ACNC | COVID19 website resource

The Australian Charities and Not-for-profits Commission has recognised that a charity’s usual operations might be affected by COVID-19 and has set up a dedicated web page to help charities.

Topics covered include:

- ACNC compliance during COVID-19

- Federal government support for eligible charities

- Charity meetings and AGMs

- Charity operations and governance

- Charity financial considerations

- Charity reserves

- Charity fundraising

- State and territory stimulus packages, and

- Other useful resources and information.

The ACNC has also updated its guidance on record-keeping, including more information on keeping records when working remotely and from home. Click here for more information.

Accounting for COVID-19 related government support

Governments are currently providing a range of support to entities in response to the COVID-19 pandemic. These include the JobKeeper payment and cash flow boost.

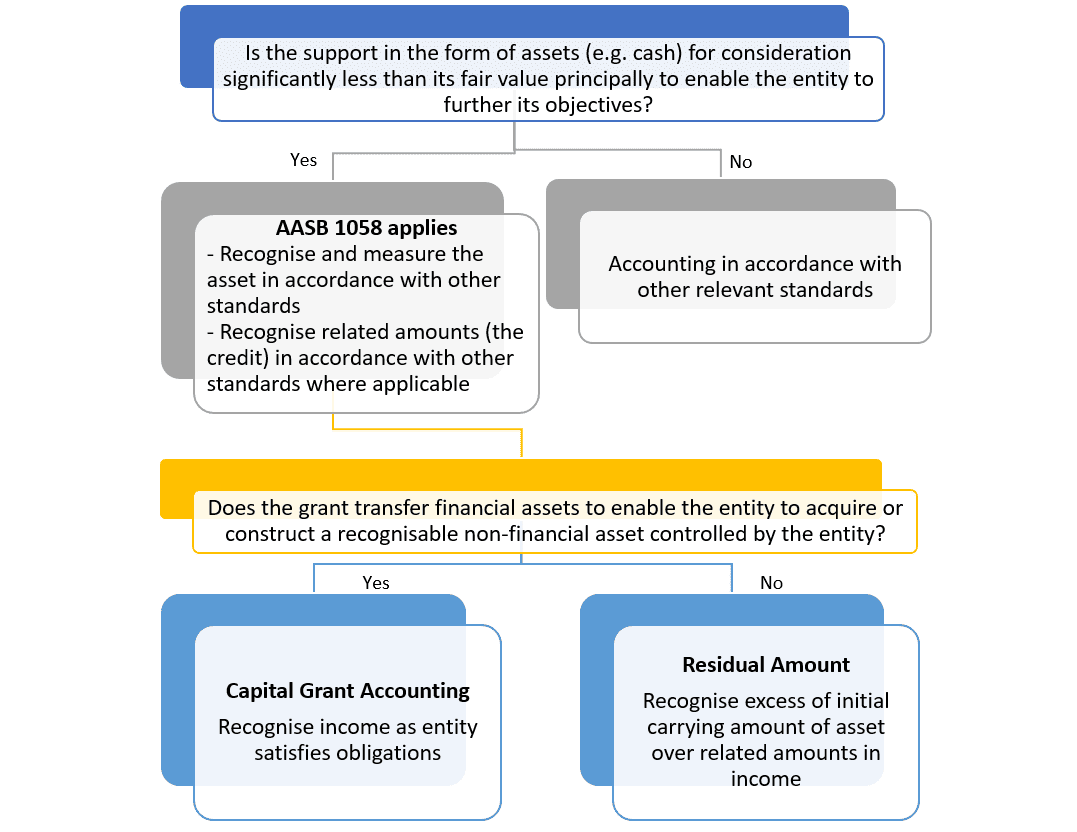

Not-for-profit entities will need to apply AASB 15 Revenue from Contracts with Customers if the support was in exchange for goods or services provided, otherwise AASB 1058 Income of Not-for-Profit Entities.

Presentation in the P&L

For-profit entities have a choice of presenting the grants as either ‘other income’ or offset against the related expense. If the grant is related to assets then it is presented as ‘deferred income’ an recognised in the P&L over the useful life of the asset, or offset against the related asset’s carrying amount.

Not-for profit entities are not permitted to offset income against expense.

