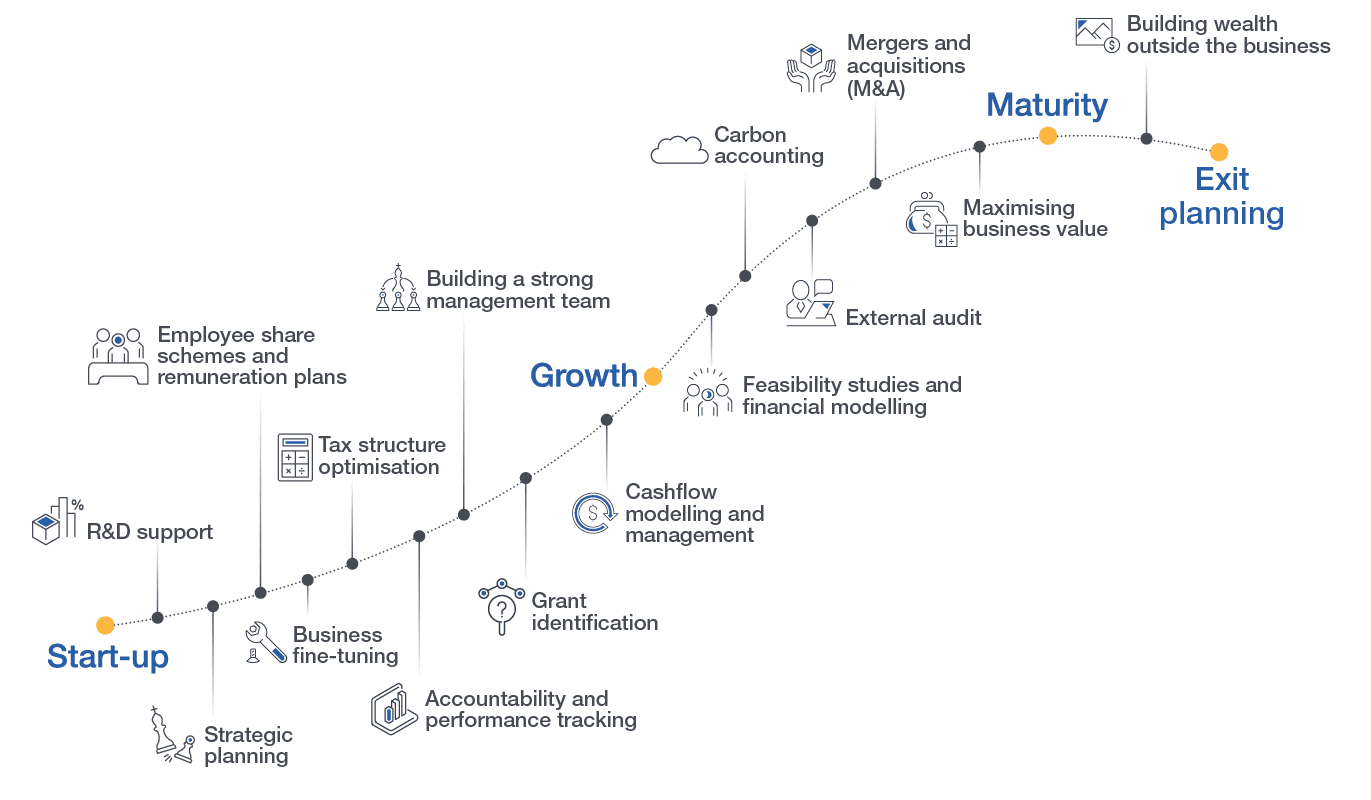

R&D support

Learn how to maximise your R&D Tax Incentive claim before the financial year-end with simple steps and important considerations. Understand eligibility, required documentation, and the process of claiming the incentive for Australian businesses.

Feasibility studies and financial modelling

William Buck’s financial modelling services help businesses make strategic decisions by creating customised models. Our expertise includes designing integrated models, sensitivity analyses, and investment opportunity assessments tailored to your specific needs.

Building wealth outside the business

Develop wealth creation, retirement, and superannuation strategies with William Buck. Our advisors integrate investments, transactions, and tax planning to ensure the most tax-effective and profitable outcomes for your business and personal wealth.

Building a strong management team

William Buck’s Strategic Business Consultancy helps businesses thrive by developing robust strategies for growth. Our process includes vision setting, environmental assessment, and strategy implementation, ensuring your business is well-prepared for future challenges.

Strategic planning

Gain a competitive advantage with strategic planning and timely decisions. Our specialist advisors offer expert advice on business restructuring, funding, mergers, valuations, risk management, and more, helping you focus on day-to-day management while planning for future growth.

Employee share schemes and remuneration plans

Explore the tax implications and benefits of setting up an employee share scheme or stock option plan in Australia. Understand the startup concession, tax deferral options, and key considerations for aligning company and employee interests.

Tax structure optimisation

Proactive tax planning for small businesses helps maximise returns and reduce liabilities. Understand key strategies like instant asset write-off, small business energy incentives, and more. Learn how to optimise your tax position before year-end.

Business fine-tuning

Discover how William Buck can ease the burden of tax compliance and reporting, ensuring your business meets all requirements efficiently. Our expert team handles everything from tax returns to strategic advice, letting you focus on growth.

Accountability and perform tracking

William Buck’s Virtual CFO services offer dedicated finance leaders providing strategic advice, performance measurement, data analysis, and cash flow management. Scalable and flexible, our VCFO solutions ensure proactive financial leadership tailored to your business needs.

Grant identification

Learn about the updated Export Market Development Grant scheme. Understand the shift to upfront funding, new tiered system, and application process to maximise your business’s export marketing potential with William Buck’s expert guidance.

Cashflow modelling and management

Ensure your cash flow forecast meets the requirements of ASA 570 Going Concern. Learn key essentials to manage with your auditor, including timing, flexibility, and comprehensive control over working capital.

Carbon accounting

Discover how to gain a competitive edge in sustainability with insights from Simon Lunn, Sustainability Analyst at William Buck, presented at AMW Sydney 2024.

External audit

William Buck’s external audit services ensure the accuracy of your financial statements, contributing to better decision making and risk management. Our tailored audit plans focus on key value drivers and critical risk areas for your business.

Mergers and acquisitions

William Buck provides end-to-end support for mergers, acquisitions, and divestments. From due diligence to post-acquisition integration, our team ensures optimal strategic, financial, and cultural fit, helping you make informed decisions and maximise value.

Maximising business value

Maximise your business value and minimise tax with William Buck’s Exit Smart Report 2023. Discover key insights and practical tips for successful exit planning, ensuring a favourable financial outcome.