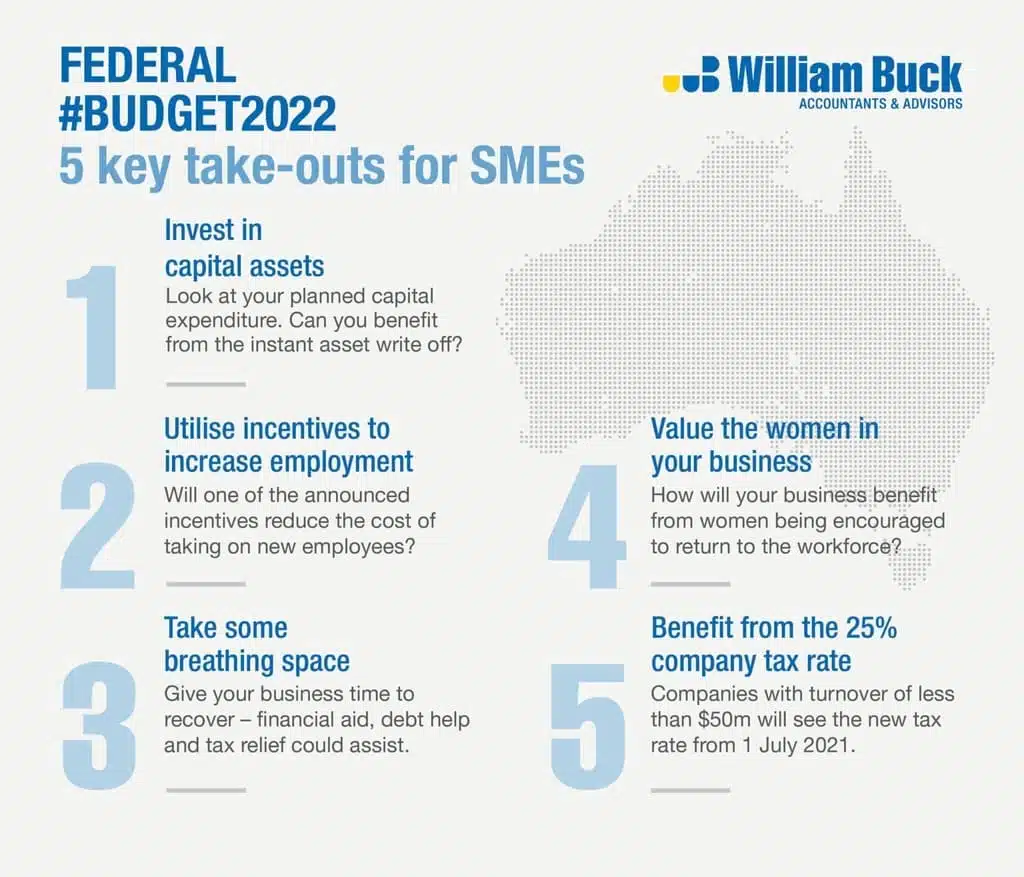

1. Invest in capital assets

Look at your planned capital expenditure.

If your business needs to buy new plant and equipment, then doing so between now and 30 June 2023 will deliver you an upfront tax deduction for the full cost of the eligible items. You can also apply this instant write-off to second-hand assets that your business purchases, but only if your turnover is less than $50 million (click here for more information under Extension of temporary full expensing measures).

From 1 July 2023, normal depreciation arrangements will apply, with the exception of eligible intangible assets such as patents, designs and software which may be depreciated much quicker (click here for more information on depreciation of intangible assets).

2. Utilise incentives to increase employment

See if one of the announced incentives will reduce the cost of taking on new employees.

The decision for your business to take on more apprentices may’ve been made easier by an increase in subsidies and support (click here for more information on boosting apprentiship through wage subsidies).

If your business operates in the digital industry, a combination of investment incentives, digital infrastructure spend and skills spending might provide benefits for your business (click here for more information on Digitising Australia).

3. Take some breathing space to get back on your feet

Giving your business some time and space to get back on its feet was a key theme for SMEs in the 2022 Budget.

Measures that may apply to you include:

- Financial incentives if you operate in the certain industries (click here for more information on industry grants and incentives)

- The ability to ask the Administrative Appeals Tribunal to pause or modify ATO debt recovery action if you are in a tax dispute with the ATO (click here for more information on the Administrative Appeals Tribunal)

- Increased ability to access Government supported loans through the SME Recovery Loan Scheme (click here for more information on SME Recovery Loan Scheme)

- Improvements to Australia’s insolvency rules which will increase thresholds for creditors to issue statutory demands, simplify insolvency arrangements where you operate through a trust, and improve the insolvent trading safe harbour provisions (click here for more information on insolvency reform)

- Let you potentially claim refunds of tax paid in prior years where you have current year losses, by expanding access to the loss carry back regime (click here for more information loss carry-back)

4. Value the women in your business

The suite of measures totalling $3.4 billion as part of the Government’s “Women’s Budget Statement” are designed to have a positive flow on effect for the whole economy.

With a $1.7 billion investment in improving affordability of childcare, the Federal Budget aims to increase workforce participation, in particular for women (click here for more information on childcare funding).

The Government’s plan to remove the $450 threshold for Superannuation Guarantee payments means that employees will start to receive super from the first $1 earned, with women expected to benefit most (click here for more information on Superannuation Guarantee).

5. Benefit from the 25% company tax rate

Small to medium sized trading companies (with a turnover of less than $50 million) shouldn’t forget the reduced company tax rate cut that kicks in from 1 July 2021.

25% will become your new company tax rate payable on profits, but it will also become your new franking rate for dividends you pay. You should consider whether to pay dividends this year, or bring forward expenses, to get a better tax outcome.