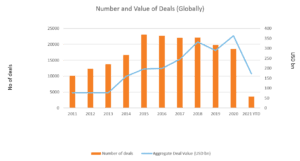

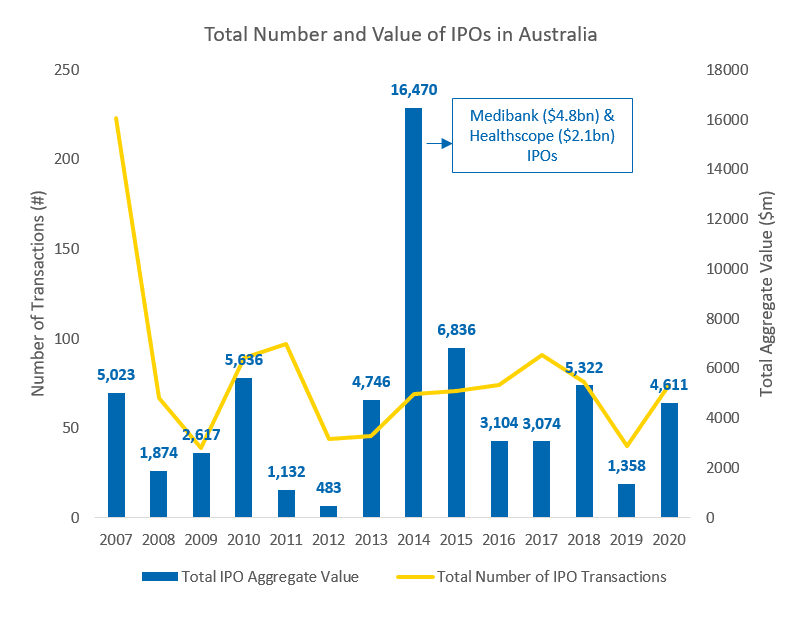

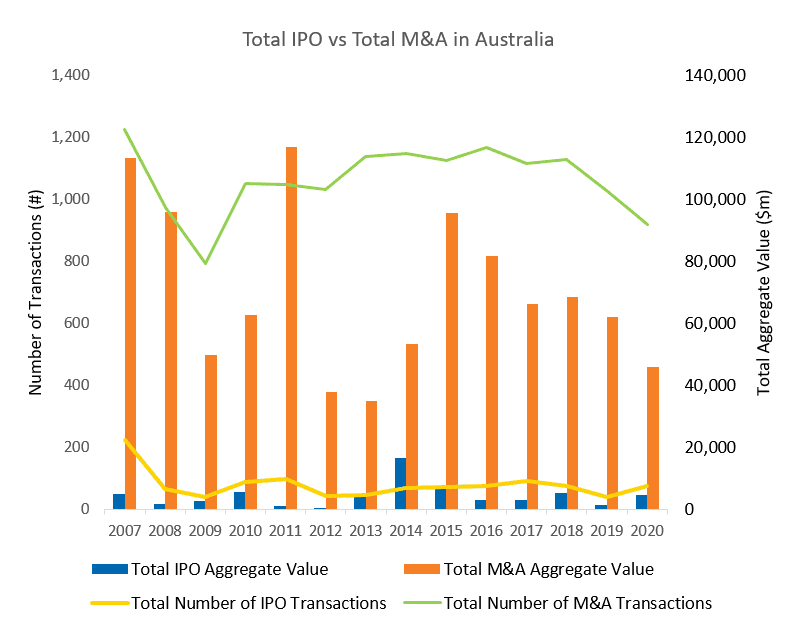

William Buck’s Mergers and Acquisitions (M&A) and Venture Capital (VC) Report 2021 is based on extensive research into M&A activity in Australia over the last 14 years, from January 2007 (prior to the Global Financial Crisis) to December 2020 and VC activity from 2019-2021. The report evaluates findings to inform our expectations of future M&A and VC activity. We also consider the current IPO market.

We’ve paid special attention to the years 2009 and 2020 which displayed interesting similarities including a spike in the number and value of deals. These two years, 2009 and 2020, were also years during which Australia was feeling the impact of major economic crises in the Global Financial Crisis (2007-2009) and COVID-19 (2020-ongoing) respectively.

M&A Insights include:

- Appetite for deal making has increased in the first half of 2021, particularly for higher value transactions of above $1 billion.

- In the difficult years of 2009 (post-GFC) and 2020 (COVID19), there was a strong decline in the number and aggregate value of M&A transactions.

- During the same years, smaller deals under $5m accounted for 50-52% of transactions. This is 10% above the average of 41% average over the 14-year period.

- While over the 14-year period between 2007-2014:

- Transactions under $100m made up around 87% of all transactions, with those under $10m accounting for the majority, averaging 54%, those between $10-$50m averaging 26% and those between $50-100m averaging 7%.

- For middle market M&A, IT and Healthcare saw the most year-on-year growth in aggregate transactions.

- Foreign buyers accounted for 24% of the aggregate volume and 30% of the aggregate value of middle-market M&A transactions.

VC Insights include:

- Globally, 2020 saw the highest aggregate VC deal over the last decade at $US363bn.

- At home, we also saw the highest total deal value in a decade at $US2.7bn.

- IT has been the top performing sector, accounting for 45-50% of all VC deals in Australia over the last decade.