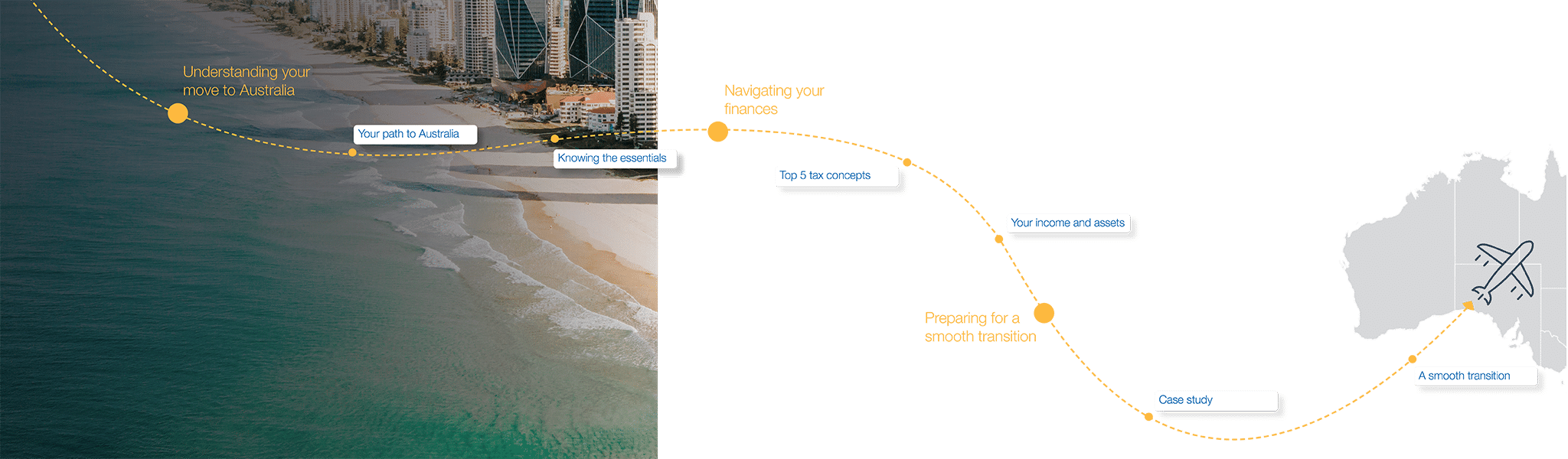

Your path to Australia

Key insights and strategies for relocating to Australia, focusing on tax implications and financial optimisation.

Knowing the essentials

Essential guidelines on tax residency, covering Australian vs. foreign status, and residency tests for individuals and entities.

Top 5 tax concepts

Simplified explanations of crucial tax concepts, including income tax, CGT, and Double Tax Agreements.

Your income and assets

Overview of how domestic and foreign income is taxed in Australia, with a focus on maximising compliance and tax efficiency.

Case study

A real-life example showing how to navigate tax implications when relocating to Australia.

A smooth transition

Practical advice on strategic tax planning, staying compliant, and minimizing tax liabilities during relocation.