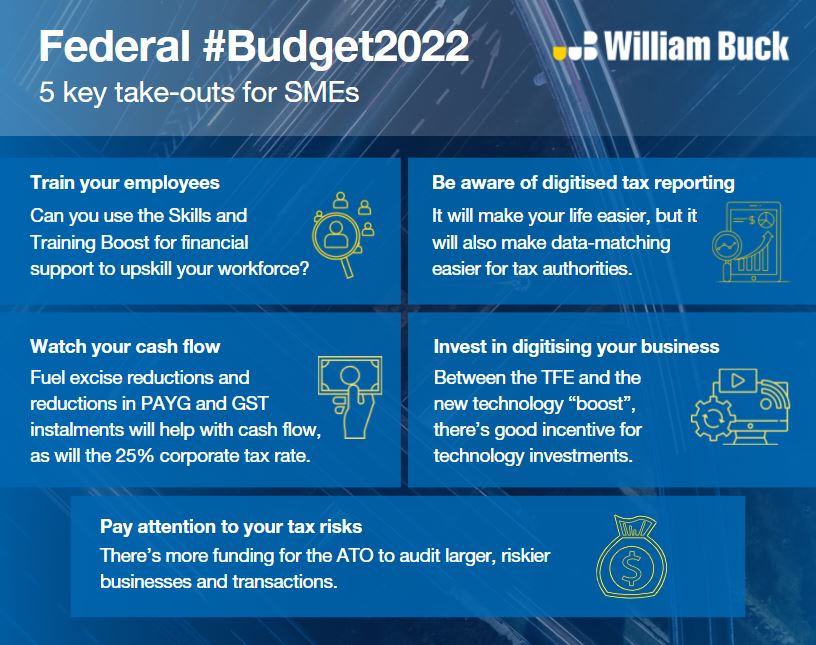

1. Utilise incentives to upskill your workforce

Can you use the skills and training boost for financial support to upskill your workforce?

SME businesses will get an additional 20% deduction for the cost of external training courses provided to employees. There is no cap, but the course needs to be delivered by an Australian provider.

Look at your planned investment in your employees. Keep in mind that the additional deduction on any costs incurred in FY22 I cannot be claimed until FY23.

2. Invest in digitising your business

Look at your planned investment in technology and digitisation.

In addition to the existing temporary full expensing (“TFE”) measures set to end on 30 June 2023, a new measure will allow SME business a “boost”, that is an additional 20% deduction, for expenses on digital adoption (e.g. portable payment devices, cyber security systems or subscriptions to cloud-based services). The boost will apply to eligible expenditure of up to $100,000 per year. Additional information is required but based on examples provided in the Budget overview, this will effectively cap the tax saving to $25,000 per year (at a 25% tax rate).

Keep in mind that the additional deduction on any costs incurred in FY22 cannot be claimed until FY23.

Also, remember that if you want to apply the TFE, the asset needs to be installed and ready for use by 30 June 2023, so watch out for those lead times on capital assets, and plan ahead.

3. Cash flows and cost savings

One of the key themes of the Budget related to the cost of living. Relevant to SMEs, the Government has announced that it will temporarily halve the excise rate on petrol and diesel for 6 months.

For SME businesses, the Budget included a measure to reduce the GDP uplift factor on PAYG income tax and GST instalments (from 10% to 2%) for the 2023 income year. Businesses with less than $10 million annual aggregated turnover will be eligible for the lower GST instalment, and businesses with less than $50 million annual aggregated turnover will be eligible for the lower PAYG instalments.

4. Tax reporting continues to be digitised

Digitisation means more pre-filling, data-matching and data-sharing.

The measures are designed to reduce compliance costs for businesses, but also make it easier for the ATO and other revenue authorities to data-match and share information. Some of these measures include:

- The option for businesses to report Taxable Payment Reporting data electronically, at the same time as BASs.

- Sharing Single Touch Payroll information with revenue offices to pre-fill payroll tax returns.

- Using real time accounting data to calculate PAYG tax instalments.

5. ATO Tax Avoidance Taskforce

The ATO has been given additional funding to target multinationals, large corporates, private groups and high wealth individuals.

This is expected to increase tax collections by $2.1 billion in a three year period. We can expect continued ATO review activity under programs such as the Top 500 Private Groups and the Next 5000 programs. Division 7A, trusts, capital gains and international dealings are some of the areas the ATO most commonly finds issues with.