A successful exit requires considerable planning!

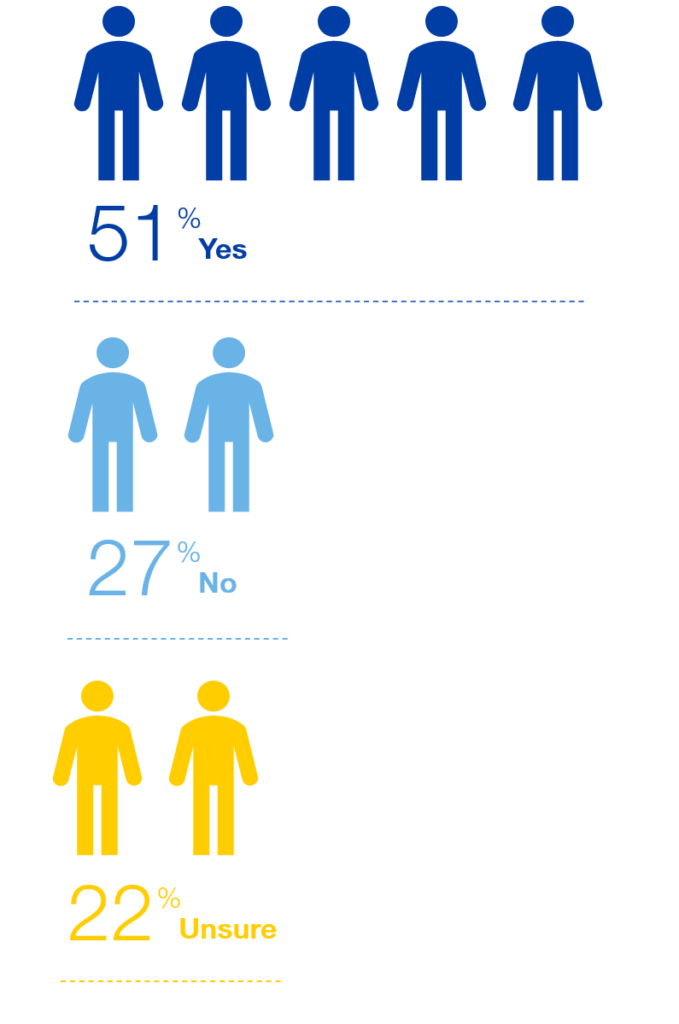

William Buck’s Exit Survey is an independent report surveying Australian small-to-medium business owners and C-suite executives, to measure their business’s level of exit readiness.

Few business owners undertake sufficient planning ahead of an exit. This is a big problem, as considering all the issues upfront could mean the difference between a successful exit at maximum profit and a difficult exit where value may be lost.

Our analysis is categorised into the topics below. Please scroll down to read the report in its entirety or click on the topic that you are interested in.