The issue of ‘skills gap’ is not a new one for many industries. In light of the current crisis we now have more employers struggling to find the right skills and training for their workforce. If you’ve relied on labour mobility from other countries, it’s likely you’ll need to find those specialised skills locally. The challenge today is how quickly companies can adapt to the changing conditions and be ready with a workforce to support a new business model.

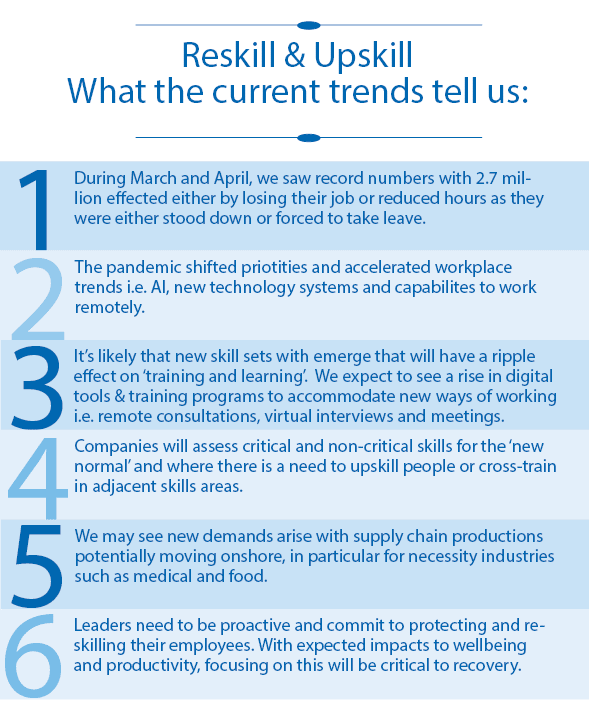

According to the labour figures from Australian Bureau of Statistics (ABS), we had a record spike in unemployment last month with the unemployment rate now at 6.2%. It’s reported that during the months of March and April, over 2.7 million people lost their job or suffered reduced hours. With almost 600,000 people losing their jobs across Australia, have we seen the worst of it?

Beyond these headline statistics, the real impact of COVID-19 is better shown by the increase in underutilisation to 19.9%. This means almost 20% of those available to work were unemployed or working less hours than they were available for, telling us that there are imbalances in talent supply and demand.

The short and long-term impact – what’s the role of Government?

While it’s impossible to predict the full impact of COVID-19, these statistics will affect the speed of economic recovery. With extended periods of unemployment, we’re expecting to see a loss of individual labour skills and a rise in mental health cases with people struggling to adapt. Both these changes will affect the ability of individuals to return to the workforce with higher productivity.

The government acted quickly and for the short-term, JobKeeper will keep official unemployment statistics low. The question is what happens when the scheme is expected to end late September. Without a clear recovery plan, we could be looking at devastating unemployment rates. Federal and State Governments must continue to support businesses by:

- Extending the JobKeeper scheme with a macroeconomic policy or programs to support high-risk industries.

- Creating more jobs by investing in infrastructure and healthcare.

- Introducing a tax reform to lower financial burdens during the COVID-19 recovery stage. E.g. payroll tax and the R&D tax incentive.

- Introducing funding and incentive schemes for education and training including in-work learning, apprentices and training opportunities to reduce labour cost pressures on businesses.

- Continued commitment and investment in the Mental Health and Wellbeing Pandemic Response Plan and consider subsidised treatments and programs for businesses.

Don’t wait – adjust your business model

Past crises tell us that companies that act quickly are better prepared for the future. Take a holistic approach to your strategy and assess all aspects and impacts to finance, marketing and employees.

Employee Training

- Don’t neglect employee training. Identify gaps in the skills pool against your recovery plans.

- Consider digital platforms and programs. Virtual webinars and roundtables, social-sharing tools and live video sessions can be cost-effective options.

- Create a cohesive culture. Improve engagement and the transition back to work by including workers who have been stood down.

Mental Health

- Promote resources and support services i.e. Beyond Blue and the Black Dog institute and any NSW Government offers including free training for NSW businesses.

- Keep communication channels open. Reports have shown an increase in the levels of depression and anxiety, so ensure you regularly check in with staff.

- Be aware of employees dealing with mental illness or on a mental health plan. Help minimise uncertainties and manage expectations.

Government Support Measures

- Check your eligibility and access the latest government measures:

- Federal government:

- State governments:

- Payroll tax relief

- Business grants – e.g. NSW small business grants for eligible employers

Insight tips from our Experts