Effective succession planning begins with identifying key person risk within a business by understanding the roles of key people and assessing how these individuals influence the business’s overall valuation. A key person is someone who holds significant influence over the organisation’s operations and performance. This could include technical or process management experts, key business development drivers, or individuals who manage and maintain critical relationships with customers and suppliers.

Notably, a key person does not necessarily need to be an owner of the business. Rather, they are any individual whose absence would result in a material financial, reputational, or strategic impact on the organisation. Small to medium-sized enterprises (SMEs) often face heightened key person risks. These businesses are typically founder-led, have smaller teams, and may lack the robust management systems or succession plans found in larger organisations. As a result, addressing key person risk is a critical area of focus for William Buck’s Corporate Finance team, given its substantial impact on business valuation.

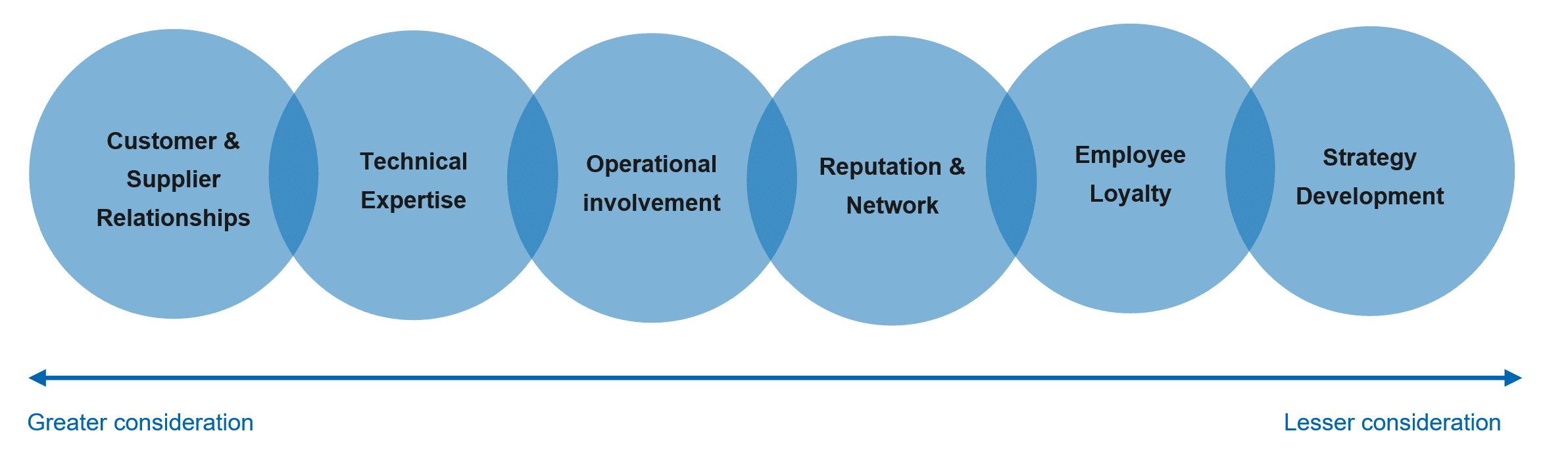

Assessing key person risk

Several methods exist to evaluate and account for key person risk in a business valuation. These include:

- Adjusting the capitalisation multiple

- Applying specific earnings normalisations, or

- Applying a discount to the enterprise value to reflect the level of key person risk.

To address this challenge, William Buck has developed a structured framework for determining an appropriate key person discount. Typically, this discount ranges between 10-25%. However, it’s important to note that these discounts are highly dependent on company-specific risk factors and, in some cases, may fall outside this range.

To ensure a comprehensive assessment of key person risk, William Buck’s framework considers the unique characteristics of each business and its exposure to this critical risk.

Customer and supplier relationships

Key individuals often maintain vital customer or supplier relationships, or they may have a strong personal rapport with key clients and vendors. Losing such a person could lead to revenue loss, increased costs, or even loss of access to exclusive supplies or products. To mitigate this risk, businesses can evaluate the importance of these relationships and take steps to shift ownership of them from the individual to the organisation. Implementing non-compete clauses can also help minimise the likelihood of a departing key person taking customers with them.

Technical expertise

A key person may possess highly specialised technical knowledge, industry expertise, or intellectual property that is difficult to transfer to others. This is particularly relevant for individuals with niche qualifications or subject matter experts with years of experience. The loss of such expertise could erode a business’s competitive advantage or slow operations due to a lack of skilled team members. To address this risk, businesses should establish internal training programs, document key processes, and promote the transfer of critical knowledge. Equally important is ensuring that intellectual property and ‘know-how’ are well protected.

Operational involvement

In many businesses, particularly smaller ones, a key person plays a central role in day-to-day operations. Combining technical and managerial skills, they ensure the smooth functioning of the organisation. If this individual leaves, the business may face inefficiencies, lower output quality, or disruption—all of which can impact earnings and reputation. Establishing clear management systems, delegating responsibilities, and defining employee roles can help distribute operational involvement more evenly across teams.

Reputation and network

Key individuals often have strong reputations and influential connections within their industry. Their credibility can enhance the goodwill of the business, while their networks may provide access to capital on favourable terms. In their absence, the business’s reputation may be affected, and opportunities for financing or strategic partnerships may become harder to secure.

Employee loyalty

In founder-led or smaller organisations, key individuals may inspire strong loyalty among employees. Their departure could disrupt team cohesion, increase turnover, and affect morale. To mitigate this risk, businesses should foster a culture based on shared values, a clear mission and a focus on excellence that transcends any one individual. Building a resilient team dynamic can ensure the organisation remains strong during transitions.

Strategy development

A key person may play a central role in shaping the company’s strategy, using their knowledge and expertise to align stakeholders and drive the business toward its vision. Without this individual, the organisation may struggle to adapt to changes in the market or capitalise on emerging trends. Developing a diverse management team with varied skills and expertise can ensure the business remains agile and strategically focused.

By proactively identifying and addressing key person risks, businesses can enhance their resilience, protect value, and position themselves for long-term success. William Buck’s structured approach ensures that businesses are well-prepared to manage these risks and thrive in an ever-changing market landscape.

For more information, contact your local Corporate Finance advisor.