The top questions answered to assist businesses looking at operating in New Zealand

Your guide to doing business in New Zealand

This guide has been prepared by our team to assist overseas individuals and businesses looking at establishing and operating a business in New Zealand. We answer some commonly asked questions on business investment, individual and corporate tax rates, and government regulations to help you better understand the complexities of doing business in New Zealand.

Common doing business in New Zealand questions:

1. What type of entity should I use?

As a foreign investor, there are several important considerations when deciding how to establish a business in New Zealand. Although New Zealand has various types of structures available for establishing a business, the most common types of entities used by foreign investors operating in New Zealand are a private company (Limited) or a branch of a foreign company….

2. What registrations will I need?

The registrations required will depend on the type of entity. All New Zealand registered companies will have a New Zealand Company Number as well as a New Zealand Business Number (NZBN). All entities operating a business will require an NZBN…

3. What tax rates apply?

Companies are subject to income tax on corporate profits. The company tax rate for New Zealand is 28%. A goods and services tax (GST) is also imposed on the supply of goods and services…

4. How do I pay taxes?

The tax system applies to the whole country and is administered by Inland Revenue. There are no social security contributions required to be made, but various levies and contributions to superannuation funds may be payable by employers…

5. Will I be subject to income tax?

Resident companies are subject to income tax on their worldwide income. A company is resident in New Zealand if it is incorporated in New Zealand, has its head office or its centre of management in New Zealand, or control and decision…

6. Will I need to pay GST?

GST is a broad-based consumption tax that applies to the supplies of most goods and services. The GST rate is 15%. Businesses are required to remit GST to Inland Revenue on supplies that they make and are generally entitled to claim a credit for GST included in the price of acquisitions they make…

7. What are the employee related obligations?

If an employer is going to have employees in New Zealand, either local hires or expatriates, a series of tax and other obligations will arise…

8. Will I need to get an audit?

The Companies Act 1993 requires some large New Zealand, and all large overseas companies, to file annual audited financial statements. An overseas company or its New Zealand business is large if…

9. What tax planning should I consider?

New Zealand has strong transfer pricing laws and robust general anti-avoidance provisions, so the tax planning that may be appropriate in other jurisdictions will not be appropriate in New Zealand…

1. What type of entity should I use?

As a foreign investor, there are several important considerations when deciding how to establish a business in New Zealand. Although New Zealand has various types of structures available for establishing a business, the most common types of entities used by foreign investors operating in New Zealand are a private company (Limited) or a branch of a foreign company. With each different type of entity comes different legal and tax implications that investors need to consider.

Establishing a New Zealand Subsidiary

To set up a new company in New Zealand you must have:

- A name, which must end with “Limited” if the shareholders’ liability is limited

- At least one shareholder, and

- One or more directors (at least one New Zealand resident director – the exception is an Australian resident who is also a director of an Australian registered company).

A company may, but is not required to, have a constitution, which sets out the rights, powers, duties and obligations of the company and its shareholders and directors. If a company does not have a constitution, the provisions of the Companies Act 1993 apply.

The New Zealand Companies Office requires the following information for company incorporation:

- Full legal name of the shareholders, their shareholdings and their address (registered address if corporate), and consent from each shareholder.

- The company’s registered office and address for service (both must be a physical address in New Zealand and not a PO Box), and an address for communication.

- Full legal names of the directors, their residential address and their date and place of birth.

Registering a Branch

Instead of incorporating a separate company, you can register a branch of your overseas company.

The registration application must be filed within 10 working days from the start of the business in New Zealand and must include:

- The name and physical address of at least one person in New Zealand who is authorised to accept service of documents on the overseas company’s behalf.

- The date the business commenced or will commence in New Zealand.

Alternatives available

Other types of structures are available in New Zealand and may be appropriate in certain circumstances.

A trust is a common form of business structure used in New Zealand by smaller, privately owned businesses. Trust income is generally taxed in the hands of the beneficiaries each income year.

