The average Australian couple will need at least $640,000 of savings at retirement to maintain a comfortable lifestyle, a single person will require at least $545,000, according to the most recent statistics released by the Association of Superannuation Funds Australia (ASFA)1.

ASFA’s estimated retirement budget is based on the assumption that retirees own their own home, receive a part age pension and are fairly healthy.

In spite of this, the average couple aged 60 to 64 has only $430,664 in superannuation. The average male in this bracket has $292,510 and the average female in this bracket has just $138,154.2 In fact, currently approximately 20 per cent of retirees achieve a ‘comfortable’ or ‘above standard’ of living in retirement based on this standard.

Today’s pre-retirees face a very real dilemma – they may not have enough savings to maintain a comfortable standard of living. Frequent reforms to the superannuation policy, together with changes to the Age Pension assets test (with 330,000 people losing theirs in 2017 according to ABS data) creates further uncertainty.

Age pension assets test

The Age Pension Assets Test reduces an individual’s age pension payment for every dollar of assets they own over a certain threshold (some assets, such as their primary home, are exempt).

Full age pension thresholds

| 2017 | 1 July 2018 | |

| Assets must be less than | ||

| Single homeowners | $250,000 | $258,500 |

| Single non-homeowners | $450,000 | $465,500 |

| Couple homeowners | $375,000 | $387,500 |

| Couple non-homeowners | $575,000 | $594,500 |

Part age pension thresholds

| 2017 | 1 July 2018 | |

| Assets must be less than | ||

| Single homeowners | $542,500 | $564,000 |

| Single non-homeowners | $742,500 | $771,000 |

| Couple homeowners | $816,000 | $848,000 |

| Couple non-homeowners | $1,016,000 | $1,055,000 |

The taper rate (the rate by which your pension is reduced) is $3 per $1,000 over the threshold. Note how a couple that owns their own home and has assets over $848,000, must rely on their own super and assets alone – no age pension. When you consider the estimation that the average retired couple will require $640,000 in super with a part age pension, it seems unlikely $848,000 will be enough for a comfortable lifestyle, which would see them enjoy luxuries, access to good healthcare and frequent recreation activities.

Moreover, as a population, we are living healthier and more active lifestyles, which means the years over which our retirement savings need to stretch are increasing. The average life expectancy today is 86 (for men) and 89 (for women). By 2050, life expectancy is expected to rise to 91 (for men) and 93 (for women).

With all these factors combined, it’s never been more important to ensure you have a superannuation strategy in place.

How much will you need for retirement?

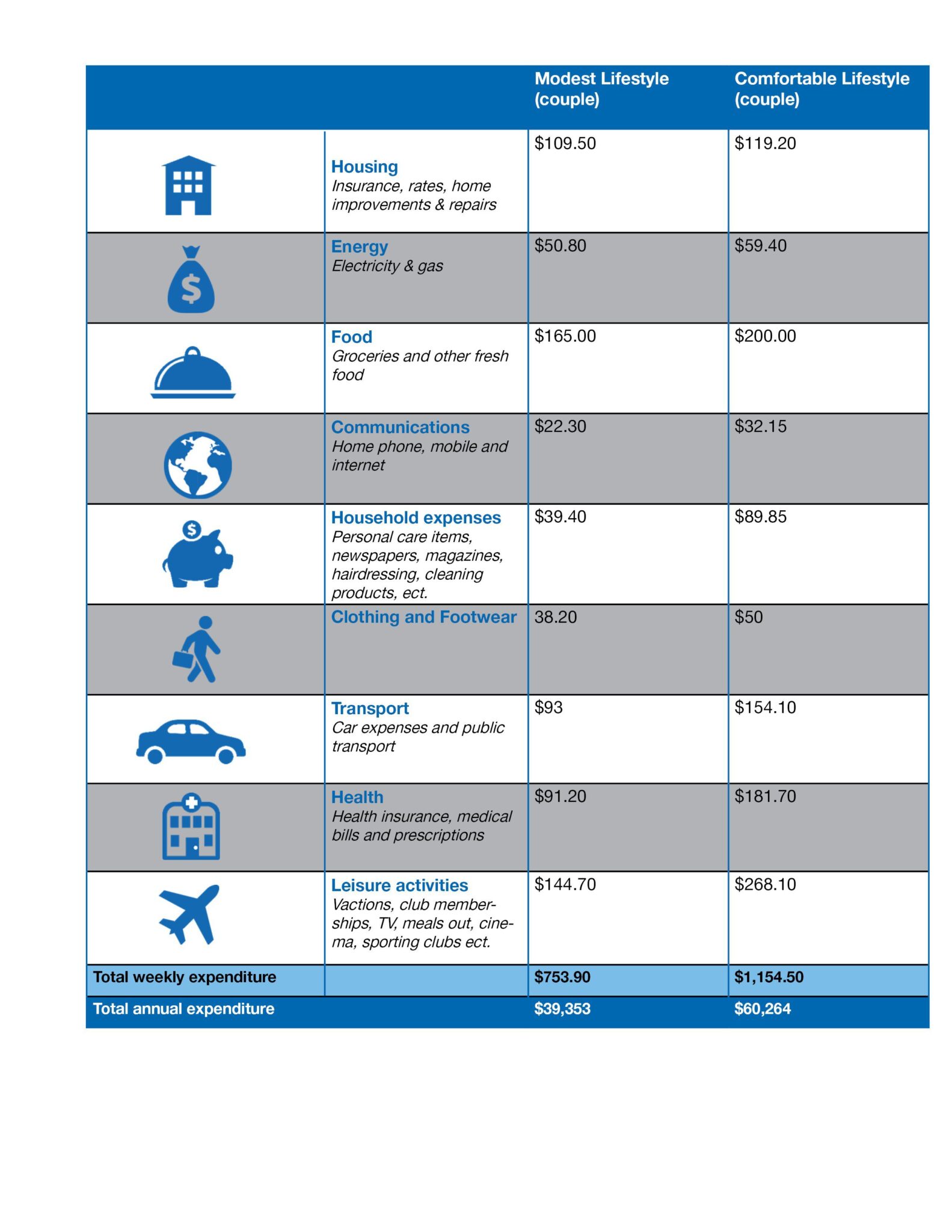

ASFA’s Retirement Standard benchmarks the annual budget needed by younger retirees (65 to 75 year-olds). Updated quarterly to reflect inflation, the report provides a detailed budget of what couples and singles need to fund their chosen lifestyle.

The table below shows the weekly budget of an average couple based on the assumption they own their own home and receive a part age pension. The biggest differences between a modest and comfortable income are in the areas of leisure activities, health and household expenditure.

There is hope that by 2050, with compulsory superannuation and voluntary retirement savings 50 per cent of retirees might reach comfortable or above.

William Buck’s advisors can help you estimate how much you will need for retirement and put you on the path to realising your desired lifestyle. Find out more by contacting your local advisor.

Source: ASFA Retirement Standard Detailed Budget and Breakdowns Quarter 2016

1ASFA Retirement Standard June Quarter 2016

2Australian Bureau of Statistics 2014 data