Unlock your business potential with a free 'William Buck Hour'

In today’s uncertain and rapidly changing business environment, the right support is crucial. At William Buck, our highly skilled team assists you in accessing funding, making strategic decisions, and developing plans tailored to each stage of your business’ lifecycle. We work closely with you to provide specialist knowledge and objective advice, ensuring your business reaches its full potential.

Get Your Free Consultation Now

The William Buck Hour

Time is precious, and we respect that. The William Buck Hour packs essential insights into a focused sixty-minute session. We cover financial management, funding options, personnel strategies, regulatory requirements, and personal wealth strategies. You’ll leave the session with a fresh perspective and a focused strategy to propel your business forward.

In your life you will spend:

48,000 Hours: Commuting to Work

27,000 Hours: In Meetings

1,800 Hours: Making Coffee

Spending just one hour with us could be the

most profitable hour of your year.

How can we help?

Explore Our Interactive Business Growth Lifecycle

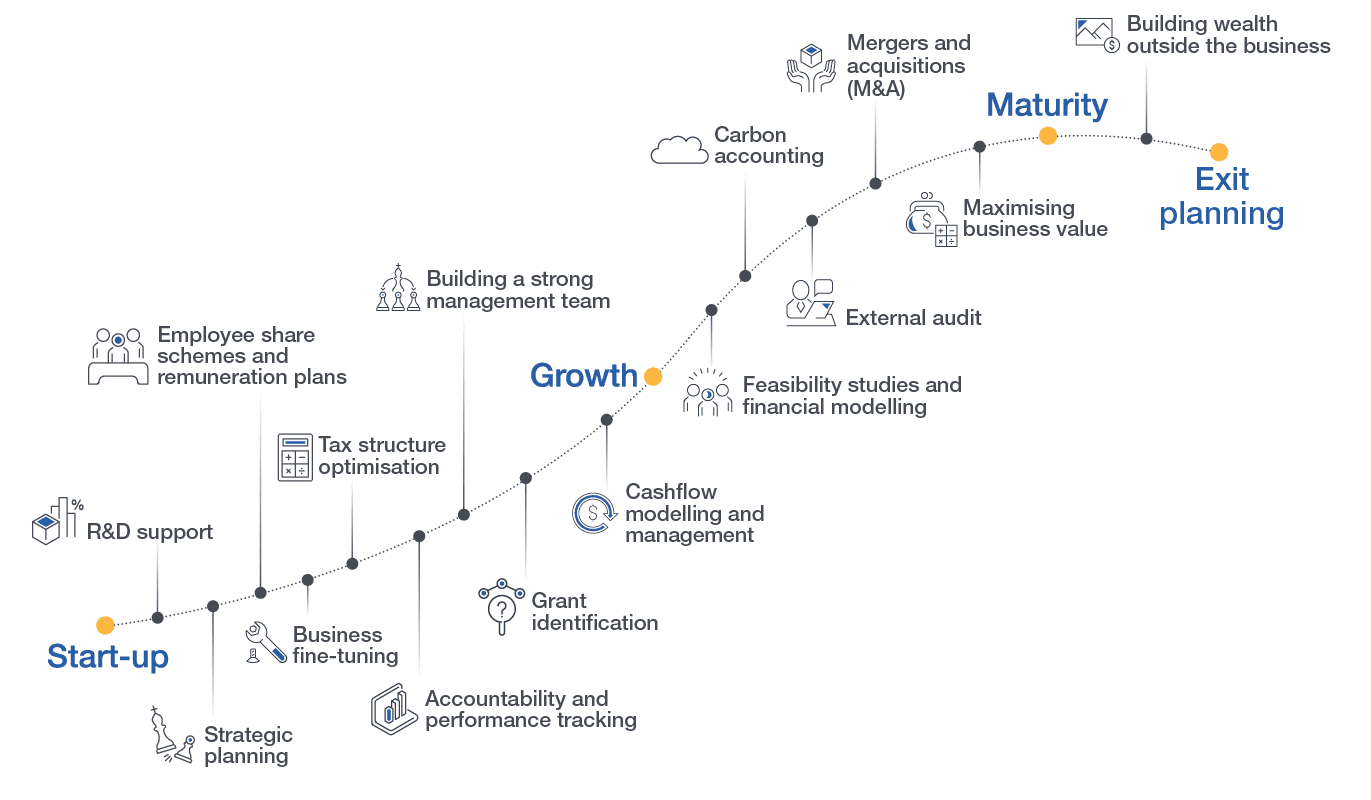

Through each stage of growth, we are focused on understanding your business, its goals and objectives and overcoming any challenges that may arise. Whether it is business planning, forecasting, funding or just making sure your risks and obligations are understood and managed, we partner with you to help your business grow profitably and sustainably.

R&D support

Learn how to maximise your R&D Tax Incentive claim before the financial year-end with simple steps and important considerations. Understand eligibility, required documentation, and the process of claiming the incentive for Australian businesses.

Feasibility studies and financial modelling

William Buck’s financial modelling services help businesses make strategic decisions by creating customised models. Our expertise includes designing integrated models, sensitivity analyses, and investment opportunity assessments tailored to your specific needs.

Building wealth outside the business

Develop wealth creation, retirement, and superannuation strategies with William Buck. Our advisors integrate investments, transactions, and tax planning to ensure the most tax-effective and profitable outcomes for your business and personal wealth.

