Register your interest to be the first to hear announcements about William Buck Adelaide’s 2026 CFO Summit.

By SHANE CROCKETT

DIRECTOR, BUSINESS ADVISORY

The William Buck Hour.

In this free one hour consultation discuss your business aspirations and challenges with a member of our manufacturing team and receive a personalised report with recommendations on how to achieve your goals click here to contact our team. Or call Shane Crockett on 03 9824 8555.

When growing a business, the focus tends to be on what products and services you will sell not how the business is set up. However, ensuring you have the right structure for your business is crucial to expanding operations.

Company

In a manufacturing business it would generally be most sensible to be set up as a company. This provides liability protection and allows profits to be reinvested into the company without paying personal tax.

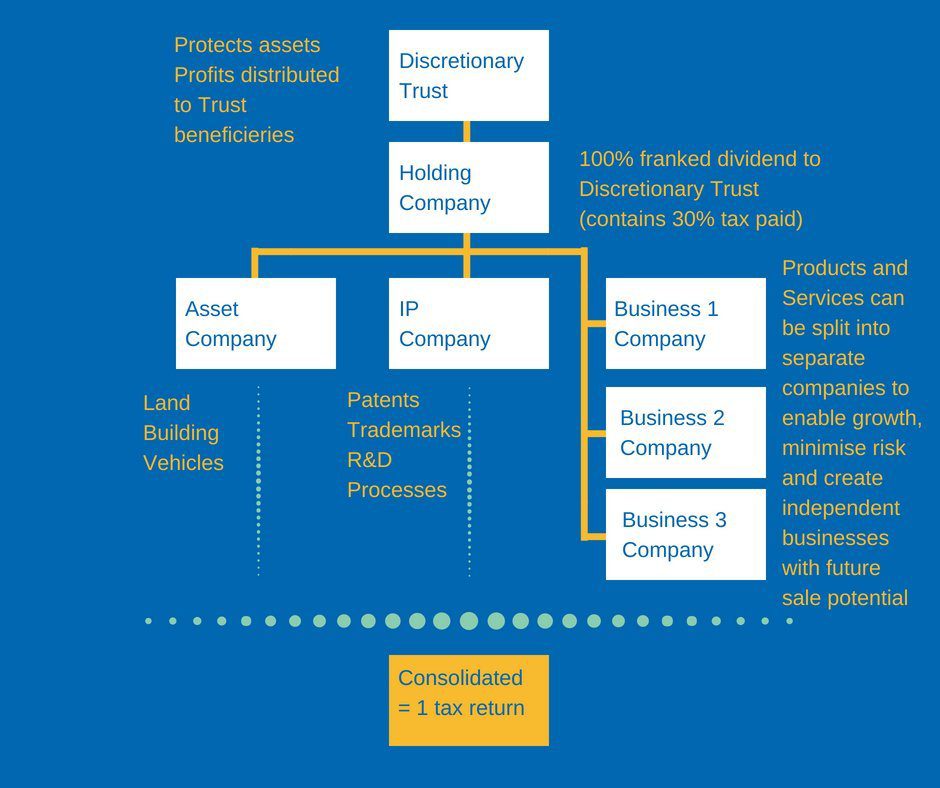

We often advise the setup of a holding company that manages operation companies. Even if there is only one operation currently, it allows for future splits in products or service lines that could have quite separate futures such as a buy out or new company shareholders.

Trust

In a family business, a discretionary trust may own the business to take advantage of its tax benefits. Profits of the business can be easily distributed amongst family members and can be distributed in such a way that tax is paid at the lowest possible individual marginal tax rate.

Discretionary trusts also offer the advantage of asset protection. If the business goes bankrupt, the assets of the beneficiaries under the trust are protected. Creditors of the business have no claims against assets of the trust. Only direct creditors of a trust have claims against such assets.

The challenge with entity structures is that they really need to be customised to the business. They need to fall in line with the objectives of the business owner(s). This may involve choosing either a company or trust structure or combination of both. It may makes sense to put company owned assets into a trust for protection and capital gains tax benefits. Sometimes it makes sense for a trust to own a company. There are a number of variables to be taken into account but it is a good idea to get this right from the start.

If you have the wrong structure, it is possible to change into one that will optimise growth potential but it will incur costs. The amount will depend on the stage of the business. A recent pre-IPO client was hit with massive costs to clean up the structure of the business to enable public shareholders. This could have been avoided with earlier intervention.

Typically, the following (Fig.1) structure would be the basis for customising a growing entity.

Fig 1.

In a growing business, the entity structure is crucial to managing growth, risk and future sale potential. This is one of 5 structures you should review to grow your business.