At some point in your business’ lifecycle, you must consider its succession. Deciding the best options for the future is both an important and sensitive issue.

In most cases, business owners have a strong emotional connection to their business after countless hours of hard work and dedication. Yet, despite this, many business owners take a one-dimensional approach to considering exit strategy and succession planning, asking ‘do I want to sell my business?’ rather than taking a much wider view of where the business is positioned in its lifecycle, as well as the financial and personal needs of the owner or owners.

Approaching the consideration from this angle would lead to asking a better question, such as ‘how can I prepare the business for an orderly succession at some point in time?’

Many owners consider the process only when they are ready to exit their business. However, leaving succession planning to the last minute can heavily impact both financial and personal outcomes later down the track. That’s why we encourage business owners to consider their exit strategy well before the time comes.

Key considerations when exit planning

Decisions on whether to pass the business onto the next generation of family, going public or selling all or part of the business requires a well-considered plan. To achieve the right outcome for all key stakeholders, some important questions need to be considered:

- Do you wish to continue owning the business? Are you ready to retire?

- Is the business dependent on one key person (‘key-man risk’) and how can this be managed?

- Is there sufficiently capable management to continue growing the business?

- Is the business your main income-producing asset and how can this be unlocked?

- What estate planning issues need to be considered?

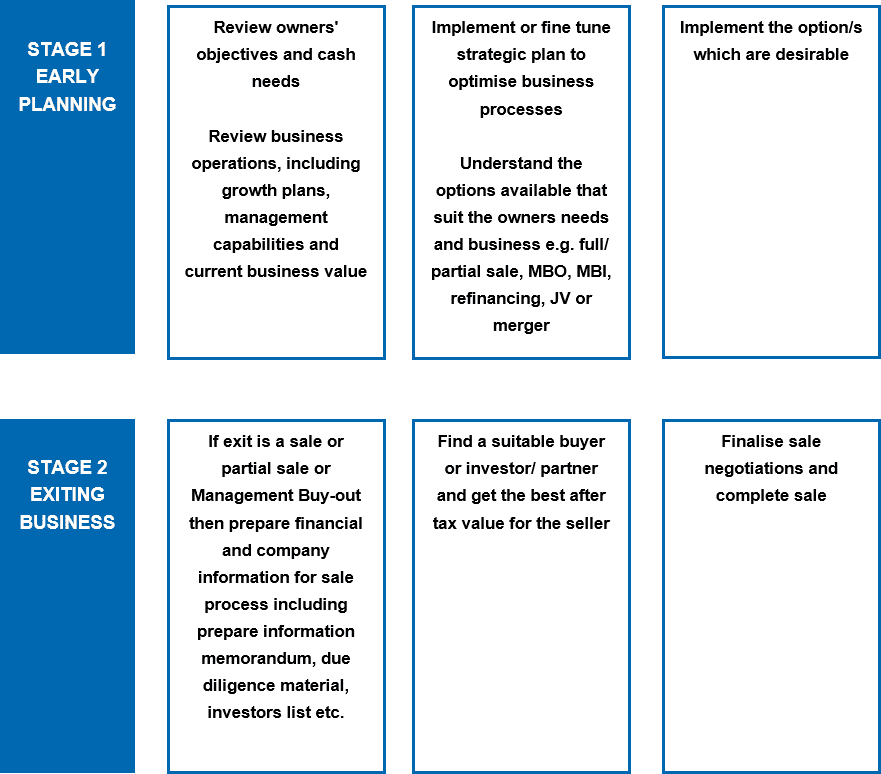

Exiting a business is a two-step process, as shown in the following diagram. The first step involves determining your objectives and understanding the options available.

Issues to bear in mind:

- When would you like to exit?

- Do you understand the current value of the business and how it’s derived?

- What do you hope the business will look like in the future?

- How are you going to get there?

- What are your expectations on sale?

- Are there any impediments to achieving these expectations?

An advisor can work through these questions with you and develop a plan to improve the value of your business and align your personal and business objectives.

The second stage involves the practical steps involved in selling your business or handing it down to the next generation. Achieving a successful outcome in stage two often depends on the level of planning in stage one.