William Buck’s annual Dealmaking Insights report 2023 is based on extensive research into Australia’s M&A, IPO, Private Equity and Venture Capital markets both in 2022 and over the last ten years from January 2013 to December 2022. We also take a look at the global state of dealmaking primarily in 2022, with observations spanning the last ten years.

1. Current dealmaking trends

3. Global M&A trends

1. Current dealmaking trends

Economic uncertainty and geopolitical tensions had a mostly negative effect on dealmaking in Australia, in the 2nd half of 2022, despite most markets still performing above pre-pandemic levels. Strong and swiftly imposed sanctions on Russia from many of the world’s developed economies had adverse impacts on prices of oil, food and commodities while supply chains were disrupted and central banks forced to increase interest rates to curb inflation. Despite this, in Australia, inflation rose to a 21-year high. Subsequently, company valuations were driven down, and this combined with market uncertainty discouraged investment, particularly in the second half of the year.

Conversely, an abundance of dry powder resulted in several mega deals occurring in the private equity sector and a larger percentage of M&A deals above $250m – with both PE and M&A achieving record aggregate deal values.

2. Mergers and Acquisitions (M&A) trends

Despite M&A activity slowing from a frenzied 2021, it was still above recent averages. The first half of 2022 saw promising M&A numbers both in terms of deal value and volume as historically low interest rates and high business optimism remained. Technology was again a leader in dealmaking volumes, despite share prices declining, as the digital transformation that was taken up during the pandemic gained further momentum.

As we moved into the second half of the year, rising inflation, interest rate hikes, supply chain disruption and growing economic and geopolitical uncertainty slowed dealmaking activity to a near standstill, with 87% of the aggregate value of transactions occurring in the first half of the year.

Key points

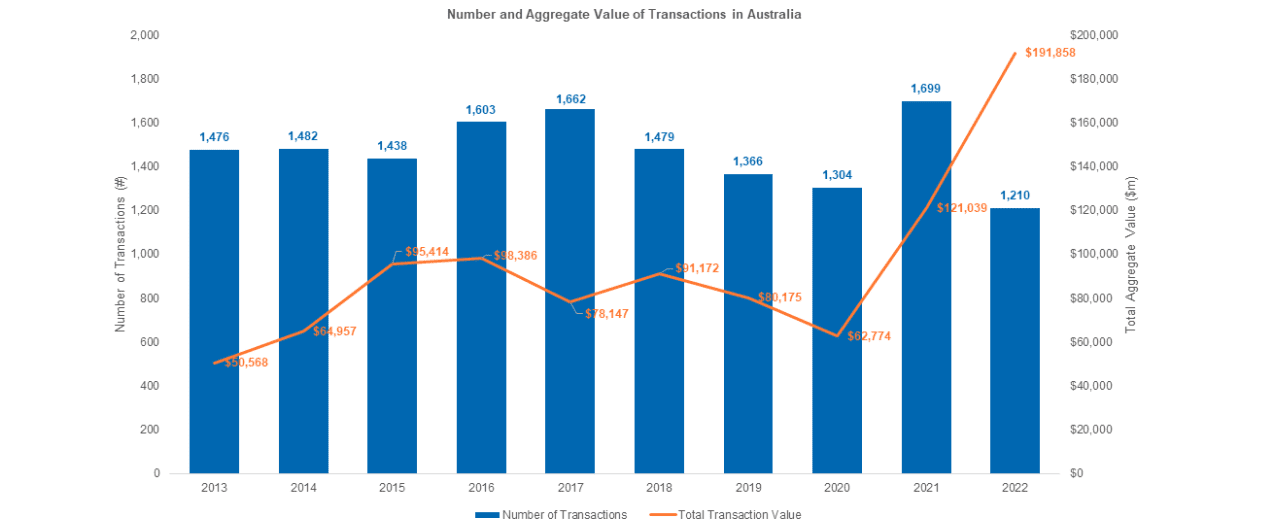

- 2022 saw aggregate deal value increase 59% to $191.9bn despite volume decreasing 29% year-on-year. This was the largest aggregate value since 2007 and the lowest number of transactions, at 1210, recorded over the ten-year span of our research.