A trust is governed by common law and contract law in New Zealand. Establishing a trust does not require an attorney.

For foreign investors, trusts (mostly unit trusts) are generally used for property investments in New Zealand.

There are also specific entity structures available for venture capital investments and managed investments.

2. What registrations will I need?

The registrations required will depend on the type of entity. All New Zealand registered companies will have a New Zealand Company Number as well as a New Zealand Business Number (NZBN). All entities operating a business will require an NZBN.

There are also a variety of business and tax registrations which may also be required as a result of conducting business in New Zealand, such as registrations for:

- An IRD Number (issued by Inland Revenue or IRD)

- Goods and Services Tax (GST)

- PAYE (Pay-As-You-Earn) withholding tax or Employer Registration

- Fringe Benefits Tax.

Corporate Registrations

All New Zealand registered companies will have a New Zealand Company Number issued by the Companies Office, as well as a New Zealand Business Number (NZBN) issued by the Ministry of Business, Innovation & Employment (MBIE).

All entities operating a business, including a New Zealand branch of a foreign company, will require an NZBN.

Companies and other organisations registered with the New Zealand Companies Office are automatically assigned an NZBN.

Business and tax registrations

All other businesses operating in New Zealand are required to apply for an IRD number.

There may be other IRD business registrations required such as GST and PAYE Withholding which can be applied for through Inland Revenue.

GST registration is not mandatory until “supplies” exceed NZ$60,000 in any 12-month period (or if there are reasonable grounds for believing that supplies will exceed NZ$60,000 in the following 12 months). However, businesses may voluntarily register for GST before they are required to do so.

There may be different timing and factual situations where this is advantageous. A PAYE or employer registration is required for remitting tax withheld from payments to employees, other workers and businesses that do not quote their IRD number. PAYE and employer registration is required prior to the first payment you are required to withhold from.

Employers who provide certain non-cash benefits to employees must be registered for Fringe Benefits Tax (FBT). Fringe benefits could include provision of entertainment (such as staff social functions), provision of a motor vehicle, payment of private expenses, provision of rent-free accommodation and interest free loans. An employer is required to be registered if they are liable for FBT.

3. What tax rates apply?

Companies are subject to income tax on corporate profits. The company tax rate for New Zealand is 28%.

A goods and services tax (GST) is also imposed on the supply of goods and services, including the provision of fringe benefits, and on importations. Most sales in New Zealand are subject to GST of 15% of the value of the sale. However, sales that qualify as being GST-free or input taxed are exempt from GST.

New Zealand has a progressive personal income tax system, with the tax rates ranging from 0% up to 39%.

There are also withholding tax obligations in respect of dividends, interest and royalties being paid to foreign or NZ tax residents. However, these rates may be reduced by tax treaty arrangements.

Capital gains are generally not taxable.

Companies

The tax rate for resident and non-resident companies is a flat rate of 28%. Persons and companies resident in New Zealand pay tax on their worldwide income. Persons and companies not resident in New Zealand are subject only to tax on any income they derive in New Zealand.

For tax purposes, a company is resident in New Zealand if:

- It is incorporated in New Zealand, or

- It has its head office in New Zealand, or

- It has its centre of management in New Zealand, or

- The control of the company by its directors is exercised in New Zealand.

