In times of economic uncertainty, SME businesses are generally squeezed harder than larger ones, with fewer levers to help them navigate financial distress.

This is particularly relevant for manufacturing businesses, which have faced headwinds in recent times caused by high inflation, increasing interest rates, supply chain issues and challenges sourcing skilled people.

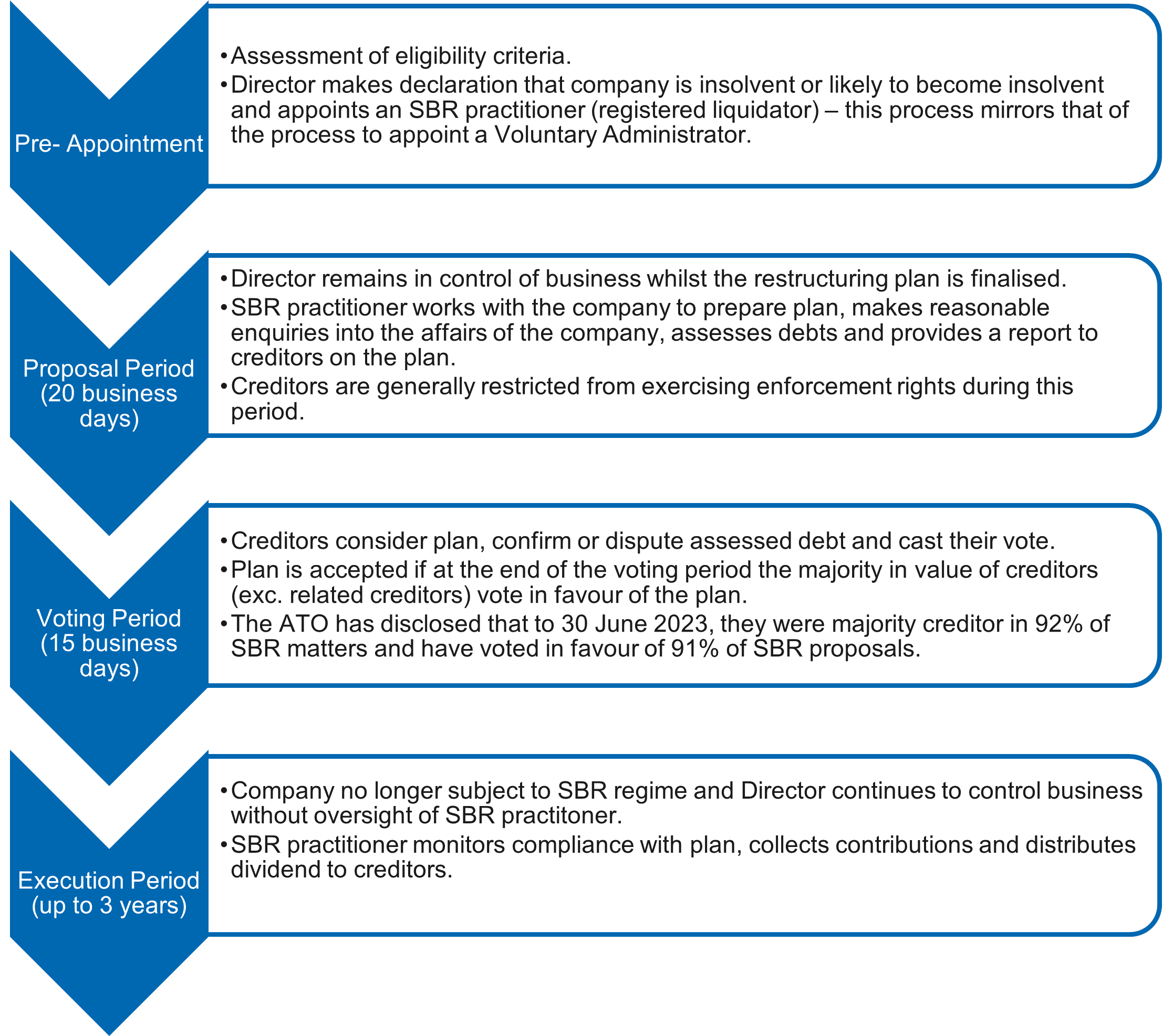

This uneven playing field was improved with the introduction of the Small Business Restructuring (SBR) regime in 2021. SBR is a tool exclusively available to SME businesses to restructure their affairs, break the cycle of funding historical losses and set themselves up for future profitability.

Eligibility

To be eligible for the small business restructuring regime, a company must have:

- Liabilities of less than $1m

- No outstanding employee entitlements (i.e., superannuation), and

- Lodged and returned all outstanding lodgments to the ATO.

It is also worth noting that a director can only use the SBR regime once every seven years.

Process

Outcome

A manufacturing business in distress is likely to have an escalation of trade and statutory creditors as declining performance requires that creditors are pushed out. However, it is also likely that the business may have equity locked up in equipment which could be used to address the build up of creditors. Below is an example of how this might work:

| Manufacturing SBR Example | $ (‘000) |

| Available Working Capital | 50 |

| less: SBR Costs | (20) |

| Residual Working Capital | 30 |

| add: SBR Contribution (Unlocked Equipment Equity) | 100 |

| Creditor Dividend Pool | 130 |

| Creditors | 500 |

| Dividend Rate | 26% |

| Net Asset Position Pre SBR | (300) |

| Changes: | |

| Reduction in Creditors | 500 |

| Reduction in Working Capital | (50) |

| Increase in Non-Current Debt | (100) |

| Net Asset Position Post SBR | 50 |

| Improvement in Net Asset Position | 350 |

The above outlines the potential upside to a manufacturing business of creating a restructuring plan with its creditors. Factoring in current working capital and costs, unlocking $100k in equity to fund the SBR contribution could lead to an improvement in the company balance sheet of $350k. This result is based on the secured creditor increasing the company’s facilities with preservation of their security (i.e., plant and equipment) and unsecured creditors accepting a dividend of 26c on the dollar for their claims.

This result is likely to be a better one for all creditors than liquidation. If the company ceases to trade, employee entitlements will crystalise and the value of the plant and equipment would decrease, reducing the equity available to pay creditors.

The SBR contribution can be generated in several ways including a third-party injection of funds or future trading profits.

Alternatives

As noted above, the SBR is exclusively available to SME businesses. The alternative for larger distressed businesses or those that don’t meet the eligibility criteria for the SBR regime include a formal restructure through a Voluntary Administration or an informal restructure under Safe Harbour. Below, you’ll find articles with further information on these options.

How and when your business should access Australia’s safe harbour provisions

Business rehabilitation through Voluntary Administration

Please contact your local William Buck Restructuring and Insolvency advisor for further information.