- The hike in deal value can be somewhat attributed to a larger portion (10%) of transactions occurring with a deal value of over $250m than in the ten-years since 2013.

- The percentage of deals between $50m – $100m was also at a ten-year high of 9% while those between $100m – $150m and $150m – $250m remained steady.

- Across the last 10 years, the SME space has dominated transaction activity. 58% of M&A transactions occurred with a deal value of up to $10m and a further 81% up to $50m.

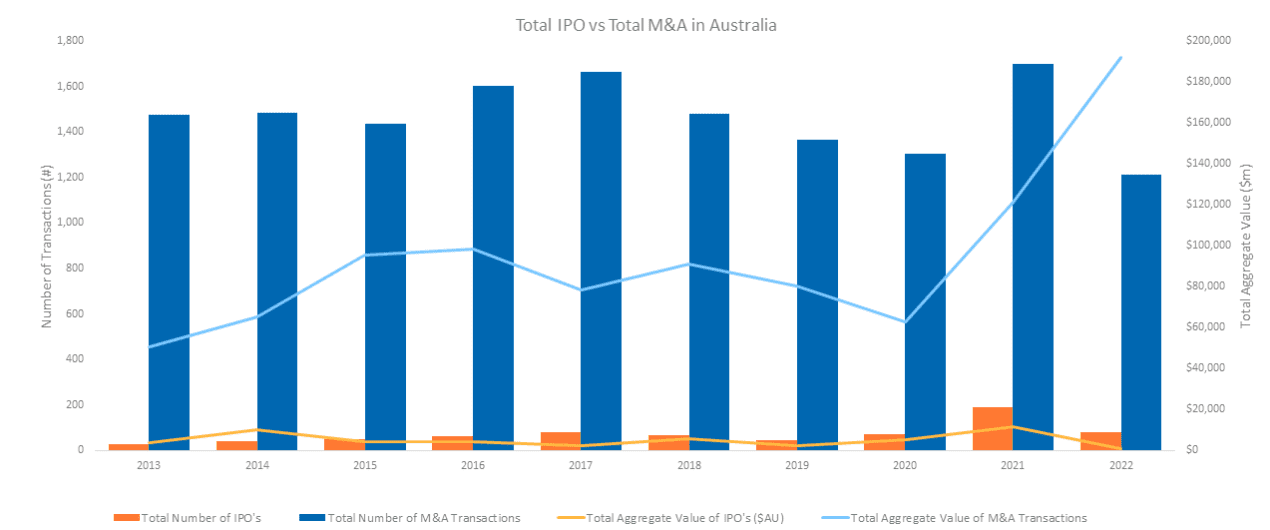

Total M&A Volume and Aggregate Value in Australia

In 2022, the aggregate value of M&A Transactions in Australia increased 59% to $191.9 billion, the largest aggregate deal value since 2007.

