We often hear clients thoughts in relation to insurance which can be negative due to stories heard on the media etc.

We de-bunk some of the most common myths about life insurance:

Myth # 1 – Life insurance companies don’t pay claims

There’s a common perception that life insurance companies will do everything they can to avoid paying claims.

In fact, 92% of all life insurance claims are paid in the first instance¹.

As long as you fulfil your duty of disclosure when you apply for cover, and you’re covered for the medical condition you’re claiming for, you can be confident your claim will be paid.

Myth # 2 – I’m young and don’t have kids or a mortgage, so I don’t need it

Life insurance isn’t all about providing for debts and dependants. It’s also about looking after yourself.

Think what would happen if you became ill or disabled and couldn’t work. If you didn’t have income protection, you’d have to find another way to supplement your income – through friends or family. Having income protection means that you are more likely to be able to manage on your own.

There are benefits to applying for life insurance when you’re young and healthy. It’s generally cheaper and it means you don’t have to worry about getting cover later if your health changes (refer myth #3).

Myth # 3 – I won’t be covered if my health changes

Once you start your cover, what you are covered under your life insurance for won’t change – even if your health declines.

In fact, you generally don’t even need to tell your insurer about a change in your health unless you intend to make a claim.

Myth # 4 – You have to do lots of medical tests to get covered

Some life insurance products sold through financial advisers require some medical tests before you get covered, but it may be as simple as one blood test and a GP examination.

- If you have an existing medical condition, you may be asked to provide extra information about your condition and insurers will generally write to your doctor for a report rather than require tests

- You generally won’t be covered for pre-existing conditions, so it’s important to establish upfront what those pre-existing conditions are. It’s important to answer all questions accurately upfront so any pre-existing conditions can be reviewed by your insurer for any impacts to your cover or ability to obtain cover.

- That way you know exactly what is and isn’t covered under your policy.

Myth # 5 – Level premiums don’t go up

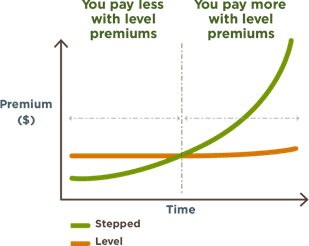

‘Level premiums’ are designed to save you money over the long term by eliminating the impact of age-based premium increases.

Level premiums are calculated based on your age when the cover started, not at each anniversary, which means premiums are generally averaged out over a number of years. This means your cover is more expensive than ‘stepped premiums’ at the beginning of your policy, but generally gets cheaper (relative to stepped premiums) as your policy continues.

It’s important to note that at policy anniversary the premium may still increase (even with level premiums), because age is just one factor that determines your premium. Other factors that impact premium (such as claims trends in Australian population) can result in a repricing of your insurance cover.

When insurers reprice stepped or level premiums, they don’t do it for an individual policy within a specific group unless they do it for every policy in that group.

Many life insurers in Australia have repriced level premiums in the past, so it’s important to talk to your financial adviser or your life insurer to understand your policy as well as any repricing activity that’s recently occurred, so you can make an informed decision.

The above graph is for illustrative purposes only. This graph illustrates age-based premium increases for stepped against level for all covers. This premium comparison has been calculated, assuming all other factors affecting the premiums are excluded.

Both stepped and level premiums can increase due to factors other than age.

Myth # 6 – I’ll be stuck paying for cover I don’t need

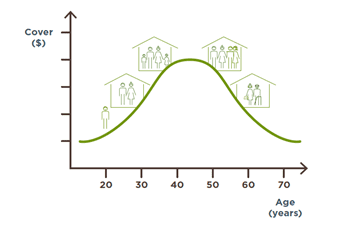

Life insurance is designed to change as your life changes, as your cover needs can vary significantly over your lifetime.

An example may be when taking out life insurance when getting married. You may want to increase your cover if you have children or increase your mortgage. But similarly you may want to reduce your cover if your children have grown up or you’ve paid down your debts.

Your financial adviser can help you work out how much cover you need at any given time, to make sure you’re not paying for any cover you don’t need.

Myth # 7 – The cover in my super is enough

Over 70% of Australian life insurance policies – more than 13.5 million separate policies – are held through superannuation funds*.

While this cover is great to have, many of these policies only provide the minimum level of cover employers have to offer, which isn’t enough for most people.

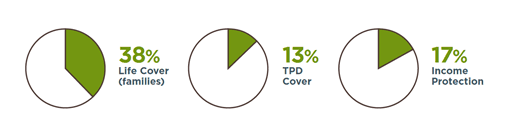

In fact, Rice Warner* estimates that the median level of cover in superannuation meets is only 60% of needs for life cover (or just 38% for families with children), 13% for TPD cover and 17% for income protection.

Basic needs met by life insurance cover in super

*Insurance through superannuation, 2016, www.ricewarner.com/insurance-through-superannuation/

Myth # 8 – I’ll be covered by workers’ compensation

Workers’ compensation provides some protection for work-related accidents or injuries.

But it doesn’t cover most illnesses, nor does it cover anything that happens to you when you’re not at work. It’s worth checking your states workers compensation legislation.

Even if you are covered by workers compensation, the benefits are typically capped in terms of the amount and duration of payments, which means the cover could fall well short of what you really need.

Myth # 9 – Only the main breadwinner needs life insurance

There’s no doubt insuring the breadwinner is vital for any family’s financial security.

But if a non-working or lower income-earning partner became seriously ill or injured, their family would need a lot of assistance to replace their services within the home.

Imagine a breadwinner had to reduce their working hours to look after their partner or young children, or employ outside help.

Either option could prove very expensive, which is why both members of a couple should consider the various life insurance cover options available – regardless of their role.

William Buck Wealth Advisors are one of South Australia’s largest locally owned wealth advisory practices and can provide advice on a wide range of wealth strategies, investments and risk insurances. They are the financial planning arm of reputable accounting firm William Buck, providing trusted wealth advice to South Australians for over 20 years (AFSL 230637, Australian Credit Licence 230637).

If you would like to review your personal insurances, contact me or email sa.riskinsurance@williambuck.com

By ALESSANDRA FORERO, ASSOCIATE ADVISOR, WEALTH ADVISORY | ADELAIDE

Alessandra is a William Buck Wealth Advisor. With over 10 years industry experience, she aims to ensure high quality client service across strategic advice areas. When she is not work, Alessandra is a mother to her little boy and has a passion for flamenco dancing.