Many tech businesses and startups tend to begin their life as one or more founder’s passion to provide a solution for a problem in their immediate surroundings. Before they know it, this ‘solution’ has become a viable business with a significant valuation attached to it. While this is great for the founders and their business, not to mention the businesses clients and customers, if the founders are not structured right from the start, they will tend to find themselves with unintended tax consequences in the future or worse yet, potential legal action which could threaten the viability of the business itself. So how do you look at structuring your tech business while in its infancy, without blowing the budget – after all it’s generally a pretty lean budget to begin with.

Effective structuring cannot be put in place without having a clear vision and strategy for your business. Whether you are a tech startup or running an ICT business, you should already be able to articulate a clear and concise vision which is ambitious, but achievable and visible from all directions – if you do not have this in place, stop right now and start working on this because there is no point having a structure in place if you do not know where you are going. Once the vision is in place, the initial strategy will allow you to start implementing the necessary actions and bring your vision to life. Now you have your vision and the strategy to implement it, the following questions will help ensure you ‘get it right from the start’ with your structure.

Note: the following are general tax and commercial observations and should not be considered as legal advice. Always consult a qualified lawyer for legal advice.

Question # 1 – Do you own your shares personally?

There are many ways to establish a company: you can see a lawyer, your tax accountant or you can go online and do it yourself. For many ‘do-it-yourself’ setups, the shareholder of a company is never really understood and ends up being the Founder. While this is simple and cost-effective, it leaves all the assets in the name of the Founder, which results in no flexibility for tax and no asset protection for the Founders interests.

While it may cost a little bit extra initially, forming a family trust to be the company shareholder will yield significant benefits in the future when it comes to tax strategies and asset protection. Having the ability to distribute future dividends or capital gains on the sale of shares can save you thousands in unnecessary tax if you can get it right from the start.

Question # 2 – Is your business and IP held by the same entity?

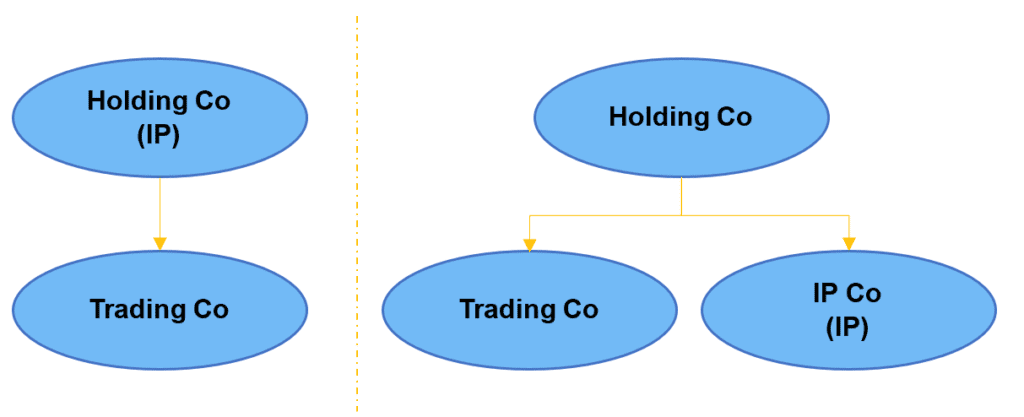

The Intellectual Property (IP) of a business is where the value really comes from and can be your most significant business asset. Unfortunately, we see it over and over where someone has not received appropriate advice or has wanted to keep costs down and only has one company setup, encompassing the trading business and the IP in one. Yes, this will save you on setup costs, however it leaves your most valuable asset in the firing line if you are to be sued. Why work so hard to build up a great business if you are not going to protect it.

To ensure your IP, and the value of your company, is protected in the event your business is sued, incorporating a second company to hold your IP from the outset will add an extra layer of protection. Depending on how complex you want your structure, you could also establish an additional holding entity to act as the head entity for your trading and IP company – doing this will ensure complete separation of your business and assets and allow you to sell off separate entities as you need, further diluting the risk of contagion between entities.

Question # 3 – Do you need to form a tax consolidated group?

Where you have separate entities to run your business and hold its IP (see above), have you considered whether forming a tax consolidated group would benefit your organisation. Some of the benefits of forming a tax consolidated group include:

- Intercompany transactions (e.g. licencing and management fees) are ignored for tax purposes

- No tax implications arise when assets are transferred within the group

- Tax losses of one entity are offset against any profits of the other

- The R&D tax incentive is assessed at the tax consolidated group level, so there’s a lower chance of eligible R&D expenditure being missed

If you believe any of the above items would be beneficial to your organisation, forming a tax consolidated group as early as possible would be best practice to ensure you do not miss out any tax benefits.

Note, tax consolidation can be quite complex, however if you get it right from the start, it can make a world of difference to your tech business.

Question # 4 – Are you in the right structure?

If after reading this article, you are starting to question whether your business or the way you hold the shares in your business is correct, don’t worry you won’t be alone and better yet, you may be able to restructure to a more appropriate structure.

Where you are not in the most appropriate structure, you can generally put steps in place to restructure your group into a more tax effective and asset protected structure. Doing this will generally result in you transferring assets to another entity. For example, the Founder selling shares held personally to a family trust.

Generally, there will be no actual transfer of money, however for tax purposes, the transfer will be deemed to occur at market value, which depending on how long your business has been running, could result in a high valuation and potentially large capital gain. Importantly, this gain can be reduced if you are a small business – even to the level of you paying no capital gains tax at all.

If a restructure is appropriate for your organisation, then the early you can do it, the better.

Having the right tax advisor can help you navigate the complex tax consequences of restructuring, to ensure you can take advantage of the available concessions or rollovers in order to limit the tax payable or potentially reduce it altogether.

Question # 5 – How do you plan to exit your business?

No matter whether you are a tech startup or ICT small business, you should always look to ‘get it right from the start’. Putting the time in at the early stages of your company will allow you to set yourself up for success and significant tax savings when the time to exit arises.

For small businesses there are several available CGT concessions, which if applied correctly, could significantly reduce your gain or in some cases clear it altogether. Many times, we have seen small business owners only start to consider their structure when they are about to sell their business and unfortunately paying significantly more tax than needed. It’s never too early to review your structure to ensure you are in the most tax effective structure for you.

For startups, and larger businesses it’s all about ensuring you have the right structure for sale and that your company or group is ‘clean’ i.e. separating out different businesses, ensuring all personal assets are removed from the group, cleaning up your cap register.

Where to next?

Structuring your business and personal assets is only one part of the puzzle when it comes to ensuring you ‘get it right from the start’. You can have the most tax effective and asset protecting structure in place, yet if there is no clear vision or strategy for your business, then it won’t matter as your business will not thrive.

If reading this article made you question whether your structure is right for you or you do not have a clear vision and strategy for your business, get in touch to discuss this further and see how William Buck can help you. As part of our alliance with ACS we offer members a complimentary structure review to see how we can assist their business.

Want to hear more in person?

Attend the upcoming ACS Queensland financial structuring seminar, which is offered free for ACS and RCL community members.

When: Wed 11 March, 5.30pm

Where: River City Labs, Level 3, The Precinct, 315 Brunswick Street Mall, Fortitude Valley

Registration essential – visit: https://bit.ly/2RCapTB