Planning to bring your wealth to Australia? Your pathway to a smooth transition

Embarking on this journey involves more than just relocation—it’s about securing your financial future in a new environment.

Australia’s tax landscape can be intricate, so understanding our tax system and financial regulations is essential to optimise your wealth.

Our comprehensive report streamlines your relocation process to Australia, addressing essential aspects of tax residency, important tax principles and effective income management strategies. Featuring actionable insights, this guide is designed to prepare you for a smooth and seamless transition to Australia.

Ready to delve deeper? Download our detailed report, crafted to help you navigate your wealth relocation to Australia.

Access our free

Wealth Relocation Guide

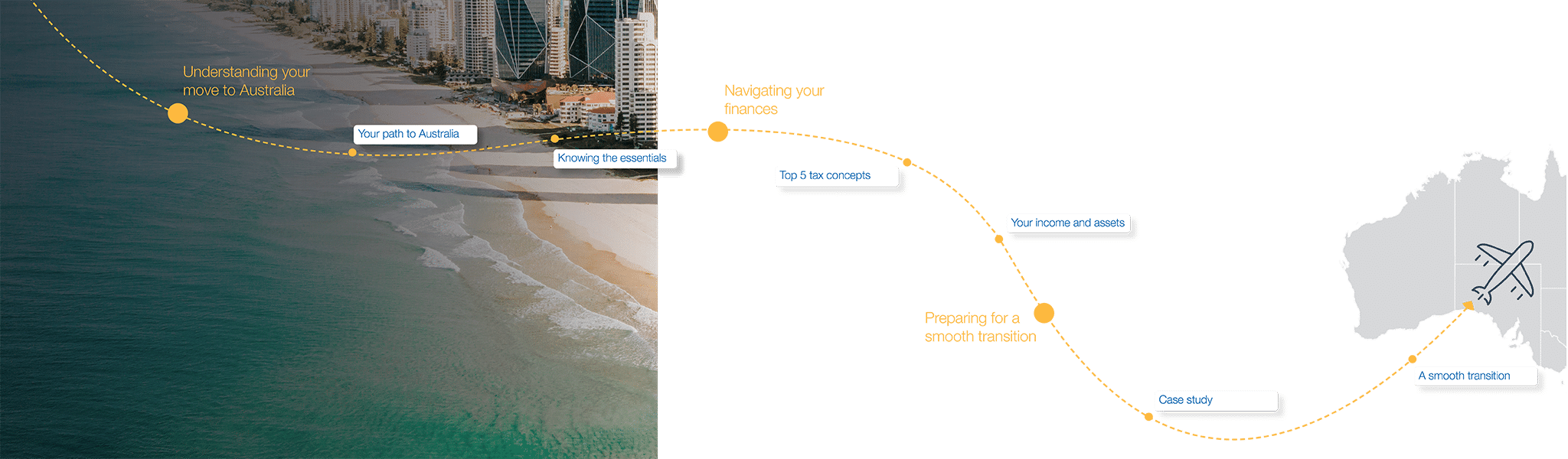

Your pathway to Australia

Navigating the move to Australia requires careful planning and insight. Here’s what you need to consider:

Your path to Australia

Key insights and strategies for relocating to Australia, focusing on tax implications and financial optimisation.

Knowing the essentials

Essential guidelines on tax residency, covering Australian vs. foreign status, and residency tests for individuals and entities.

Top 5 tax concepts

Simplified explanations of crucial tax concepts, including income tax, CGT, and Double Tax Agreements.

Your income and assets

Overview of how domestic and foreign income is taxed in Australia, with a focus on maximising compliance and tax efficiency.

Case study

A real-life example showing how to navigate tax implications when relocating to Australia.

A smooth transition

Practical advice on strategic tax planning, staying compliant, and minimizing tax liabilities during relocation.

Understanding your move to Australia

Your tax residency status in Australia will determine how your income, assets and capital gains are taxed.

- Australian vs foreign tax residency – Residents are taxed on their worldwide income, while non-residents are only taxed on Australian-sourced income. Temporary residents enjoy certain exemptions.

- Key tax residency tests – The 183-day, domicile, and ordinary concept tests assess your ties to Australia , each with different tax implications.

- Impact on foreign income – If you’re a resident, rental income, dividends and other earnings from overseas may be taxable in Australia.

Understanding these rules can help you optimise your tax position and avoid unnecessary liabilities when moving.

Preparing for a smooth transition

Taking a proactive approach can make your financial transition smoother and help avoid common pitfalls.

- Temporary vs permanent residency tax implications – Temporary residents are generally exempt from tax on foreign income, but this changes if you apply for permanent residency or citizenship.

- Foreign assets and offshore trusts – If you have business interests, investments or trusts overseas, different tax treatments apply. Planning how to structure these assets before becoming an Australian resident is essential.

Ensuring you have the right structures in place before your move can help protect your wealth, reduce tax exposure and create a smoother financial transition to life in Australia.

Your guide to doing business in Australia