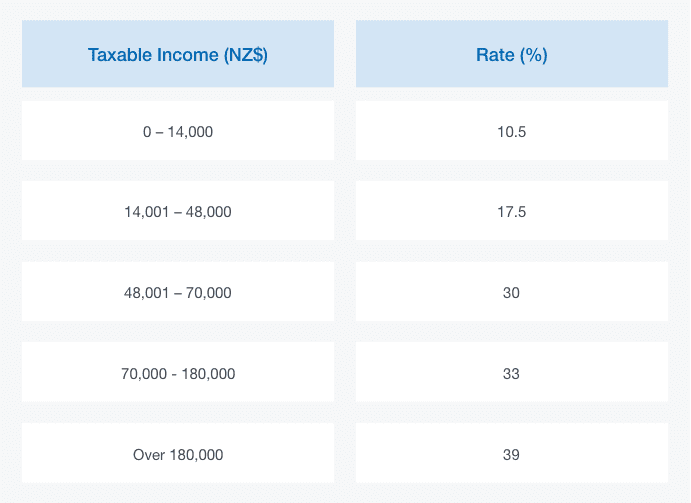

Individuals

Individuals are regarded as resident in New Zealand for income tax purposes if they have a permanent place of abode in New Zealand or are present in New Zealand for more than a total of 183 days within any 12-month period.

The latest progressive tax rates for individuals are as follows:

Goods and Services Tax (GST)

The GST rate in New Zealand is 15% of the value of sale.

This GST rate is applicable to all sales made in New Zealand unless they are GST-free or input taxed. Sales that qualify as being GST-free or input taxed are exempt from GST.

GST is generally payable by the supplier and is included in the price of the goods or services being supplied.

Persons who are GST registered charge the tax on their supply (unless the supply is not a taxable supply, or it is a zero-rated or exempt supply) and claim input tax credits on acquisitions (unless the acquisition does not relate to making taxable supplies or is in relation to an exempt supply).

Withholding tax

Non-resident withholding tax

Dividends, interest and royalties paid to non-residents are generally subject to non-resident withholding tax. The rate of non-resident withholding tax depends upon the type of payment and whether a double tax agreement is in place.

Dividends paid to non-residents are subject to a withholding tax of 30% on the gross amount, which may be reduced by a tax treaty to 15%, or in some cases 5% or zero. The withholding tax is final. Interest paid or accrued to non-residents is subject to a withholding tax of 15% on the gross amount, which may be reduced by a tax treaty. The withholding tax is final, except on payments to an associated person.

Non-resident investors may apply for approved issuer status, in which case no withholding tax is payable if the payer pays the approved issuer levy (AIL) of 2%.

New Zealand is also a signatory to numerous Double Taxation Treaties with foreign countries. This means that, in general, New Zealand allows a tax credit for foreign tax paid. The availability and quantum of the foreign tax credit is subject to certain limitations.

Resident withholding tax

Subject to certain exceptions, a dividend paid by a company to a resident is subject to a 33% resident withholding tax, less any imputation credits attached to the dividend. If the dividend is fully imputed, a 5% withholding tax (the difference between 33% and the current corporate tax rate of 28%) will be imposed on the dividend.

New Zealand also operates a full dividend imputation system. This means there is no double payment of tax on the same income by the company and the shareholder when the company’s income is distributed as a dividend. Imputation credit may be attached to dividends paid by resident companies to both residents and non- residents.

Fringe benefits tax (FBT)

Fringe benefits tax is a tax payable by employers based on the value of non-cash benefits provided to employees, e.g. provision of motor vehicle, low-interest loans, fully paid holidays, and payment expenses.

There are four different options when calculating fringe benefit tax (FBT) rates:

- Single rate

- Short form alternate rate

- Full alternate rate

- Pooled alternate rate.

The rate you can choose depends on whether:

- the benefit must be attributed to a particular employee, and

- you want to calculate FBT every quarter or only once a year.

You need to know your filing frequency so you can choose the available rate that best suits your business.

FBT returns can be filed quarterly, annually or by income year. Filing frequency depends on the type of company you manage, the benefits you provide and how much tax you pay.

There are various FBT exemptions and concessions available.

Capital gains

Capital gains are generally not taxable.

However, there are certain circumstances where capital gains may be taxable. Examples include capital gains from sale of properties acquired with a purpose of disposal and certain residential land being subject to bright-line test rules. For an offshore person being subject to bright-line test rules they will also be subject to residential land withholding tax (RLWT).

4. How do I pay taxes?

The tax system applies to the whole country and is administered by Inland Revenue.

There are no social security contributions required to be made, but various levies and contributions to superannuation funds may be payable by employers.

