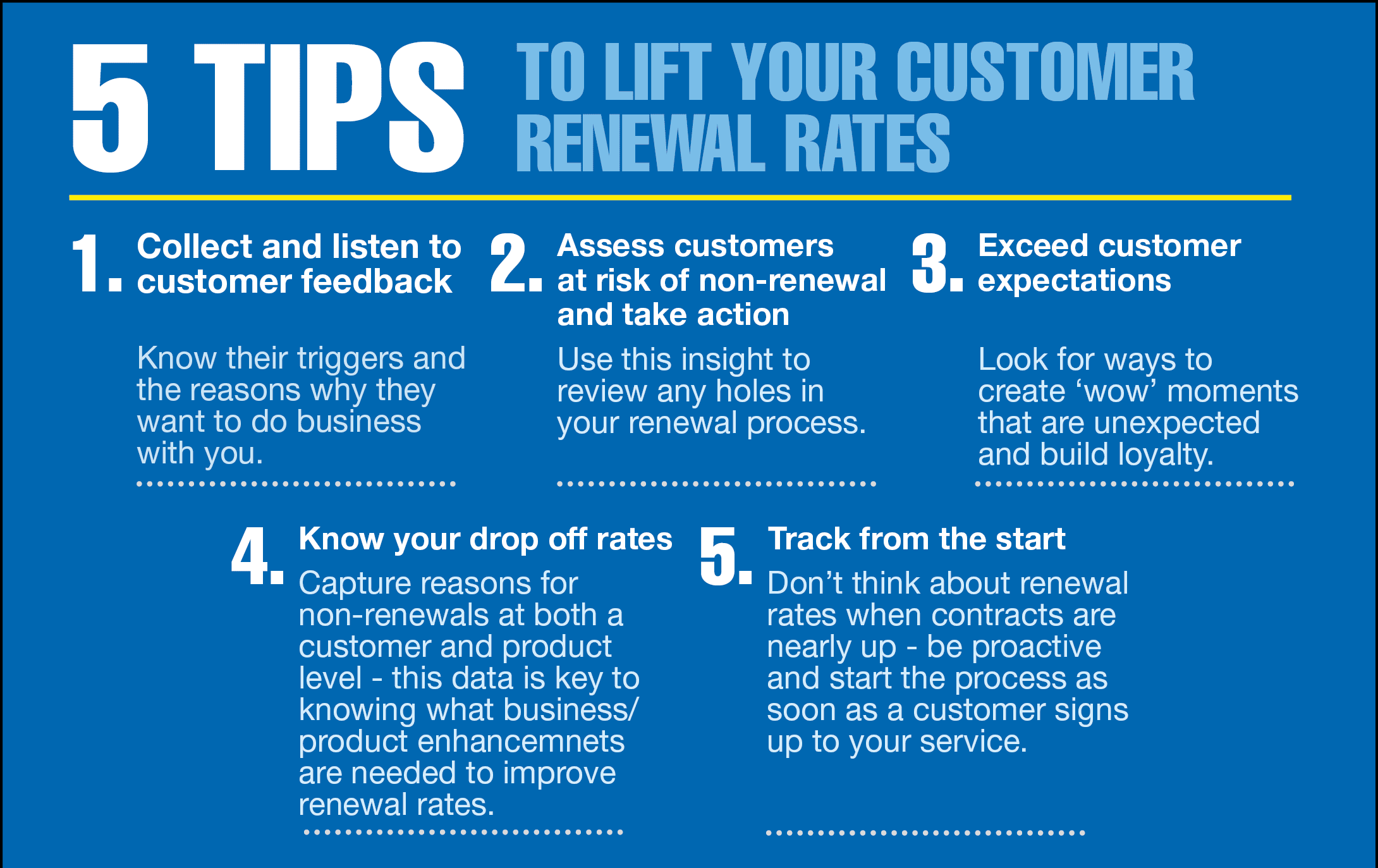

Don’t wait until it’s too late – boost your customer renewal rate

There are a number of reasons for poor renewal rates but there are things you can do today to support a healthy pricing strategy and a profitable subscription business. In a perfect world, your CRM system would be fully integrated with your accounting system, which should hopefully allow customer and product renewal metrics to be easily extracted and reported on.

However, in many cases a business’s CRM and accounting system will not be integrated or will not have such reporting capabilities. It is in these circumstances that a workaround will be required to obtain and collate data from multiple sources and produce the renewal rate analysis.

This all sounds simple but in today’s digital age, renewal is your new bottom line. That’s why it is critical to understand and measure your operating metrics to properly assess your renewal rate and leverage it to improve your customer success efforts.