Business succession planning

At some point in your business’ lifecycle, you must consider its succession. Deciding the best options for the future is both an important and sensitive issue.

In most cases, business owners have a strong emotional connection to their business after countless hours of hard work and dedication. Yet, despite this, many owners take a one-dimensional approach to considering their exit strategy and business succession plan. They ask, ‘Do I want to sell my business?’ rather than taking a much wider view of where the business is positioned in its lifecycle, as well as the financial and personal needs of a business partner or owners.

Approaching the consideration from this angle would lead to asking a better question, such as, ‘How can I prepare the business for an orderly succession at some point in time?’

Many owners consider the process only when they are ready to exit their business. However, leaving succession planning to the last minute can heavily impact future financial and personal outcomes. The most effective business success planning requires a 3-5-year outlook for the best results.

Benefits of 3–5-year succession planning for business owners include:

- Maximising short to medium-term capital value

- Aligning the leadership structure with your preferred level of involvement

- Developing in-house leadership for future succession

- Defining long-term business benefits in terms of capital or legacy

- Ensuring a profitable, tax-effective, and commercially realistic business structure and transfer strategy

Key considerations when exit planning

Decisions on whether to pass the business onto the next generation of family, going public or selling all or part of the business requires a well-considered plan. To achieve the right outcome for all key stakeholders, some important questions need to be considered:

- Do you wish to continue owning the business? Are you ready to retire?

- Is the business dependent on one key person (‘key-person risk’), and how can this be managed?

- Is there sufficient management capable of continuing to grow the business?

- Is the business your main income-producing asset, and how can it be unlocked?

- What estate planning issues need to be considered?

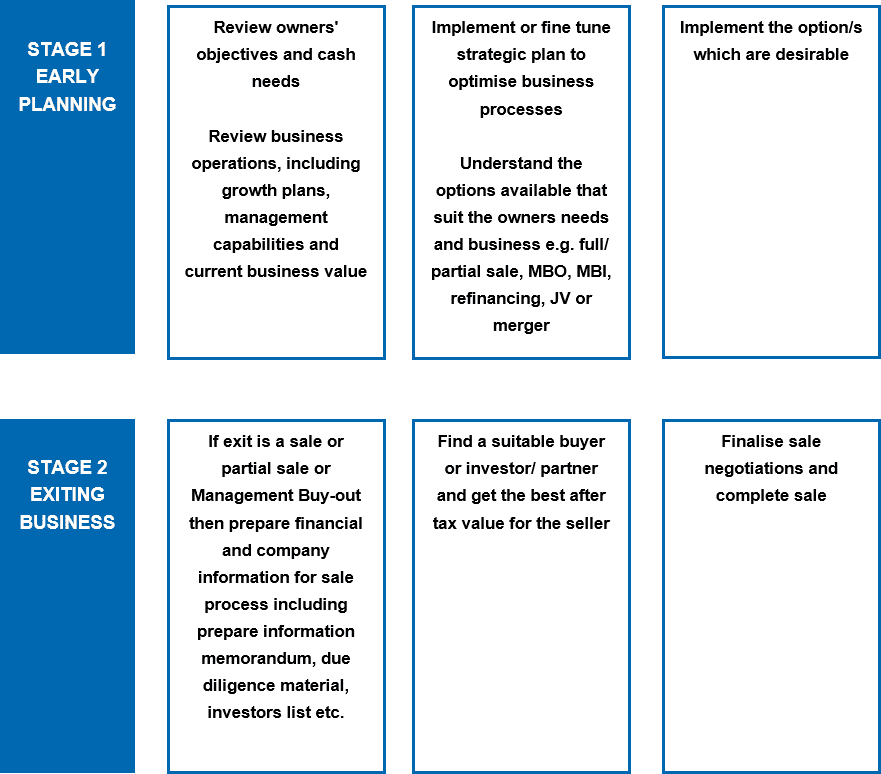

Exiting a business is a two-step process, as shown in the following diagram. The first step involves determining your objectives and understanding the options available.

Issues to bear in mind:

- When would you like to exit?

- Do you understand the current value of the business and how it’s derived?

- What do you hope the business will look like in the future?

- How are you going to get there?

- What are your expectations on sale?

- Are there any impediments to achieving these expectations?

An advisor can work through these questions with you and develop a plan to improve the value of your business and align your personal and business objectives.

The second stage involves the practical steps involved in selling your business or handing it down to the next generation. Achieving a successful outcome in stage two often depends on the level of planning in stage one.

What types of businesses need succession plans?

All businesses benefit from succession plans to ensure continuity and stability during leadership transitions. Family businesses need robust plans to manage the complexities of passing ownership while maintaining operations. Businesses with key-personnel risks also require strategies to mitigate potential disruptions caused by losing an important leadership individual.

Business strategy assessment

Analysing the current strategic direction helps business owners identify strengths and weaknesses and set clear, measurable goals for the future. By evaluating the company’s mission, goals, and strategies, owners can align their succession plan with long-term objectives, positioning the business for maximum success and providing a clear roadmap for leadership transitions that support sustained growth.

How can William Buck assist?

Succession planning is complex, so our comprehensive corporate finance services are tailored to your needs. Our Corporate Finance team is prepared to craft a succession plan template or plan for you to follow, helping you navigate the intricacies of success planning, ensuring a smooth transition, and preserving your business’s value.

For financial aspects, our Wealth Advisory team can likewise assist in managing finances–from tax implications to estate planning, William Buck is here to ensure that your personal and business goals are completely aligned. Contact William Buck today and start your succession planning process.