The NSW Government has announced a raft of changes to the landholder duty regime set to take effect from 1 February, 2024. The cornerstone of these changes is the reduction of the threshold for the acquisition of a ‘significant interest’ in a private unit trust from 50% to 20%.

This change means that taxpayers who hold 20%t or more of the units in a private unit trust may need to pay duty on their acquisition of the units, potentially adding significant unexpected costs to the transaction.

What is Landholder Duty?

Landholder Duty is applied when someone acquires a ‘significant interest’ in a company or unit trust that owns real property in NSW with an unencumbered value of $2 million or more. The NSW Government has set thresholds for what is considered a ‘significant interest’ for different entities.

Significant changes afoot for private unit trusts

Change

The threshold for acquiring a significant interest in a private unit trust will be reduced. Previously, you needed to own 50% or more of a private unit trust to be potentially liable to pay landholder duty. Now, you’ll only need to own 20% or more.

These changes will apply to acquisitions made from 1 February, 2024 unless the acquisition arose from an agreement or arrangement entered into before 19 September, 2023.

Example

There are five unrelated people, each owning 20% of a private unit trust. The unit trust holds a property in NSW with a current market value of $10 million. If one person wants to sell their units equally to the others (i.e., the remaining four unitholders will each go from a 20% to 25% ownership in the unit trust) landholder duty will need to be considered.

Under the current provisions, no landholder duty will be payable as there is not a relevant acquisition of a ‘significant interest’ (as the law currently sets the ‘significant interest’ threshold at 50% or more). However, under the new provisions, if the transaction takes place on or after 1 February, 2024, each of the four acquiring unitholders will be subject to landholder duty on their acquisition.

Under the aggregation rules that apply to work out the amount of duty payable, the duty might be payable on the entire 25% holding of each unitholder (i.e., not just the additional 5% they are acquiring) depending on when they acquired their initial 20% of units. This could result in more than $120,000 of duty payable by each unitholder in addition to the $500,000 they may’ve each paid to the exiting unitholder to buy the units.

Things to consider

- Be aware of your interest in a private unit trust rising to 20% or more as you may need to pay landholder duty on your entire ownership interest.

- Be conscious of other parties exiting the unit trust which could increase your stake to 20% or more (for example unit transfers or unit buybacks).

- Be aware that in arriving at the 20% or 50% threshold, certain interests (such as those of related parties) will be aggregated to determine if the threshold is breached.

- If you intend to increase your interest in a private unit trust that holds land in NSW, consider bringing the date forward to before 1 February, 2024.

- When structuring property purchases, reconsider whether a unit trust is the appropriate holding structure, especially if you are likely to purchase additional units in the trust in the future. It is worth noting that the threshold for landholder duty will remain at 50% for private companies. We recommend that you seek professional advice considering all state and federal taxes and your personal circumstances prior to considering structuring a purchase or undertaking a restructure.

Changes to the linked entity rules

Change

In addition to the core landholder duty changes, the threshold for tracing property through linked entities of a landholder will also be reduced from 50 to 20%. Importantly, entities need only have an entitlement (directly or indirectly) to just 20% or more of the property of a downstream entity for the downstream entity’s land holdings to be attributed to it.

This change from 1 February, 2024 means that a large number of companies and unit trusts will become ‘landholders’ for NSW landholder duty purposes for the first time.

Example

An individual intends to acquire a 30% stake in Trust A, which in turn owns 20% of Trust B. Trust B holds a $100 million dollar NSW property portfolio.

As a result of the threshold changes, Trust B will be linked with Trust A, meaning that 20% of the value of Trust B’s property portfolio will be included as a ‘landholding’ of Trust A for the purpose of calculating duty on the purchase of Trust A.

Things to consider

- Careful consideration and due diligence are crucial when acquiring shares in companies or units in trusts with land assets, or where that entity has interests in other companies and trusts that have landholdings.

- Ensure that you are aware of the aggregated land holdings to avoid unexpected landholder duty implications.

- If you are considering an acquisition or restructure involving a ‘multi-tier’ structure (where one company or trust owns interests in other companies or trusts), consider whether this should take place before to 1 February, 2024, so it is prior to the changes to landholder duty and linked entities.

In summary, if you’re dealing with private unit trusts or connected entities in New South Wales, you’ll want to be mindful of these new rules to avoid unnecessary landholder duty costs.

Other changes in NSW tax landscape

Beyond the significant changes to landholder duty, there are several other adjustments affecting the NSW tax landscape:

Transfer duty – corporate reconstruction and consolidation relief:

Amendments to the Duties Act 1997 will reduce the concession for corporations from 100% to 90% of the transfer duty for corporate reconstruction and consolidation transactions. It’s crucial to note that transactions executed before February 1, 2024, will still enjoy the full exemption. This means that if you have a corporate group where you are looking to move assets around (such as moving land or motor vehicles from one company in a group to another) or are looking to restructure by interposing a holding company in your group, you should act now to implement the arrangement prior to the duty changes kicking in on 1 February, 2024.

Changes to Principal Place of Residence Land Tax exemption:

Significant changes to the Land Tax Management Act 1956 impact the availability of the Principal Place of Residence (PPR) exemption. Individuals will now need a minimum 25% stake in a property they use as their principal place of residence to claim the exemption. This rule does not apply to home buyers participating in approved shared equity schemes.

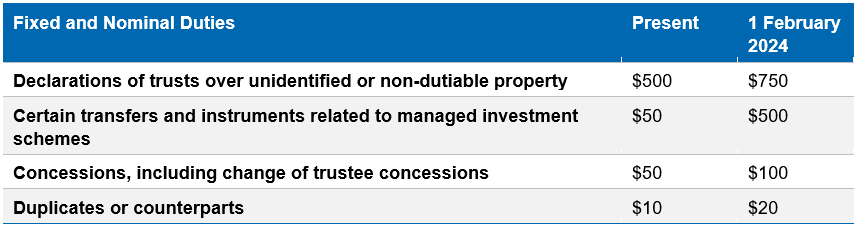

Fixed and nominal duties:

Fixed and nominal duties, which have seen minimal changes since 2009, will experience slight increases to account for growing administrative costs.

To discuss how the proposed changes may impact you, contact your local William Buck tax advisor.