For Australian businesses, June provided greater insights into the future of sustainability reporting including for who and when it will likely become mandatory.

Treasury’s second climate consultation

On 27 June 2023, the Australian Treasury released its second paper to consult on climate-related financial disclosures, in particular seeking feedback on the proposed coverage, content, framework and enforcement of the requirements.

Australian standards will be set by the Australian Accounting Standards Board (AASB), which will lead its own consultation later this year, and will be aligned as far as practicable with IFRS, the first two of which were issued by the International Sustainability Standards Board (ISSB) on 26 June 2023. The standards issued were:

- IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, and

- IFRS S2 Climate-related Disclosures.

IFRS S1 provides a set of disclosure requirements designed to enable companies to communicate with investors about the sustainability-related risks and opportunities they face over the short, medium and long term. IFRS 2 on the other hand established specific climate-related disclosures and is designed to be used with IFRS S1.

Who will be impacted by mandatory climate-related disclosures?

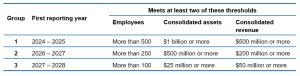

Treasury has proposed that mandatory climate-related disclosures will be required for three groups of entities in Australia starting from 2024-25 and phased in to the 2027-28 financial year for entities reporting under Chapter 2M of the Corporations Act 2001, that meet at least two of the below thresholds for each respective year:

Disclosures will need to be included in both an entity’s director’s report and financial report.

Assurance requirements will also be phased in with the group’s subject to an increase in the scope and level of assurance provided from their first year of reporting.

What impacted business should do now

Treasury is signalling that within the next five years, all businesses that require an audit will need to report on a range of environmental disclosures.

If your business is going to be impacted, it’s critical you keep up to date with announcements from Treasury and AASB on their progress finalising the disclosures.

Mandatory climate-related disclosures will require significant preparation which is why you should begin to collate relevant information now, including:

- Information about your business’s governance processes, controls and procedures used to monitor and manage climate-related financial risks.

- Your strategy for identifying and addressing climate-related risks and opportunities

- Material climate-related risks and opportunities to your business and how these will be identified, assessed and managed.

- Targets and progress towards those targets including scope 1 and 2 emissions for the first reporting period and scope 1, 2 and 3 emissions for the second period and those following.

Failure to plan could mean substantial administrative costs and you also risk not complying.

What’s next for Australian businesses?

These mandatory climate-related disclosures will standardise just one element of Environmental, Social and Governance reporting. It’s likely that standards regarding Social and Governance information will be established in the future, which businesses will need to address in their financial reporting.

Forward-thinking companies should begin planning for these disclosures now to gain a competitive advantage and offer their investors greater oversight and transparency. For more information on financial reporting, including the proposed climate-related disclosures, please contact your local William Buck Audit Advisor.