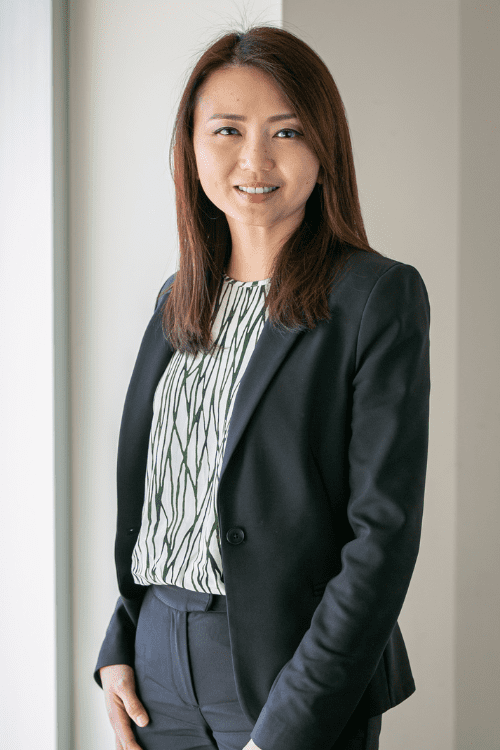

Frances Carter

Director Asia Pacific, Conservation Capital

Frances is the Director of Asia Pacific for Conservation Capital where she works on conservation area business planning, innovative natural capital financing and sustainable natural resource management projects across Africa, Asia and South America. Conservation Capital works with corporations, civil society, government, international development finance institutions, supranational institutions, private landowners, and Indigenous communities to create and protect resilient natural landscapes that support communities and private enterprise. Conservation Capital has worked in over 40 counties, mobilising over US$250 million to natural capital investments.

Frances is also a Subject Matter Expert on corporate sustainable development, ESG strategies, sustainability reporting and carbon management, including carbon offsets and nature-based solutions. This involves a focus on global climate investments that deliver ecological and social co-benefits, as well as meeting international best practice standards.

Prior to joining Conservation Capital, Frances spent over ten years as a senior Chartered Accountant in auditing, agriculture, banking and funds management, and international development. In addition to her CA qualification, she has two international Masters’ degrees: Master of Science (Sustainability Management) from Columbia University (New York City), and a Master of International Business Administration from IE Business School (Madrid).