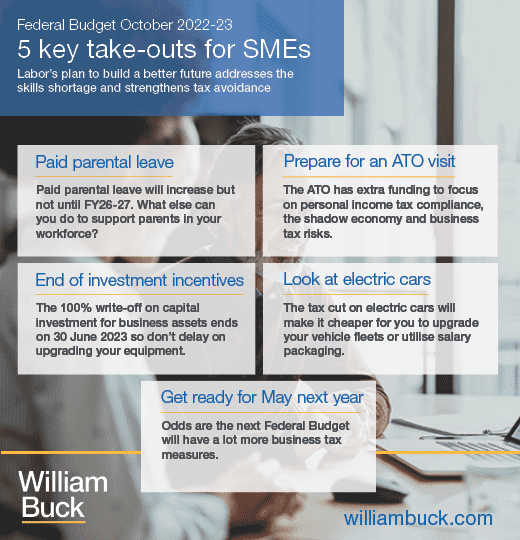

1. Paid parental leave

The Federal Government has announced the biggest expansion of the Paid Parental Leave (PPL) scheme since 2011.

PPL will be increased from 18 weeks to 26 weeks by FY26-27. To encourage both parents to access the reformed PPL scheme, there will be a yet to be determined ‘use it or lose it’ portion for each parent.

2. Prepare for an ATO visit

The ATO has renewed funding to focus on key-areas on non-compliance for individuals, the shadow economy; and new priority areas of observed business risks.

These measures are expected to increase receipts by $6bn over a four-year period from FY22-23

Focus areas include over-claiming of deductions and incorrect reporting of income for individuals.

3. End of investment incentives?

The temporary full expensing rules provide businesses with a turnover of up to $5 billion with an immediate deduction for 100% of the cost of eligible depreciating assets. This measure will end on 30 June 2023. To take advantage of this limited incentive, purchase eligible depreciating assets and instal them ready for use prior to 30 June 2023.

4. Look at electric cars

From 1 July 2022 newly acquired electric cars will be exempted from FBT and import taxes if they are below the luxury car tax threshold for fuel efficient vehicles ($84,916 for 2022-23).

The measure covers battery, hydrogen fuel cell and plug-in hybrid cars.

The exemption from FBT will encourage those interested in upgrading to an electric car to use salary packaging measures offered by their employer.

5. Get ready for May next year

It was expected that this budget would be smaller than the usual May budget. It has outlined how the new Government will fund its election promises and seek to repair the budget deficit created from the COVID-19 pandemic, but as the budget position deteriorates expect further tax measures in the May 23 Budget. Will we see any of the mooted changes to CGT concessions, Division 7A or Trusts?