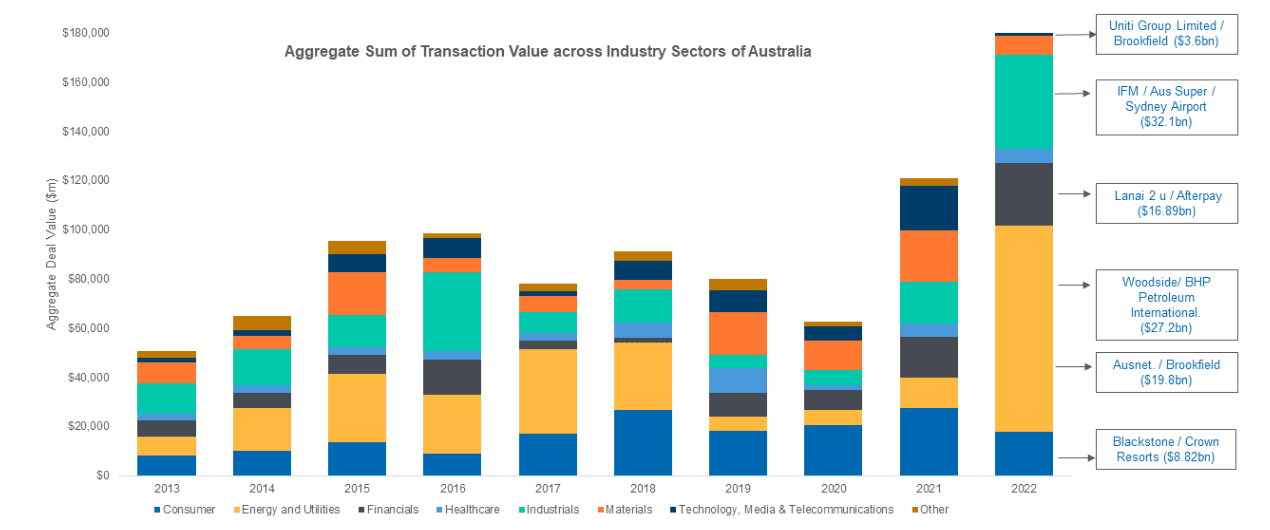

Sector performance

By value, the largest industry sector was Energy and Utilities, with deals equating to $83.8bn. This is despite experiencing the lowest volume of transactions, at 54 deals, compared to other major sectors which stemmed from the global energy crisis driving an increase in both demand and price or commodities and energy.

Major deals in this sector included the BHP Petroleum and Woodside merger at $27.2bn – now the largest energy company listed on the ASX; and Brookfield’s acquisition of Ausnet for $19.8bn.

Other sectors recording strong deal values were Industrials at $38bn, particularly in infrastructure – evidenced by IFM’s acquisition of Sydney Airport; and Financials, at $25.5bn.

Materials, and Technology, Media & Communications saw the highest number of transactions at 250 and 247 respectively.

Industry Sectors of Australia’s Total Market

Largest Industry Sectors by value in 2022 were Energy and Utilities, Industrials and Financials.

3. Global M&A trends

The global M&A market declined in value in comparison with 2021 due to the onset of macroeconomic events driving inflation up and the tightening of monetary policy. Company valuations were driven down in response to future cash flows being discounted at higher rates and the war in Ukraine continued to create volatility and uncertainty.

Key points

- The Industrials sector aggregate deal value grew significantly from $53m in Quarter 1 2022, to $177m in Quarter 4, a 228% increase.

- Financials M&A aggregate deal value declined over the four quarters, driven by a decrease in transaction value as well as a slow down in deal activity.

- Higher commodity prices and the global energy crisis saw activity in the Energy and Utilities sector remain stable.

- Overall activity slowed generally in all sectors (deal count dropped from 8,359 in Quarter 1 to 6,975 in Quarter 4).

4. IPO trends

Elevated volatility in 2022 suppressed activity and has been the IPO market’s ‘annus horribilis’, with only 79 IPOs completed throughout the year and aggregate value decreasing a dizzying 91% from 2021 levels to $1bn. Weakened stock markets and the underwhelming performance of many 2021 listings also deterred investors.

While the aggregate value of IPOs decreased 91%, that of M&A transactions increased 59%. The stark contrast in terms of the record value experienced within the M&A market shows that M&A was by far the most popular option for companies looking to exit during 2022.

Key points

- Number of IPOs decreased 55% in 2022 year-on-year to 79 IPOs

- Aggregate value of $1bn was the lowest in the last ten years.

- Largest IPOs were Chrysos Corporation Limited at $184m and Leo Lithium Limited at $100m.

Total IPO Market vs Total M&A Market

Aggregate value of M&A Transactions in Australia increased 59% to $191.9 billion in 2022 , the largest aggregate deal value since 2007. Contrastingly, aggregate value of IPO’s decreased 91%, the lowest value over the last 10 years.

