The festive season is here, and with it come the Fringe Benefits Tax (FBT) implications related to Christmas parties, client lunches, and gift giving and receiving. This means now is the perfect time to consider FBT and manage the additional costs proactively.

If your employees are attending client functions, business-led social functions, broader community events or receiving gifts, your business may be liable for Fringe Benefits Tax. Generally, benefits provided to employees (or their ‘associates’) are subject to FBT during these festive events, where the benefits are considered ‘entertainment’.

Food and drinks

When determining whether providing food or drink is ‘entertainment’, consider the following:

- Social situations are generally considered entertainment, as opposed to refreshments during working hours, which are generally not entertainment.

- Food or drink provided during work hours and on-premises (or while travelling) are less likely to be entertainment. Events outside of work hours and off-premises are generally considered entertainment.

If a fringe benefit does arise, there are two common ways that a business can value entertainment: the actual method or the 50/50 method. It is important to note that client attendance at Christmas parties is outside of the FBT rules.

Actual method

Under the actual method, only entertainment provided to employees and their associates is subject to FBT. There is no specific ‘entertainment fringe benefit’ and as such, when a fringe benefit arises from providing an employee or their associate with entertainment by way of food, drink or recreation, this may give rise to a property fringe benefit or expense payment fringe benefit.

The advantage of using the actual method is the potential to utilise the minor benefits exemption. Minor benefits (those valued at less than $300 per head, inclusive of GST) which are infrequently provided, can be exempt from FBT. Therefore, if your business does not entertain employees often, this could significantly reduce the amount of FBT payable. It is important to remember that employees who frequently entertain may not be eligible for the minor benefits exemption. Furthermore, the actual method and the minor benefits exemption require detailed documentation to be maintained, which can be a burden for businesses.

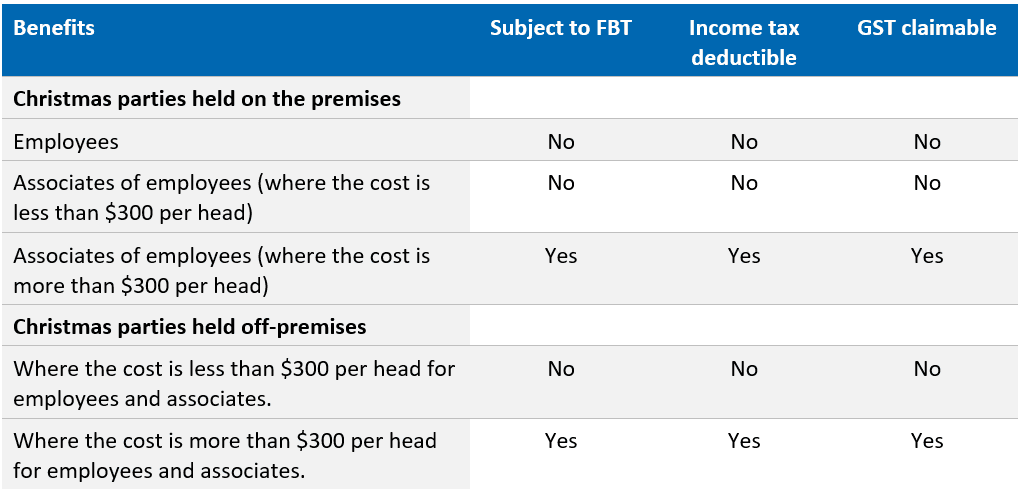

The table below summarises the tax implications for Christmas parties:

Note this table may differ if your organisation is considered a tax-exempt body.

50/50 method

Rather than apportioning the cost of meal entertainment based on employees versus non-employees, or by reference to where meals are consumed, many employers may choose to use the 50/50 method. This method values 50% of total entertainment expenditure incurred during the year as subject to FBT. This method is simple and can be effective where the business spends more on employee entertainment than client entertainment. However, you’re unable to use the minor benefits exemption under the 50/50 method.

Giving gifts

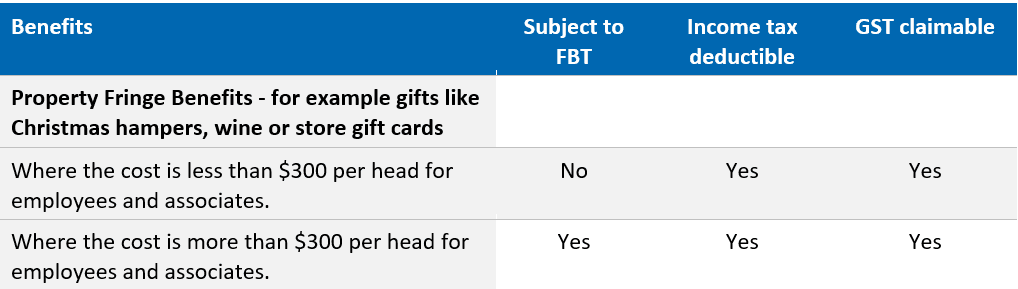

Gifts provided to employees, or their associates typically constitute a property fringe benefit (rather than entertainment) and are subject to FBT unless the minor benefits exemption applies.

The value of gifts should be considered separate from the per-head cost of Christmas functions for the use of the minor benefits exemption.

The table below summarises the tax implications for providing gifts:

It is important to note that gifts provided to clients are outside of the FBT rules.

If you have any questions or would like help determining your FBT liability, please call your

local William Buck Tax Advisor.

Wishing everyone a very happy festive season.