If you’ve heard about the Australian Government’s plans to progressively reduce the corporate tax rate from 30% to 25% by 2027, and you’re currently claiming the R&D Tax Incentive, you might be wondering what this means for the R&D tax offset rates going forward and the net benefit of registering an R&D claim.

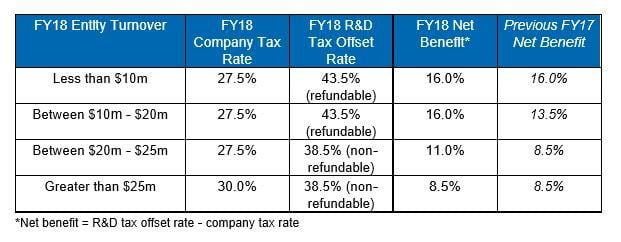

Well, you’re in luck – the result is a positive one for R&D tax purposes, especially for companies with a turnover between $10m – $25m in FY18. As the company turnover threshold for accessing the lower 27.5% tax rate is set to rise from $10m (FY17) to $25m (FY18), more companies will be able to enjoy a higher net benefit resulting from registering eligible R&D Tax Incentive claims.

The table below illustrates the net benefit available to companies in certain turnover brackets for FY18:

Disclaimer: The contents of this article are in the nature of general comments only, and are not to be used, relied or acted upon with seeking further professional advice. William Buck accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. Liability limited by a scheme approved under Professional Standards Legislation.