As a follow-up to William Buck’s extensive Dealmaking Insights Report 2024, this half-yearly update investigates the key trends observed across Australia’s Mergers and Acquisitions (M&A), Initial Public Offerings (IPOs), Private Equity (PE), and Venture Capital (VC) markets. It mainly focuses on the mid-market (up to $100m in value) to understand market opportunities and trends and their implications for our diverse mid-market client base.

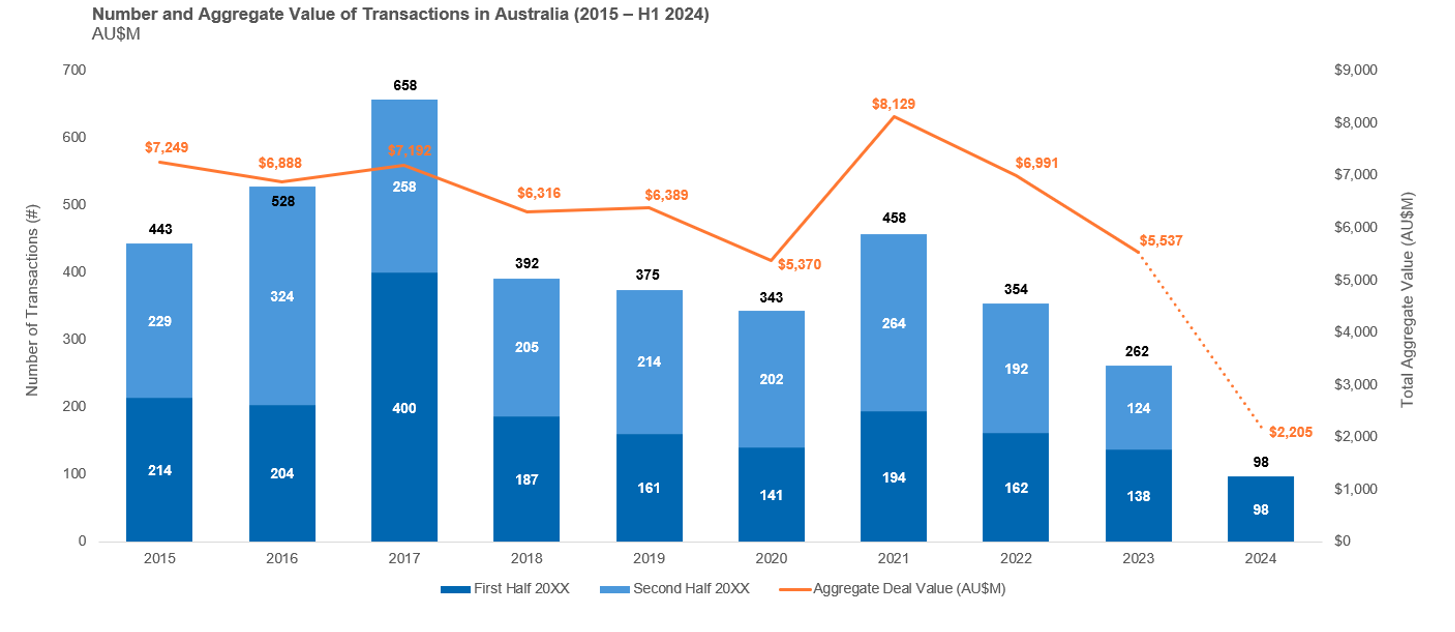

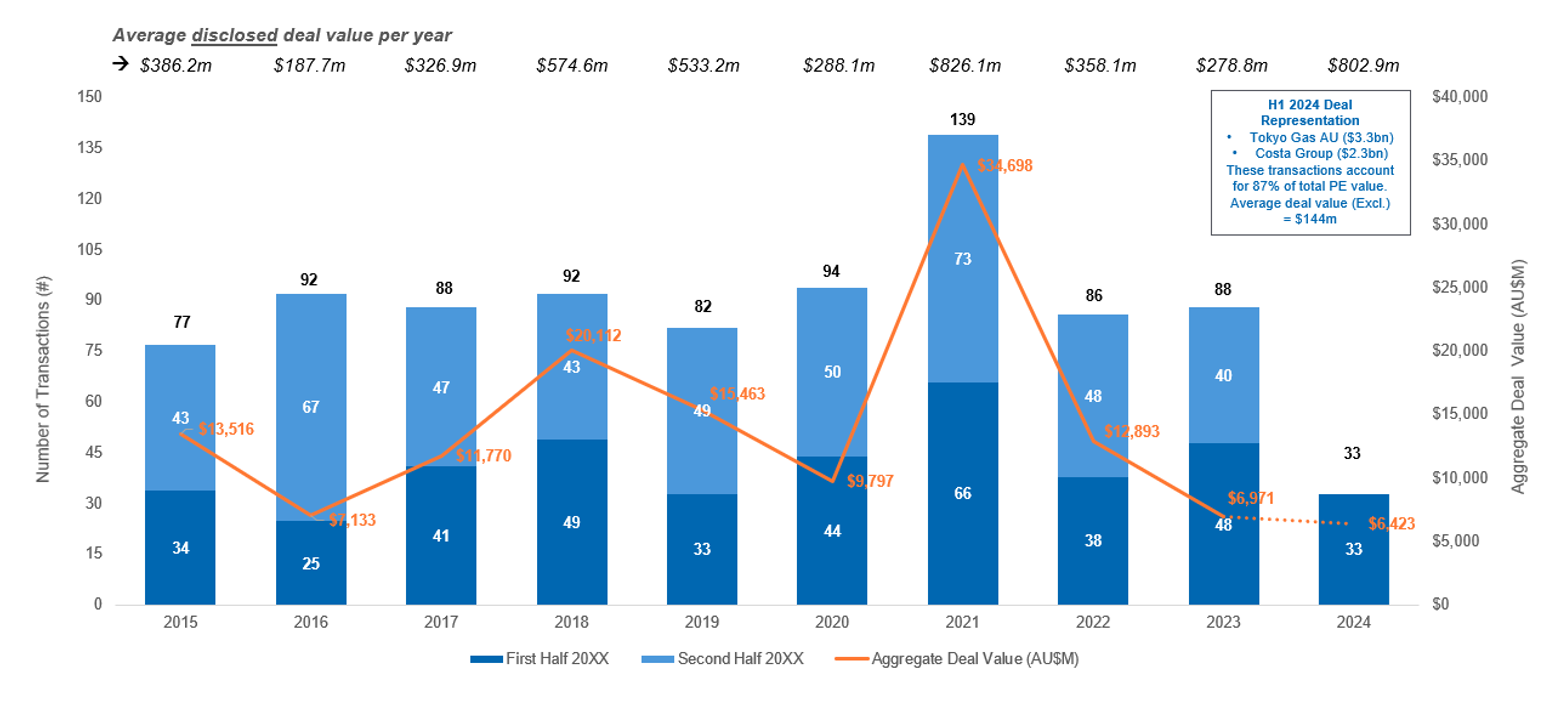

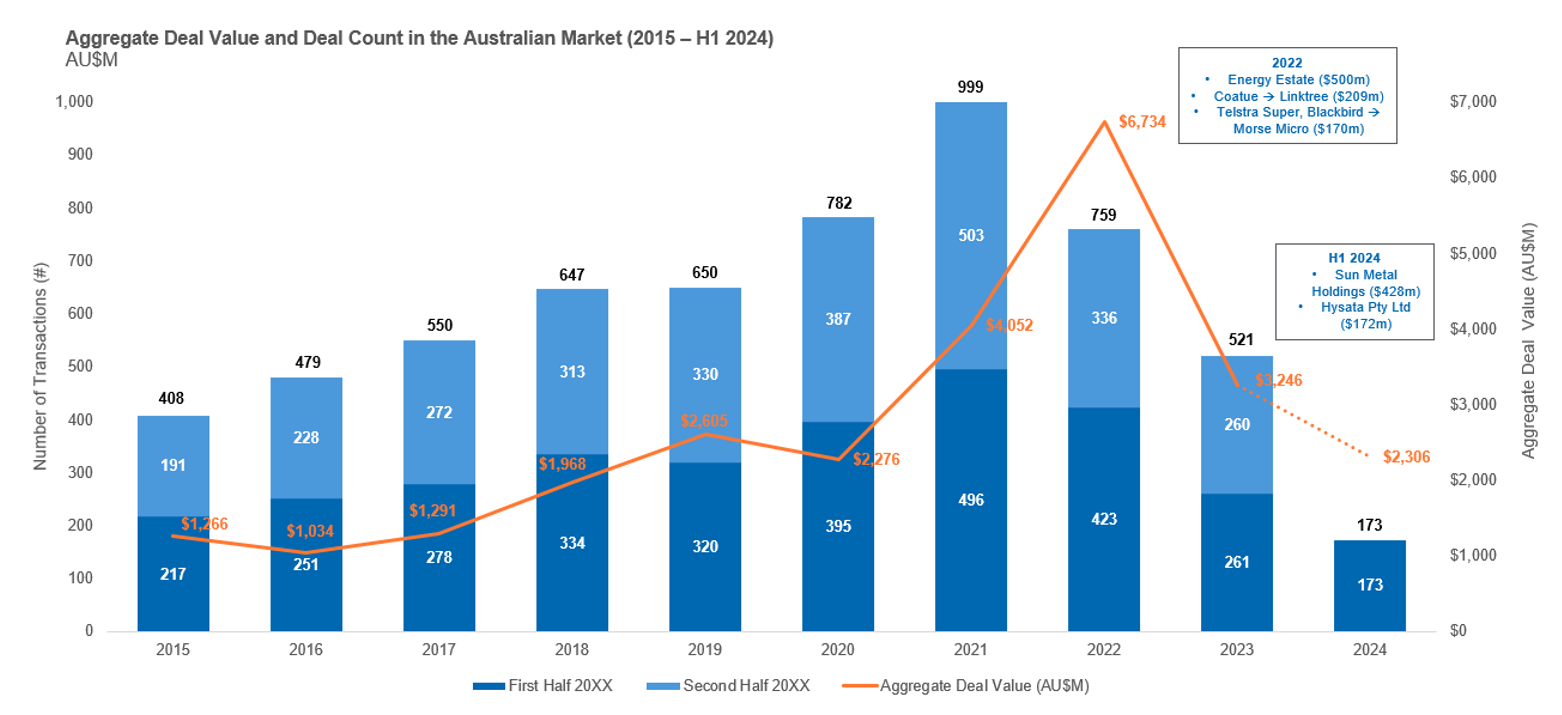

A slowdown in dealmaking activity was observed in H1 2024 across M&As, IPOs, PE and Venture Capital markets, driven primarily by heightened volatility and market uncertainty. In our research, four major themes emerged:

Higher interest rates, for longer

While inflation has come down from its high of 6.8% in December 2022, it remains above the RBA’s long-term CPI target of 2-3% p.a. Consequently, the cash rate has remained at 4.35% since November 2023. The higher interest rates have continued to lower investor risk appetites while simultaneously placing downward pressure on the profitability of most businesses. Businesses have continued to experience cost inflation, albeit at lower levels than during and after the pandemic.