5. Private Equity (PE)

Similar to M&A, private equity in Australia last year saw its largest aggregate deal value of US$20.8bn despite a 20% drop in the volume of deals year-on-year. This hike in deal value can be attributed to several mega deals occurring throughout the year including Blackstone’s acquisition of Crown Resorts for US$6.6bn and Uniti Group Limited’s acquisition by a consortium of Commonwealth Superannuation Corporation, Brookfield Asset Management and Morrison & Co for US$2.7bn.

- Aggregate deal value was a record US$20.8bn.

- Number of deals were 20% less year-on-year at 161, compared with 2022 the year prior. However, 2022 still saw above average deal numbers in comparison with the last ten years.

- Over the past ten years, Consumer Discretionary has seen the highest deal count and aggregate deal value. However, in 2022, Information Technology achieved a massive 43 deals to Consumer Discretionary’s 34.

- The strongest performing sector in terms of aggregate deal value last year was Consumer Discretionary at US$7.9bn, followed by Healthcare at US$3.1bn.

6. Venture Capital (VC)

In contrast to trends in M&A and PE markets, the Australian Venture Capital market experienced a steep 41% decline year-on-year to US$4.5bn, despite deal volumes remaining consistent with 2021 levels. This decline can be attributed to a difficult adjustment period as investors reset what they are prepared to pay for riskier companies in this macroeconomic environment.

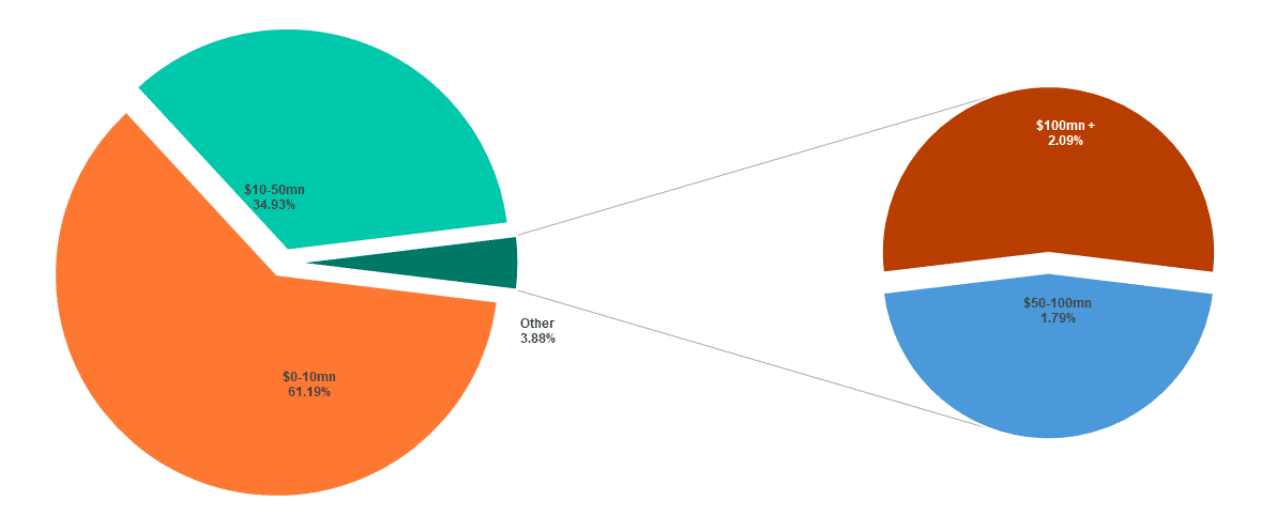

- Of the 374 VC deals in Australia in 2022, 61% fell within the US$0-10mn deal band, indicating early stage is becoming more favoured, as this area may perform better than other strategies, with longer incubation periods providing a longer runway until the exit environment picks up again. (Preqin, 2023)

- The strongest performing sector both in deal count and value was Information Technology which accounted for 47% of the deals and had an aggregate deal value of US$2.27bn. IT far surpassed any other sector in both deal count and value.

Venture Capital Activity Breakdown – Number of Deals by Deal Value Band 2022