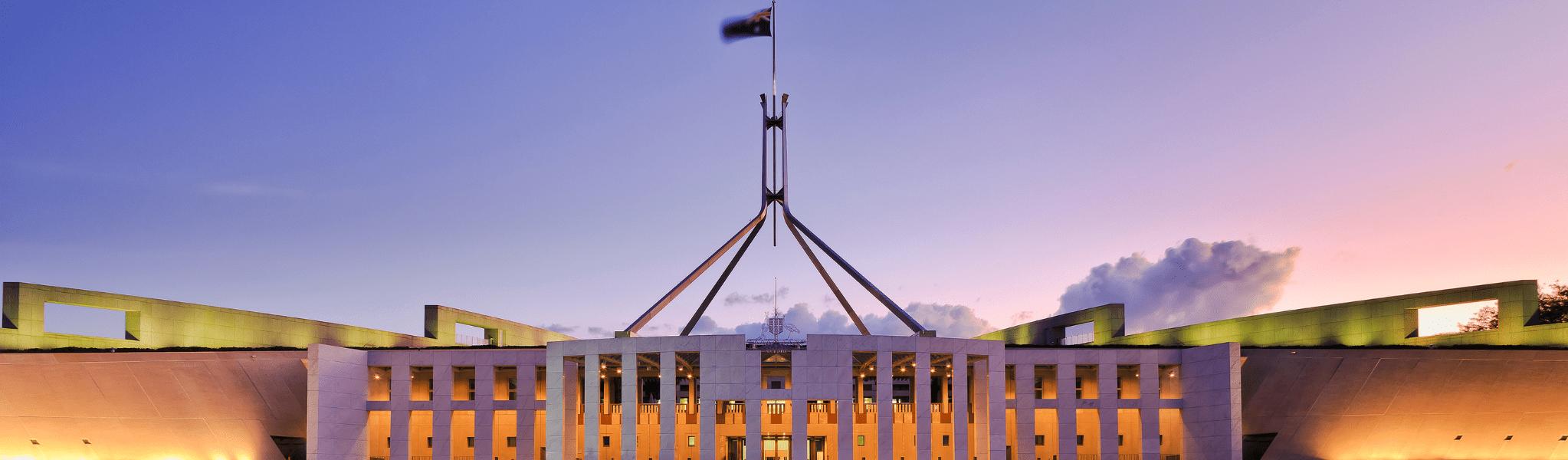

Local and international firms can benefit from Asia Pacific’s rapid development. However, having a detailed understanding of how each country’s markets are developing and how to take advantage of these opportunities is important.

William Buck has a rich history of over 130 years’ in Australia, 30 of which we have been helping clients and their advisors across the Asia Pacific. We bring global insights and local knowledge to help businesses navigate the international landscape. We’ve established our dedicated Asia Pacific team to assist:

- Inbound – Businesses and individuals from across the Asia Pacific looking to invest in or establish operations in Australia.

- Outbound – Businesses and individuals in Australia looking to invest in or expand into Asia Pacific markets.

- International businesses – Cross border businesses with an Asia Pacific hub that provides finance and back office support or acts as a gateway to the region.

- Local Asian businesses and families – Businesses and families, high-net-worth individuals settling in or establishing a base in Australia.