The currency is the New Zealand dollar (NZD).

Taxable period

Income tax is imposed in a year of assessment on the taxable income derived during the tax year. A tax year normally commences on 1 April and ends on 31 March.

In certain circumstances, the Commissioner may permit the substitution of a different accounting period as the income year.

Tax returns and assessment

Corporate income tax returns must be filed by the seventh day of the fourth month after the end of the tax year (i.e. by 7 July for a 31 March year-end). An extension may be granted if the tax return is lodged via a tax agent.

Companies self-assess their taxation liability. Filed returns can only be amended if the Commissioner allows the amendment, generally up to four years after the assessment was made. Non-active companies are not required to file returns.

Payment of tax

Provisional tax

Provisional tax helps you manage your income tax. This is paid in instalments during the year instead of a lump sum at the end of the year.

Provisional tax will need to be paid if you had to pay more than $5,000 tax at the end of the year from your last return. $2,500 before the 2020 return.

It is payable the following year after your tax return. For example, if your residual income tax from the 2020 return is more than $5,000, then you will need to pay provisional tax during the 2021 tax year.

Provisional tax due dates will depend on:

- which option is used

- if you are GST registered.

These payments can be calculated using one of the following methods:

| Standard method | The standard option is based on your previous year’s residual income tax (RIT) plus 5%. It is useful if your income is steady or increases over the next year.

If you use the standard option, you will pay three equal instalments during the year. If you are registered for GST and file 6-monthly GST returns you will only pay two instalments. You may have more tax to pay once you have filed your income tax return. Inland Revenue will use the standard option for provisional tax unless you choose otherwise. You can change from the standard option to AIM or the estimation option at any time, but you cannot change to the ratio option during the same year. |

| Estimation method | The estimation option can help you avoid overpaying or underpaying your provisional tax. It may be right for you if you already pay provisional tax and:

|

| GST-ratio method | The ratio option lets you match your provisional tax payments with your business cashflow. It also bases your provisional tax payments on a percentage of your GST-taxable supplies. You need to let Inland Revenue know you want to use this option at the beginning of the tax year. |

| Accounting income method (AIM) | AIM is available to individuals and companies with a yearly turnover under $5 million.

Using AIM will suit your business if:

Provisional tax is paid when your business makes a profit. If you make your payments in full and on time, Inland Revenue will not charge use of money interest. You can sign up to use AIM any time during the year. |

Terminal tax

Generally, for taxpayers with a standard balance date of 31 March, the terminal tax due date is 7 February of the following year. However, those with a tax agent have until 7 April the following year to make a terminal tax payment.

The terminal payment amount is the net tax payable after taking into consideration any provisional tax payments and/or withholding tax.

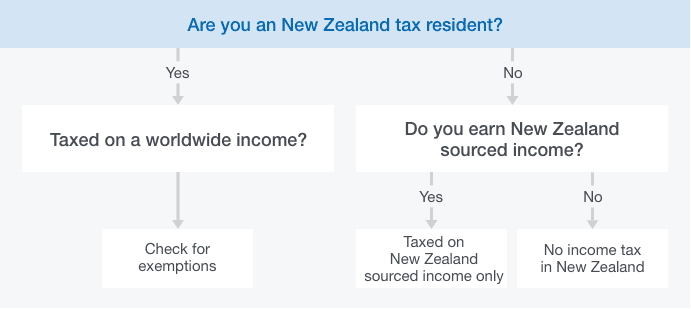

5. Will I be subject to income tax?

Resident companies are subject to income tax on their worldwide income. A company is resident in New Zealand if it is incorporated in New Zealand, has its head office or its centre of management in New Zealand, or control and decision- making by its directors are exercised in New Zealand.

Assessable income

The taxable income for an income year is determined by subtracting allowable deductions from assessable income. Assessable income is determined by reference to the provisions of the Income Tax Act 2007 (ITA), and not being exempt or excluded income under the ITA. Excluded income is listed in the ITA to include such items as fringe benefit tax, goods and services tax and superannuation contributions made by employers.