What does this mean for your business?

Businesses with significant debt balances will continue to experience substantial profitability headwinds as interest repayments reduce profit. This issue is likely to remain more acute for SMEs, who have less access to diverse debt financings options, such as corporate bonds and favourable rates, than larger public entities.

Geopolitical uncertainty

This year represents the most significant election year in modern history, with more than 60 elections held or expected to be held globally, with market attention being fixed on the outcomes of the US, UK, EU and Indian elections. While many of these elections have already occurred in the first half of 2024, markets are still grappling with the uncertainty around the policy responses of these elected officials to cost of living pressures, civil unrest, climate change and international conflicts.

The first half of 2024 has also represented a period of increased escalation in global conflicts, with heightened geopolitical tensions in the Middle East and Ukraine. These tensions have had material effects on the global supply chain and forced major powers to respond despite an increasing number of domestic issues at home.

In addition, Australian market participants, including domestic and foreign investors, have also been forced to assess the impact of recent proposed ACCC merger laws, which place mandatory disclosure, notification and approval requirements for acquisitions above a 20% interest level and on the condition the deal meets the notification threshold (expected to be c. $30m). These changes have introduced further uncertainty and risk into the market, even if it is too early to determine whether the net effect of these changes will be positive and pro-competition or stifling to deal-making activity in Australia.

What does this mean for your business?

While supply-chain costs and concerns have decreased since their height post-pandemic, logistical and supply issues remain front-of-mind for many of our clients. For our larger clients in the mid-market who are looking to sell in the medium term, increased regulatory scrutiny arriving in 2026 may expedite their exit plans, reducing the list of potential buyers and lengthening the due diligence process.

