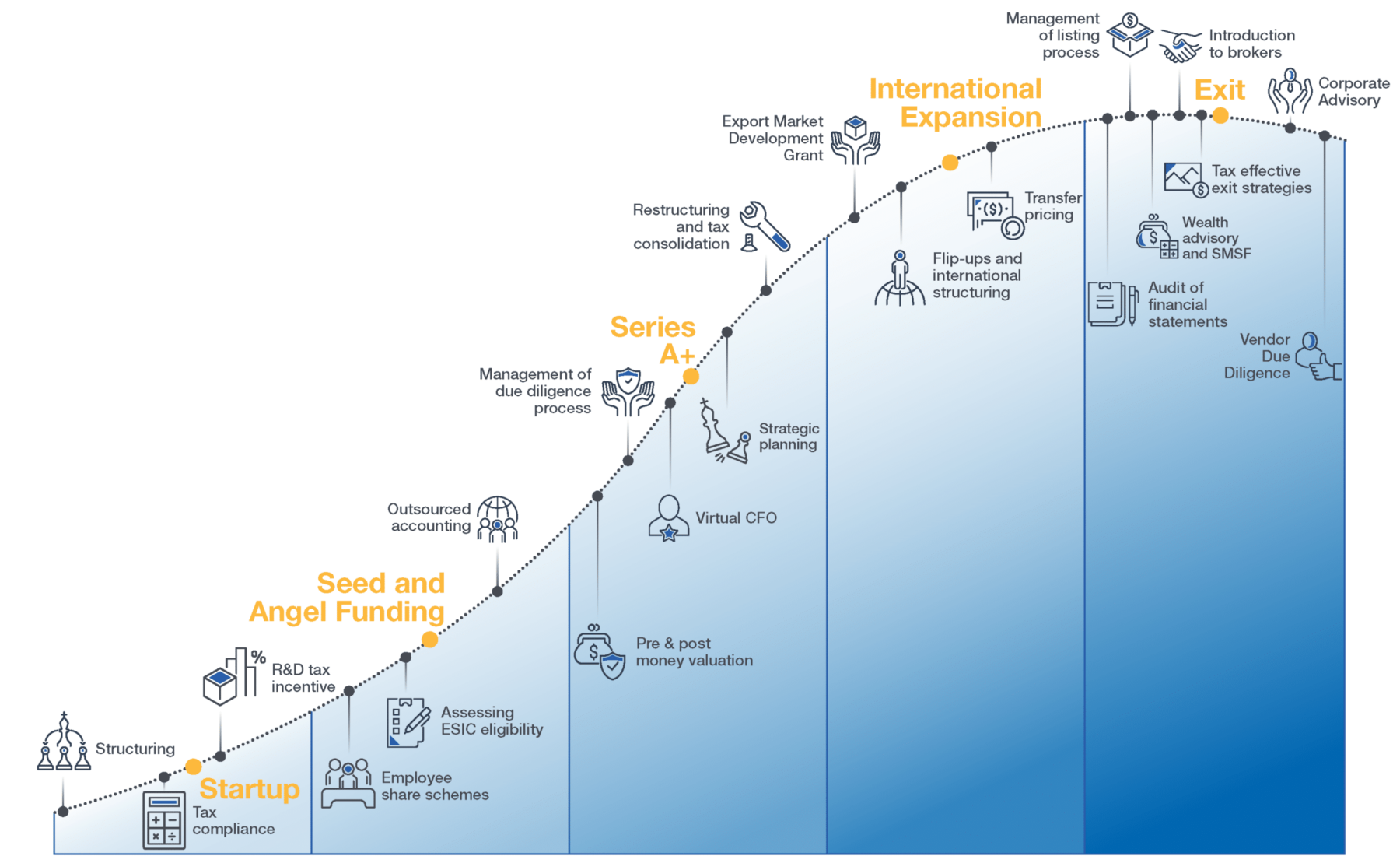

We’re accountants and advisors who have a deep understanding of the tech sector. Helping tech companies to grow from startup to exit, our passion is working with people who put everything into a business to commercialise ideas that change lives.

We’ve built our experience over the years working with the tech sector to deliver services such as tax advisory, virtual CFO, outsourced accounting, capital raising, M&A advisory, structuring for international expansion, R&D tax incentive claims, employee share schemes, valuations and ESIC advisory.

Who we serve

- SaaS and cloud

- Blockchain

- IoT

- Fintech

- Mobile and apps

- Agritech

- Data science

- Edutech

- Digital media

- Regtech

- Advanced manufacturing

- Medtech/Biotech

- AI, machine learning and automation

- Virtual/augmented reality

- NFTs

- Cryptocurrency

- CleanTech