Generally, a receipt of a capital nature is not assessable income.

Income is calculated for an income year, normally 1 April to 31 March, on an accrual basis. Some taxpayers are allowed to calculate taxable income on a cash basis.

Exempt income includes capital gains and other amounts which are not ordinary income, as well as amounts specifically listed as exempt in the ITA, such as group dividends and certain foreign dividends. Domestic non-group dividends are not exempt from income tax.

Dividends received by resident companies from non-resident companies are exempt from income tax, subject to the following exclusions:

- dividends from a foreign investment fund (FIF) comprising less than 10% shares in companies listed on an approved index of the Australian Stock Exchange, Australian unit trusts with adequate turnover or distributions

- certain venture capital investments into New Zealand companies that have since migrated to a “grey list” country

- dividends from fixed-rate foreign equity, and

- deductible foreign equity distributions.

An ordinary tax credit is granted, both unilaterally and under tax treaties, if the income would be subject to tax in New Zealand. The credit is subject to both country- by-country and source-by-source limitations, in that the credit for foreign tax paid on income from one class is limited to the amount of New Zealand tax that would be payable on that class of income from the same country.

The tax treaties with China (People’s Republic), Fiji, India, Korea (Rep.), Malaysia, Papua New Guinea, Singapore and Vietnam contain tax sparing credit provisions.

Treatment of tax losses

Tax losses can be carried forward indefinitely to offset future net income. For companies, prior losses may only be used if a shareholder continuity or business continuity test is satisfied.

The shareholder continuity test requires maintenance of at least 49% of the shareholders from the time the losses were incurred.

The business continuity test requires that the nature of the business has not materially changed. In certain circumstances, taxpayers can carry back losses to prior years.

Losses can be offset between a “group of companies” (defined as companies with at least 66% common ownership). Capital losses are not deductible for income tax purposes.

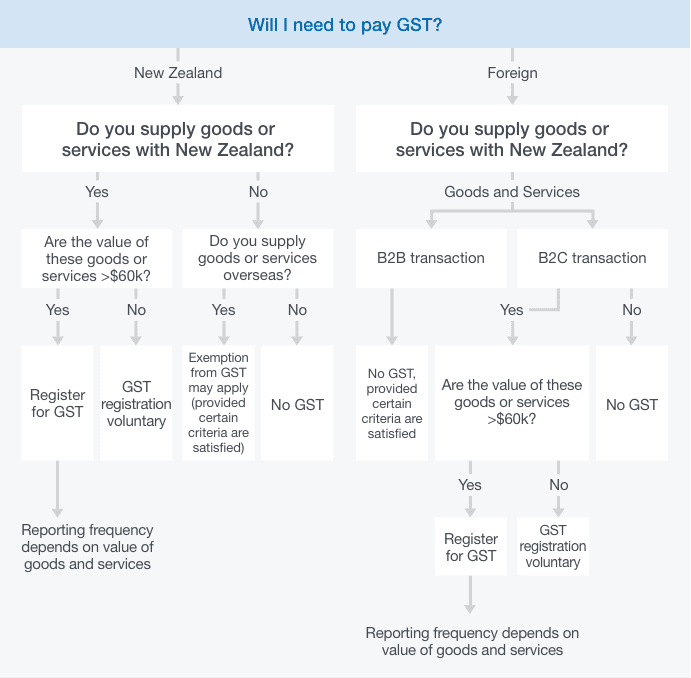

6. Will I need to pay GST?

GST is a broad-based consumption tax that applies to the supplies of most goods and services. The GST rate is 15%. Businesses are required to remit GST to Inland Revenue on supplies that they make and are generally entitled to claim a credit for GST included in the price of acquisitions they make.

A tax invoice needs to be issued for supplies that are subject to GST. A tax invoice is an invoice that includes specific details set out in the GST laws.