Building a strong management team

William Buck’s Strategic Business Consultancy helps businesses thrive by developing robust strategies for growth. Our process includes vision setting, environmental assessment, and strategy implementation, ensuring your business is well-prepared for future challenges.

Strategic planning

Gain a competitive advantage with strategic planning and timely decisions. Our specialist advisors offer expert advice on business restructuring, funding, mergers, valuations, risk management, and more, helping you focus on day-to-day management while planning for future growth.

Employee share schemes and remuneration plans

Explore the tax implications and benefits of setting up an employee share scheme or stock option plan in Australia. Understand the startup concession, tax deferral options, and key considerations for aligning company and employee interests.

Tax structure optimisation

Proactive tax planning for small businesses helps maximise returns and reduce liabilities. Understand key strategies like instant asset write-off, small business energy incentives, and more. Learn how to optimise your tax position before year-end.

Business fine-tuning

Discover how William Buck can ease the burden of tax compliance and reporting, ensuring your business meets all requirements efficiently. Our expert team handles everything from tax returns to strategic advice, letting you focus on growth.

Accountability and perform tracking

William Buck’s Virtual CFO services offer dedicated finance leaders providing strategic advice, performance measurement, data analysis, and cash flow management. Scalable and flexible, our VCFO solutions ensure proactive financial leadership tailored to your business needs.

Grant identification

Learn about the updated Export Market Development Grant scheme. Understand the shift to upfront funding, new tiered system, and application process to maximise your business’s export marketing potential with William Buck’s expert guidance.

Cashflow modelling and management

Ensure your cash flow forecast meets the requirements of ASA 570 Going Concern. Learn key essentials to manage with your auditor, including timing, flexibility, and comprehensive control over working capital.

Carbon accounting

Discover how to gain a competitive edge in sustainability with insights from Simon Lunn, Sustainability Analyst at William Buck, presented at AMW Sydney 2024.

External audit

William Buck’s external audit services ensure the accuracy of your financial statements, contributing to better decision making and risk management. Our tailored audit plans focus on key value drivers and critical risk areas for your business.

Mergers and acquisitions

William Buck provides end-to-end support for mergers, acquisitions, and divestments. From due diligence to post-acquisition integration, our team ensures optimal strategic, financial, and cultural fit, helping you make informed decisions and maximise value.

Maximising business value

Maximise your business value and minimise tax with William Buck’s Exit Smart Report 2023. Discover key insights and practical tips for successful exit planning, ensuring a favourable financial outcome.

Strategic business planning

Whether you want to expand your market share, improve your profitability or prepare for succession or exit, we can help you design and implement an effective business strategy Through strategic planning, we will ensure alignment across the business, provide clear, achievable targets and allocate responsibilities so that you can make more informed decisions and arrive at your goals.

VCFO

We tailor our Virtual CFO solutions to your needs, providing you with a dedicated and experienced finance leader without having to invest in a full-time resource. Project-based or permanent, our Virtual CFO solutions are scalable and flexible and encompass a range of services including strategic financial management, process optimisation and risk management.

Explore Business Advisory Services

Accessing Finance & Grants

At some point, most businesses will need to access finance. Whether a startup looking at applying for a business loan, an emerging SME interested in raising venture capital, or a well-established company considering an IPO, we can assist.

Accounting & tax compliance

Tax compliance and reporting regulations are onerous, time consuming and complex. Working with William Buck can ease the burden on both administrative staff and the key decision makers of the business. We make your compliance our top priority allowing you to focus on what you do best; managing and growing your business.

Cloud Accounting

Cloud accounting enables us to access your financial data securely, in real time. Spending less time on data management translates to less cost to your business. Moreover, takes away the need to transfer files and allows our advisors to deliver timely recommendations.

Private Client Services

Our Private Client service is for those with substantial business investments, family investment trusts, large family estates, SMSFs or varied investment portfolios that require a remarkable level of attention. We provide a streamlined and holistic, tax-effective service.

Restructures & Asset Protection

An evolving business can reach a point where it finds its structure obsolete or inflexible and needs a change. The ability to identify the need to restructure without triggering unnecessary taxes or other costs is a challenging but value driven process.

SMSF Compliance

Self-managed super funds are Australia’s fastest growing investment vehicle. However, there’s a large administrative burden involved in managing a fund and ensuring it complies with current legislation and regulations. Our client-focused superannuation team can relieve the burden of compliance and daily management.

Strategic business advice and planning

Strategic planning is more than examining budgets and cash flows. It involves the ability to look at the business holistically; assessing its strengths, weaknesses, opportunities and threats, and optimising resources to allow the business to meet its goals.

Succession Planning

One of the more difficult issues a family business has to contend with is managing the transition of the business to the next generation. Our Business Advisory specialists will take the emotion and potential for disputes out of the succession planning process by developing a clear plan, including all members of the family in the process.

Virtual CFO Services

Our virtual CFO service provides the expertise of a CFO or senior accountant for those business that don’t want to invest in a full-time resource. We provide forward-looking, long-term strategic financial advice, tailored to your needs.

Resources

Doing Business in Australia

The top questions answered to assist businesses looking at operating in Australia.

The advantages of outsourcing parts of your business

The global outsourcing industry has grown exponentially over the years…