Illustrative example (AASB staff FAQs)

| Not-for-profit entity |

| Due to the COVID-19 pandemic, a not-for-profit entity (an income tax-exempt entity) receives a wage subsidy in the form of cash payments from the government for a specified period. The subsidy is receivable fortnightly, if eligibility criteria for the subsidy are met for the latest fortnightly period. Once paid, the subsidy is not refundable. The government intends that the support will help businesses to keep paying their employees and help people to retain their jobs.The entity receives the government support for its own benefit even though it transfers the cash payment in full to the eligible employees. |

| The entity notes the government support does not involve the transfer of goods or services. Accordingly, the entity concludes the government support is not within the scope of AASB 15 and instead would be accounted for under AASB 1058 as cash received for consideration to the government, which is significantly less than fair value to enable the entity to further its objectives. In this case, the grant assists the not-for-profit entity to further its objectives by subsidising the costs of employing its existing staff during the COVID-19 crisis. |

| The not-for-profit entity recognises an asset on the receipt of cash from the government or when the eligibility criteria for the subsidy are met. The entity also recognises any related amounts arising under other Australian Accounting Standards in accordance with AASB 1058. As the entity did not identify any related amounts in this scenario, the entire amount of the subsidy for the latest fortnightly period is recognised as income upon the recognition of the asset. |

Disclosure requirements

For many entities this may be the first time disclosures have been required around government support.

Not-for-profit entities accounting for government support under AASB 158 need to disclose sufficient information to allow users to understand the effects of transactions. This includes the amount of income recognised during the period, disaggregated into categories that reflect how the nature and amount of income (and resultant cash flows) are affected by economic factors. Additional disclosures are required for capital grants under paragraphs 31 to 36 of AASB 1058.

COVID-19 causes Leases amendment

AASB 16 Leases has been amended to exclude rent holidays caused by COVID-19 from being assessed as lease ‘modifications’.

The amendment provides a practical expedient that permits lessees not to assess whether rent concessions such as rent holidays and temporary rent reductions that occur as a direct consequence of the COVID-19 pandemic and meet specified conditions are lease modifications.

The standard amends AASB 16 to:

- Provide lessees with an optional practical expedient regarding assessing whether a COVID-19-related rent concession is a lease modification

- Require lessees that apply the practical expedient to account for COVID-19-related rent concessions as if they were not lease modifications

- Require a lessee that applies the practical expedient to disclose that it has applied it to rent concessions that meet the conditions, or, if not applied, to supply information about the nature of the contracts to which it has applied it

- Require lessees applying the practical expedient to disclose the amount recognised in profit or loss to reflect changes in lease payments that arise from COVID-19-related rent concessions

- Require lessees to apply the practical expedient retrospectively at the start of the reporting period in which the expedient is first applied, and

- Not require lessees to disclose the information required by AASB 108 paragraph 28(f) in the reporting period in which the practical expedient is first applied.

AASB 2020-4 Amendments to Australian Accounting Standards – Covid-19-Related Rent Concessions applies to annual periods beginning on or after 1 June. Earlier application is permitted, including in financial statements not authorised for issue at the date this standard was issued (15 June).

COVID-19 is having an unprecedented impact on the economic outlook for Australian and global economies.

For the first time, many entities will be required to consider in more detail their solvency and ability to continue operating as a going concern.

Surprisingly, there are only two paragraphs in AASB 101 Presentation of Financial Statements that directly address the going-concern basis:

‘25 When preparing financial statements, management shall make an assessment of an entity’s ability to continue as a going concern. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so. When management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern, the entity shall disclose those uncertainties. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern.’

‘26 In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future, which is at least, but is not limited to, twelve months from the end of the reporting period. The degree of consideration depends on the facts in each case. When an entity has a history of profitable operations and ready access to financial resources, the entity may reach a conclusion that the going concern basis of accounting is appropriate without detailed analysis. In other cases, management may need to consider a wide range of factors relating to current and expected profitability, debt repayment schedules and potential sources of replacement financing before it can satisfy itself that the going concern basis is appropriate.’

To help with this assessment, the AASB and the Auditing and Assurance Standards Board have released a new 27-page publication The Impact of COVID-19 on Going Concern and Related Assessments that provides an overview of directors’ and management’s responsibilities. They are:

- Duties in relation to assessments of solvency and going concern, how these concepts interact and how they might be affected by COVID-19, and

- Responsibilities to assess whether the going-concern basis of preparation is appropriate and how this affects preparation and disclosures in financial statements.

The publication is available here.