There are special rules for international transactions including the import or export of goods, supplies of services to non-residents and supplies of intangibles (such as software) by non-residents.

The GST implications of cross border transactions, including with related parties, is something we would recommend that specific advice be sought on.

Tax Rates

GST is an indirect tax on most goods and services. Usually, GST is charged at a flat rate of 15%. However, in some limited situations, for example when goods are exported or a business is sold as a going concern, GST is charged at the rate of 0%.

Financial services and rental paid for private accommodation are two of the major exemptions from GST.

Businesses registering for GST can claim input credits for any GST they incur in conducting business. They must charge GST on goods and services provided, file returns and pay it to Inland Revenue when the GST collected is greater than the GST credit. They will be due a refund if the GST collected is less than GST paid.

Registration and filing

GST registration is not mandatory until “supplies” exceed $60,000 in any 12-month period (or if there are reasonable grounds for believing that supplies will exceed $60,000 in the following 12 months). However, businesses may voluntarily register for GST before they are required to do so. There may be different timing and factual situations where this is advantageous.

When goods arrive into New Zealand they are subject to GST, which is calculated and collected by the Customs Department as if it were customs duty. It is normal practice for the GST to be paid on importation. However, if the importer has a deferred payment account with the Customs Department, GST can be paid monthly.

Provided certain circumstances are met, non-residents who do not carry on a taxable activity in New Zealand may also voluntarily register for GST.

Once you are registered for GST, you will need to file regular GST returns and pay GST on your taxable activities. You must file a GST return for every taxable period using the accounting basis you have chosen, even if it is a nil return. It may be one, two or six months. Taxable periods end on the last day of the month.

7. What are the employee related obligations?

If an employer is going to have employees in New Zealand, either local hires or expatriates, a series of tax and other obligations will arise.

PAYE withholding tax

Employers are required to register with Inland Revenue for Pay-As-You-Earn (PAYE) withholding tax. Employees will withhold and subsequently remit to Inland Revenue a portion of the salary paid to employees. An employer will be subject to penalties for failing to withhold and remit the appropriate level of PAYE tax, or for late payment of PAYE tax, to Inland Revenue.

Employer’s superannuation contribution tax

Contributions to a superannuation fund for an employee are made by the employer but are not compulsory unless the contribution is to a KiwiSaver superannuation fund.

KiwiSaver is a voluntary work-based saving scheme to which employees can contribute 3%, 4%, 6%, 8% or 10% of their gross salary or wages. The compulsory contribution of employers is 3%.

Contribution payments by the employer to KiwiSaver schemes are subject to employer superannuation contribution tax (ESCT) at the employee’s marginal income tax rate.

Fringe benefit tax

Where an employer provides non-cash benefits to an employee, their family or other associates of that employee, FBT may need to be paid by the employer in respect of those benefits. Examples of fringe benefits include allowing an employee to use a car for private purposes, paying an employee’s gym membership and for a private expense incurred by an employee, such as school fees.

Employers must self-assess the amount of FBT they have to pay and lodge a FBT return at the end of each FBT year.

Accident compensation levies

Employers are required to pay the following compensation levies for its employees:

WorkPlace Cover (work levy) – Covers claims for all work-related injuries and is payable by employers (based on the employee payroll).

Health and safety levy – A levy of 8 cents per $100 of an employee’s earnings must also be paid by employers.

8. Will I need to get an audit?

The Companies Act 1993 requires some large New Zealand, and all large overseas companies, to file annual audited financial statements. An overseas company or its New Zealand business is large if:

- at the balance date for the two preceding accounting periods, their total assets, including those of any subsidiary companies, are more than NZ$22 million, or

- in each of the 2 preceding accounting periods, their total revenue, including revenue from subsidiary companies, is more than NZ$11 million.

Under the Financial Markets Conduct Act 2013, all Financial Markets Conduct (FMC) reporting entities must file annual audited financial statements.

Financial statements must be audited by a qualified auditor. If your auditor is not based in New Zealand, they must be on the Register of Approved Overseas Auditors & Associations of Accountants.

