Electric cars are now exempt from Fringe Benefits Tax (FBT), making it an opportune time to boost your employee benefits by offering employees salary packaging on electric cars.

From 1 July 2022, electric and plug-in hybrid vehicles became exempt from FBT in Australia, where broadly the following conditions are met:

- The car is a zero or low emissions vehicle’, being a battery electric, hydrogen fuel cell or plug-in hybrid car,

- The car is used by a current employee or their associate,

- The value of the car at the first retail sale was below the Luxury Car Tax threshold for fuel efficient vehicles (which is $89,332 for the 2023-24 year), and

- The car is both first held and used on or after 1 July 2022.

It is important to note that with respect to plug-in hybrids, the exemption will be available only until 31 March 2025, unless the taxpayer maintains a pre-existing commitment.

Given there is no FBT cost in providing electric vehicles to employees, salary packaging could provide a substantial tax benefit for employees.

What is salary packaging?

Salary packaging is broadly defined as an agreement between an employer and an employee, where the employee agrees to forego part of their future entitlement to salary to receive benefits of a similar value.

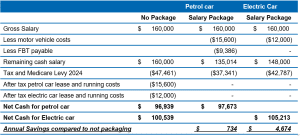

As an example, the following table details the comparison of an employee’s net cash position in the following scenarios:

- The employee did not salary package

- Packaging a petrol car, and

- Utilising the FBT exemption available for electric car.

The below assumes an Australian employee has a gross salary of $160,000 (excluding superannuation), and enters into a novated lease for an electric vehicle that costs $73,000 with lease and running costs of circa $1,000 per month compared to a novated lease for a petrol vehicle that costs $48,000 with lease and running costs of $1,300 per month.

As you can see from this example, the employee will obtain the greatest net cash benefit when an electric vehicle is packaged as the employee does not have to pay an FBT cost.

Although there is no FBT cost in providing electric vehicles, there is a requirement to calculate the reportable fringe benefit amount each year, therefore employers should be aware of this additional administrative burden.

The other important item to note is that the set-up costs of in-home charging stations/equipment does not fall within the scope of the FBT exemption available for cars. As such, if an employer pays or reimburses an employee for the cost of the charging station, a separate fringe benefit will arise which will be subject to FBT. Should such charging station costs be included within the financed amount of a lease, the amount will need to be extracted from the lease to determine the amount subject to FBT.

Boosting and communicating employee benefits

When considering whether your organisation will allow employees to salary package electric cars, it may be an opportune time to consider what other benefits are, or could be, provided to employees in a cost-effective manner. Promoting all the benefits that an organisation offers employees is a great way to highlight why working at your organisation stands out amongst competitors. In a competitive employment market, attracting and retaining staff a common area of focus for many of our clients.

We recommend:

- Developing or refining the organisations salary packaging policy

- Circulate this policy amongst staff to make sure they are aware of what the organisation has to offer employees, and

- Consider further highlighting both the non-cash and cash components of an employee’s package by rolling out a ‘total remuneration statement’, which can be provided either on commencement with the organisation, on salary increases or promotions, or annually as part of their performance review discussions.

If you would like assistance with preparing and/or communicating a salary packaging policy or refining your policy to utilise the electric vehicle exemption, please reach out to your local William Buck advisor.