Longer, more complex deals

In current market conditions, deals are taking longer and are driven by slower, more comprehensive due diligence processes, ESG considerations, and differing views on value between buyer and seller. Due diligence processes are being extended, with buyers wanting to understand the quantum, quality and resilience of future revenues and earnings. Part of this process involves understanding where the target company fits in its supply chain, the degree to which it is vertically integrated and the quality of its margins and earnings. ESG has become an increasingly significant consideration in transactions, especially when the buyer is a PE fund or the deal is financed through the debt of a major bank, which also has its own ESG obligations.

In addition, while we’ve observed owners becoming more realistic about their company’s valuation, there remains a valuation gap between buyers and sellers. As such, buyers are increasingly opting to use earn-outs and deferred compensation to reduce their down-side risk, along with their up-front investment and keep the owners in the business to ultimately ‘bridge the gap’ in valuation and see through the sale of the business.

What does this mean for your business?

Owners who are looking to sell their business in the short-medium term should carefully consider their exit and ask the following questions:

-

-

- What are my personal goals and objectives in the sale process? A complete exit or remain in the business?

- What state is my business in?

- Have I conducted vendor due diligence before going to market?

-

These questions have become ever more important in current market conditions, as investors are increasingly selective and discerning in the deals in which they undertake due diligence and ultimately buy. For example, depending on the buyer, an owner who wishes to exit the business and be paid upfront may have to accept a lower transaction value to see the deal through.