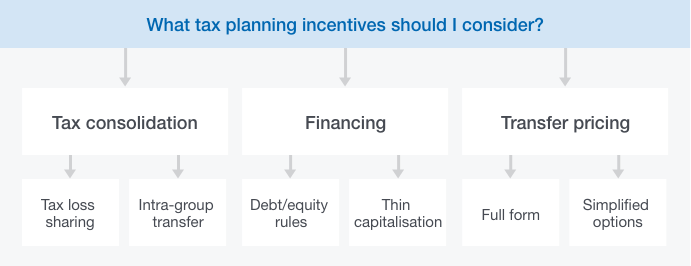

9. What tax planning should I consider?

New Zealand has strong transfer pricing laws and robust general anti-avoidance provisions, so the tax planning that may be appropriate in other jurisdictions will not be appropriate in New Zealand.

Nevertheless, overseas businesses should consider:

- The ideal structure to repatriate profits in a tax-effective manner

- The mix of debt and equity used to fund the New Zealand operations, as this will have an impact on the amount of interest expenses that can be claimed as a tax deduction, and

- Forming a tax consolidated group so that multiple entities operating in New Zealand can be treated as a single taxpayer, enabling the sharing of tax losses and facilitating intra-group transactions.

Tax consolidation

The tax consolidation regime allows wholly owned New Zealand group companies to consolidate for tax purposes.

Entry into the tax consolidation regime is not compulsory.

Entities that are part of a consolidated group are treated as one entity for income tax purposes and will lodge one income tax return that covers all members of the group. This will allow the losses of one group member to be offset against the assessable income of another entity within the group

Transactions between entities that are part of the same consolidated group are effectively ignored for income tax purposes.

However, entities that form part of a consolidated group for tax purposes are still separate legal entities. As such, they are still required to maintain separate accounts, records etc.

It should be noted that GST, FBT and PAYE Withholding tax are not included within the tax consolidation regime and will continue to be the responsibility of the individual entities in the group.

Separate grouping rules are available for GST.

Financing – debt vs equity

When reviewing your financing of the New Zealand operations, consideration should be given as to whether you wish to finance the entity with equity or debt. This decision is usually made in conjunction with the thin capitalisation rules outlined below.

When the funding of an entity will occur in part with debt, care should be taken to ensure that the debt instrument (e.g. a loan) will meet the tax definition of ‘debt’.

Factors such as the applicable interest rate (or interest free nature of the loan), term of the loan and existence of other debt or equity instruments can impact the classification of the loan. If a loan is determined to be equity, any interest will be treated as a dividend and not deductible.

Thin capitalisation

The thin capitalisation rules generally apply where the amount of debt used to finance the New Zealand operations exceeds certain limits. The rules can operate to disallow a proportion of the finance charges (e.g. interest) attributable to the New Zealand entity. If the entity is part of a tax consolidated group, the tests are applied to the overall group.

Excessive debt normally exists where the New Zealand group debt percentage exceeds both the safe-harbour threshold of 60% (for New Zealand taxpayers owned or controlled by a non-resident) and 110% of the worldwide group of entities where the New Zealand taxpayer is a part. Exceeding the thresholds results in interest deductions being denied.

Due to the complexity of this area, we would recommend that detailed advice and discussions be held prior to the finalisation of the capital structure of the New Zealand subsidiary.

Transfer pricing

Transfer pricing only applies if your business involves international trade or investment with associates.

New Zealand’s transfer pricing rules focus on finding a balance between protecting the tax base and containing compliance costs. The rules are to be applied with the OECD’s Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations – July 2017.

New Zealand endorses the OECD approach to transfer pricing documentation and accepts local file and master file documentation prepared in accordance with this approach. In the interests of containing compliance costs, there are no specific rules for the maintenance or filing of local file and master file documentation.

A range of simplification measures reduce compliance costs in situations that are likely to present a low transfer pricing risk.