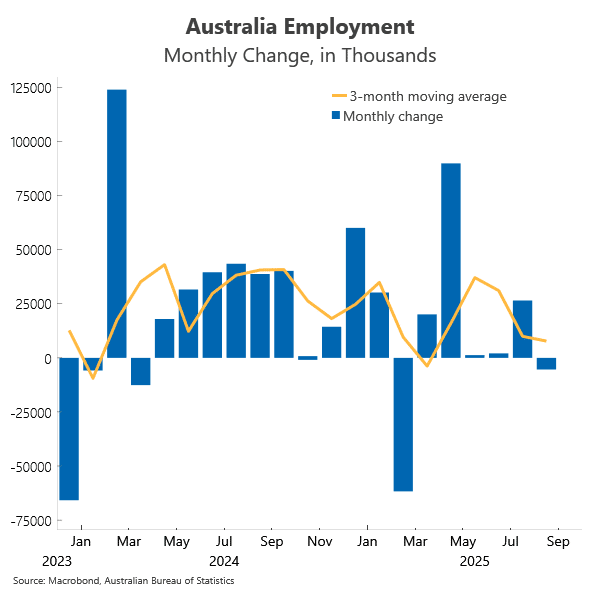

Australia’s jobs data shows the momentum has started to soften. The employment market still has ongoing strength, but some of its vigour is now deflating. In our last two jobs reports, we flagged that there are soft signs of slowing, notably recruiters’ liaison indicating that employers are becoming fussier around skills matching. This is now materialising in the hard data.

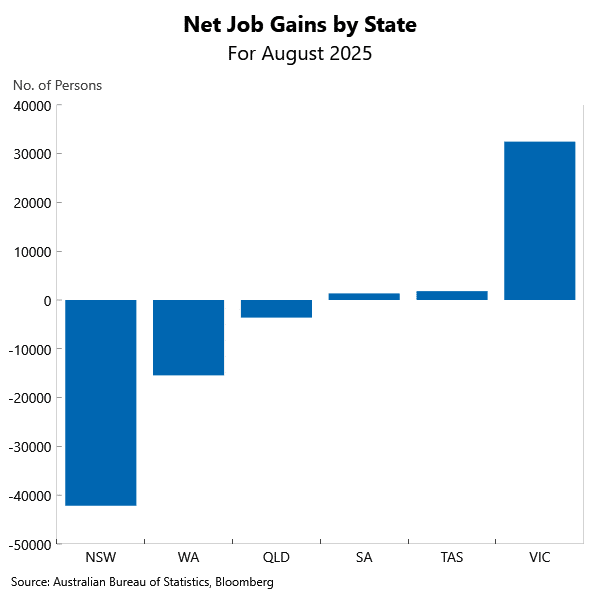

Employment fell 5.4k in August, which is the weakest outcome in six months. The decline was driven by a drop in full-time positions of nearly 41k, and those reductions were concentrated in NSW. Losses totalled 42.2k in NSW, larger than those in WA, QLD and ACT, which also recorded declines. The strongest gain was in Victoria at 32.4k.

The decline in momentum is also evident in the total net job gains in the year to August easing to 217.2k, the fourth consecutive monthly drop. In January, the 12-month total was almost double August’s figure at 427.1k. Another measure of the health of the labour market is the employment-to-population ratio, which also dropped in August. It fell to 63.6%, equalling the weakest reading since January.

The unemployment rate disguises the slowing pace because the participation rate fell 0.2 percentage points to 66.8%. This means the labour force, represented by those employed and actively seeking work, was smaller, helping to keep the unemployment rate steady at 4.2%. We continue to expect the unemployment rate to drift higher towards 4.5% over the next six to nine months, before recovering.

Today’s data shouldn’t bring the RBA off the sidelines at its policy meeting later this month. The RBA is too cautious a cutter for that and will want to have the benefit of the next quarterly inflation data in hand before moving again. But it does leave us comfortable with our view that another rate cut is in store at the RBA November meeting.

The US Federal Reserve also faces a deteriorating labour market, although unlike Australia, jobs growth in the US is cooling rapidly and inflation is above target. The US Federal Reserve cut the fed funds rate by a quarter per cent overnight to take the fed funds rate to 4-4.25%. This was the first rate cut this year, driven by the weakening labour market. Non-farm payrolls averaged a gain of only 28.3k over the three months to August, the least since mid-2020 during the height of COVID-19.

The US rate cut comes amid persistently high inflation. The Fed’s favoured inflation measure, the core personal consumption expenditure deflator, is running at an annual rate of 2.9%. This is well above the Fed’s inflation target of 2% amid tariff changes sweeping the country. The Fed’s fresh forecasts have revised higher core inflation to 3.1% for 2025, 2.6% for 2026 and 2.1% for 2027. The situation of elevated prices and weakening jobs market leaves the Fed in a difficult position. It perhaps explains why Fed Chair Jerome Powell, in the post-decision address, said that they’re “in a meeting-by-meeting situation”. These comments pushed against the more aggressive easing cycle that markets were pricing in before the Fed meeting.

What does this mean for Australia? One, the rate cut in the US will help ease financial conditions in the US, providing a boost to US economic activity. As the world’s largest economy, this will also improve global growth prospects. Secondly, the different outlooks for monetary policy in the US and Australia has pushed the Australian dollar higher against the US dollar. Indeed, the AUD rose to a 2025 high of 0.6707 in the early hours of this morning, as the US Fed has more easing to do in comparison to the RBA. We continue to expect the RBA to deliver two more rate cuts over the next twelve months, whereas the US is likely to deliver at least four more. Fresh projections published by the Fed (“the dot plot”) shows the majority of the Committee expect the Fed to deliver 2 more rate cuts this year (up from one previously), two more in 2026 and 1 more in 2027.

The information in this article is general in nature, intended for informational purposes only and does not constitute financial, investment, legal or professional advice; readers should seek guidance from qualified professionals before making decisions based on its content.