Flourishing sectors

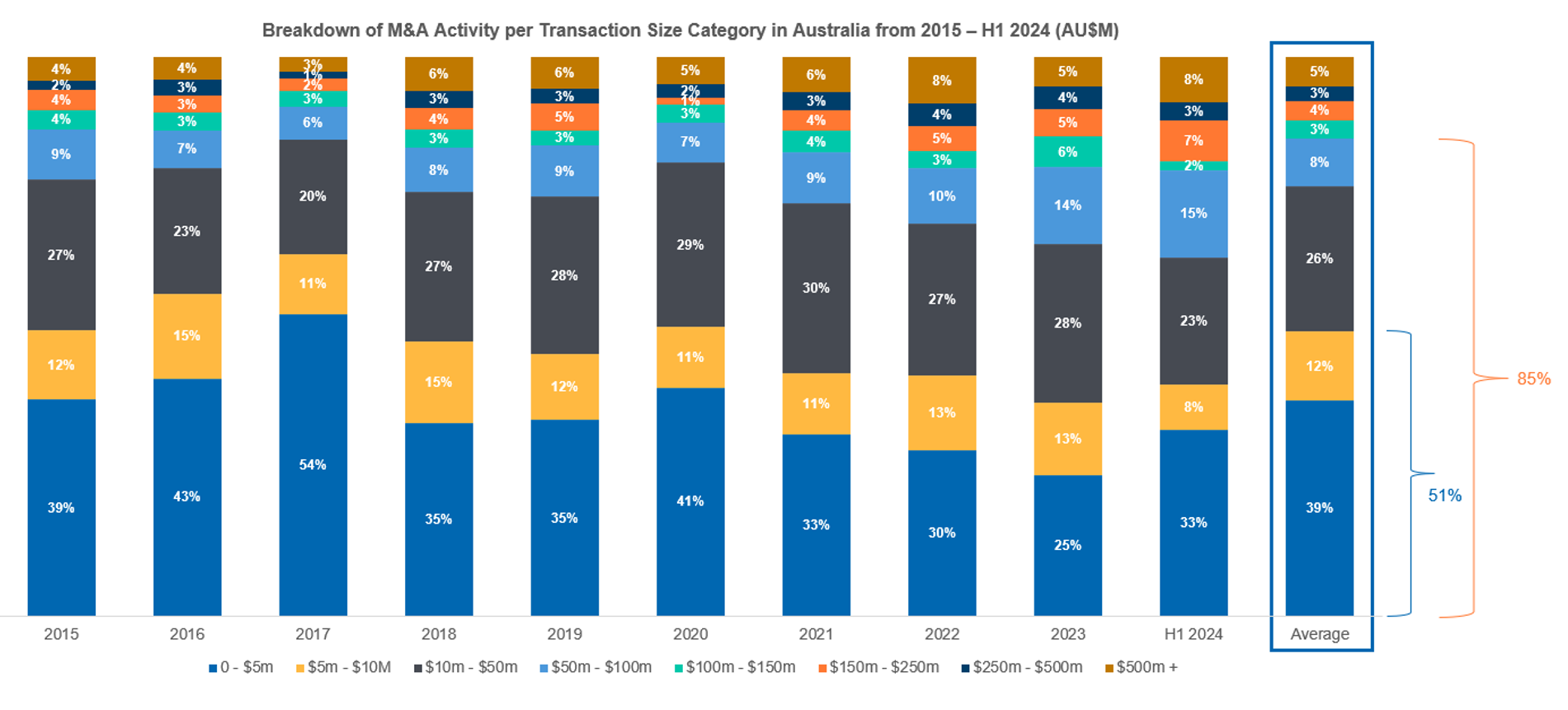

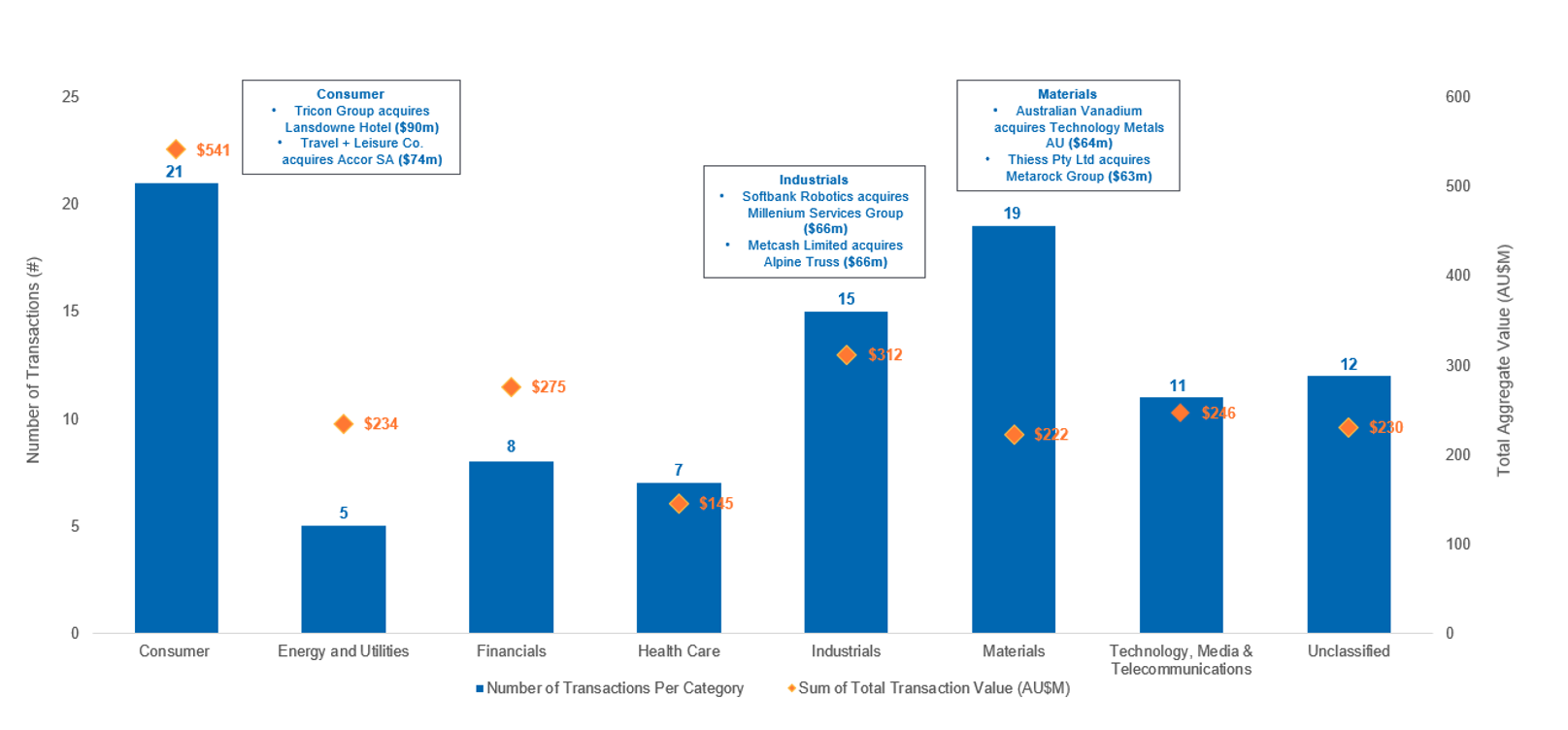

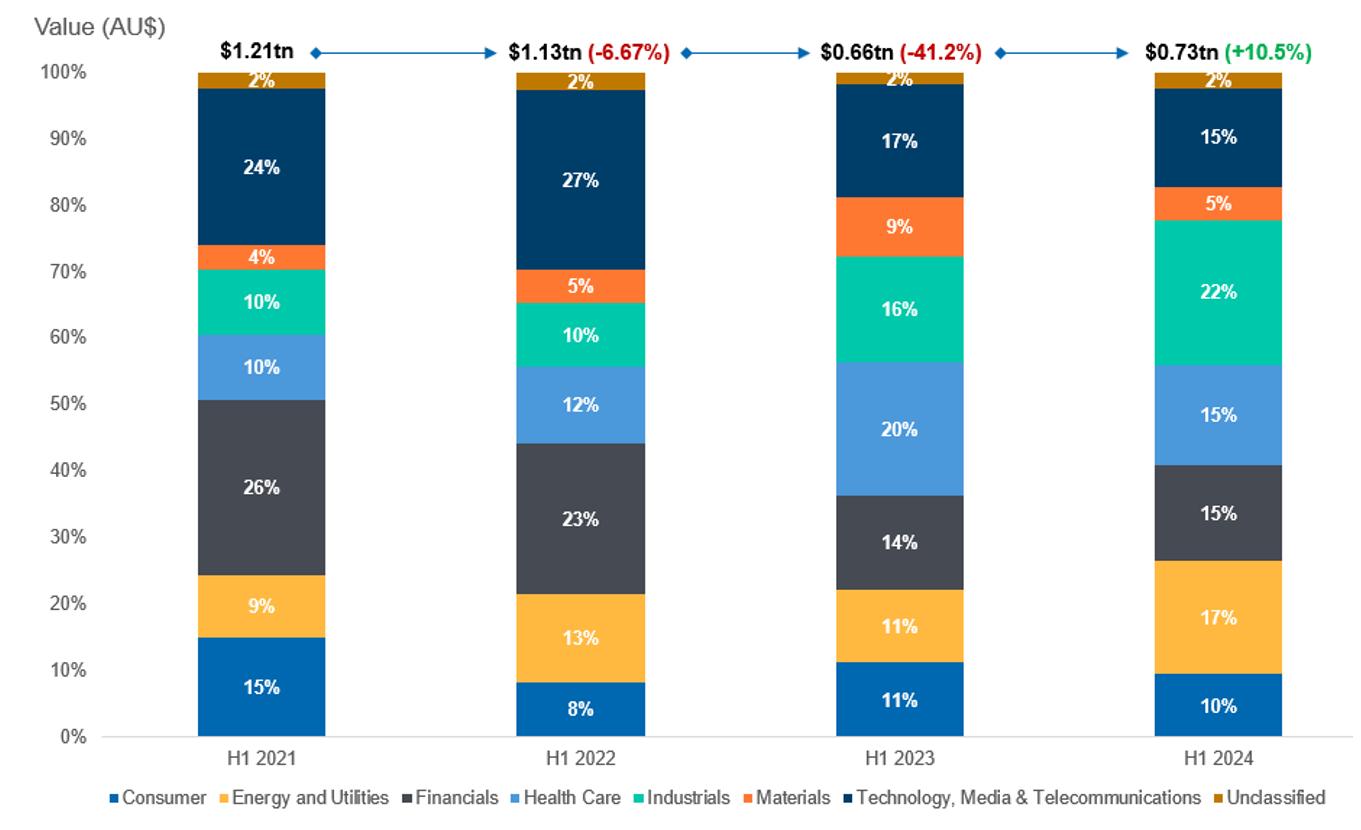

Our Dealmaking analysis suggests that the Consumer, Technology, and Materials sectors continue to dominate mid-market transactions, accounting for 51% of total mid-market deals. These findings highlight the durability of consumer-centric businesses across all stages of the economic cycle and the ongoing role that mining and manufacturing play in the Australian economy.

Looking forward, we anticipate accelerated growth in specialised manufacturing as Australia increases its independence, fuelled by ‘Made in Australia’ tailwinds in an increasingly de-globalised world. Professional services firms remain attractive and ripe for acquisition, given their low-capex requirement in a high-interest rate environment. We’ve also observed, anecdotally, an uplift in the number of doctor-owned healthcare roll-ups and new-site developments, with a focus on improved and expedient patient care.

With these four insights in mind, I encourage you to continue exploring our half-year Dealmaking Insights Report Update to understand how your business is positioned in today’s market

One thing is for sure – the middle market remains the place to be.