Venture Capital investment in Australia reaches A$3 billion in 2018: William Buck 2019 Venture Capital Funding Report

Key points in this release

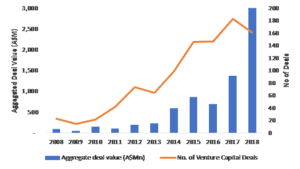

- In the year ended 31 December 2018, the value which the Venture Capital (“VC”) groups invested in Australian deals grew by 122% to A$3 billion, compared to A$1.4 billion invested in 2017;

- 2018 has seen VCs invest in fewer deals but larger deal sizes. Although the number of deals fell from 183 in 2017 to 161 in 2018 (compared to the average number of deals in 2015/ 2016 of 146), the average deal size has grown substantially in 2018 to A$20 million from A$8 million in 2017;

- Technology and Healthcare, particularly Software and Biotechnology were the top industries where VCs invested in Australia and Globally;

- VC deals has been increasing in recent years growing from approximately A$230m in 2013, more than doubling in value to A$695 million in 2016 and again doubling in value in each of the 2017 and 2018 years;

- VC appetite is changing locally as well as across the globe – with late-stage rounds continuing to grow as a percentage of VC investments;

- VC investors preferred exit strategy is selling to a public company.

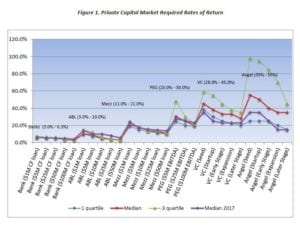

A report by William Buck Chartered Accountants and Advisors shows expected returns from capital funding investments is increasing, particularly for Venture Capital (VC) and Angel Investor groups.

Mark Calvetti, Director of Corporate Advisory, says this is based on William Buck’s experience with a number of transactions in the Australian market, corroborated with further research.

“Our experience shows that the expected rate of return from capital funding investments by Venture Capital groups in 2018 were between 30% to 50%. Whilst the expected rate of return by angel investors was even higher at 35-65%, says Mark Calvetti.

These returns are in line with the returns by these groups based on a survey carried out by Pepperdine Capital Markets in the US, which highlighted that the target rates of return by VC investors ranged between 25%-45%, with considerably higher expected rates for seed to early stage investments (30% to 45%); reaching as high as 38% to 60%. Bank loans had the lowest average rates of return (3-6%).

Refer the chart below for expected rate of return as per the Pepperdine Capital Markets report 2018:

Figure 1 – Private Capital Markets Expected Rate of Return

Source: Pepperdine Private Capital Markets Report 2018

The above chart shows a clear correlation between the size of loan or capital and the cost of borrowing – as the size of loan or capital increases, the cost of borrowing decreases.

Mark Calvetti, Director of Corporate Advisory says expectations depend on funding type – with earlier stage investments having a higher expected rate of return.

“What the evidence showed us is that there’s a wide range of investment returns depending on the type of Investor and stage of investee business. Angel investors – seen at the earliest investment stage – are receiving the greatest returns, generally due to the greater perceived risk,” says Mark.

In 2018, the top Australian deals were dominated by software and biotechnology, coinciding with global trends, which were led by healthcare & biotechnology businesses (39% of target investments), followed by information technology (32%).

“Most VC investments are seen in the seed, start-up or early stage businesses, with each VC investors making an average of 2-5 investments in a year and, typically in the range of $1-$4 million – depending on the stage of the business being invested in.”

William Buck’s report also highlighted that the Capital Investment appetite is changing, both in Australia and across the globe; with a growing trend for mega-funds investing in late stage companies.

“There is a huge amount of VC activity across the globe. VC backed companies globally are projected to have raised approximately US$330 billion during the calendar year 2018. In comparison, that’s around 55.7% over the US$212 billion capital raised in 2017,” says Mark Calvetti.

“There’s also a growing trend for mega-funds investing in late-stage companies, with late-stage rounds continuing to grow as a percentage of VC investments,” says Mark.

“Globally, the late stage rounds contributed 58% of the dollar value in 2018 compared to 49% in 2017. Interestingly, however, late stage rounds represented only seven percent of the total VC deals in 2018.”

In recent years, Australian private businesses are accessing more funding through Venture Capital.

“Historical data shows there’s a continued trend in Australia and globally of a declining number of deals, but an increase in average deal sizes, with globally the median deal size reaching US$40M.

“Contrary to the small investment size appetite of a VC investor, Australia’s recent investments have been dominated by few large size VC investments in software and bio-tech.”

The VC investments in Australia reached A$3.1bn across 161 deals over the 2018 calendar year, with an average deal size of A$20m. This is more than double the value of VC investment in 2017 of A$1.4bn across 183 deals, with an average deals size of A$7.5m.

Figure 2 – Trends in VC deals in Australia over the period 2008 – 2018

Source: Preqin data on Venture Capital Activity in Australia 2018 and WB Analysis

Note:

- Preqin defines Venture Capital deals in Australia to include all investments in Australia-based portfolio companies from both local and overseas investors. These investors can be GPs and LPs, sometimes unspecified investors as well.

- The dollar values in above chart has been calculated based on conversion of US dollar value to Australian dollar based on the average annual exchange rate for each calendar year, as sourced from Reserve Bank of Australia.

Mark Calvetti says for software and biotech entities, VC has been a great way for private business to take the next step.

“There’s a real interest in tech driving VC demand. Software and biotech remain the key players for Venture Capital investments,” Mark Calvetti says.

Some of the top Australian transactions in 2018 included: Deputy – A Sydney based workforce management software company which recently raised US$81 million (A$111 million) in one of Australia’s largest Series B round; Clinical Genomics – A US based bio-technology company specialising in colorectal cancer (CRC) diagnosis raised A$33 million in series B round – essentially in convertible notes.

“Australia’s climate remains strong for biotech, with favourable R&D incentives. Also aiding Australia is their proximity to China, with Chinese companies representing eight of the top 10 deals globally, especially during the first half of calendar year 2018.”

Mark Calvetti says for private business seeking funding, these findings are critical.

“When it comes to accessing funding, the type and source of capital depends upon various factors relevant to the individual requirements of each lender type – including stage of business, amount of funding required, expected rate of return, outlook of the business and other things such as the value-add of lender experience.” Mark says.

Mark says the aim of William Buck’s report was to fill the gap for their clients who, when seeking funding didn’t know what rates of return an investor wanted.

“These findings give private business a guide to managing expectations and analysing various funding options when raising private capital funding,” Says Mark Calvetti.

The report also discussed the preferred exit strategies for VC investors. Selling out the investment to another public company was at the top of the list, followed by selling to a private company and IPO’s.

“Experience shows us that investors want a clear exit plan. Private business owners need to ensure succession planning is worked out at the beginning of their contract.”

ENDS

Keep up-to-date with our latest press releases