For hospitality businesses, particularly those that operate across states or as part of a broader group, payroll tax can carry hidden risks and compliance costs when not properly understood.

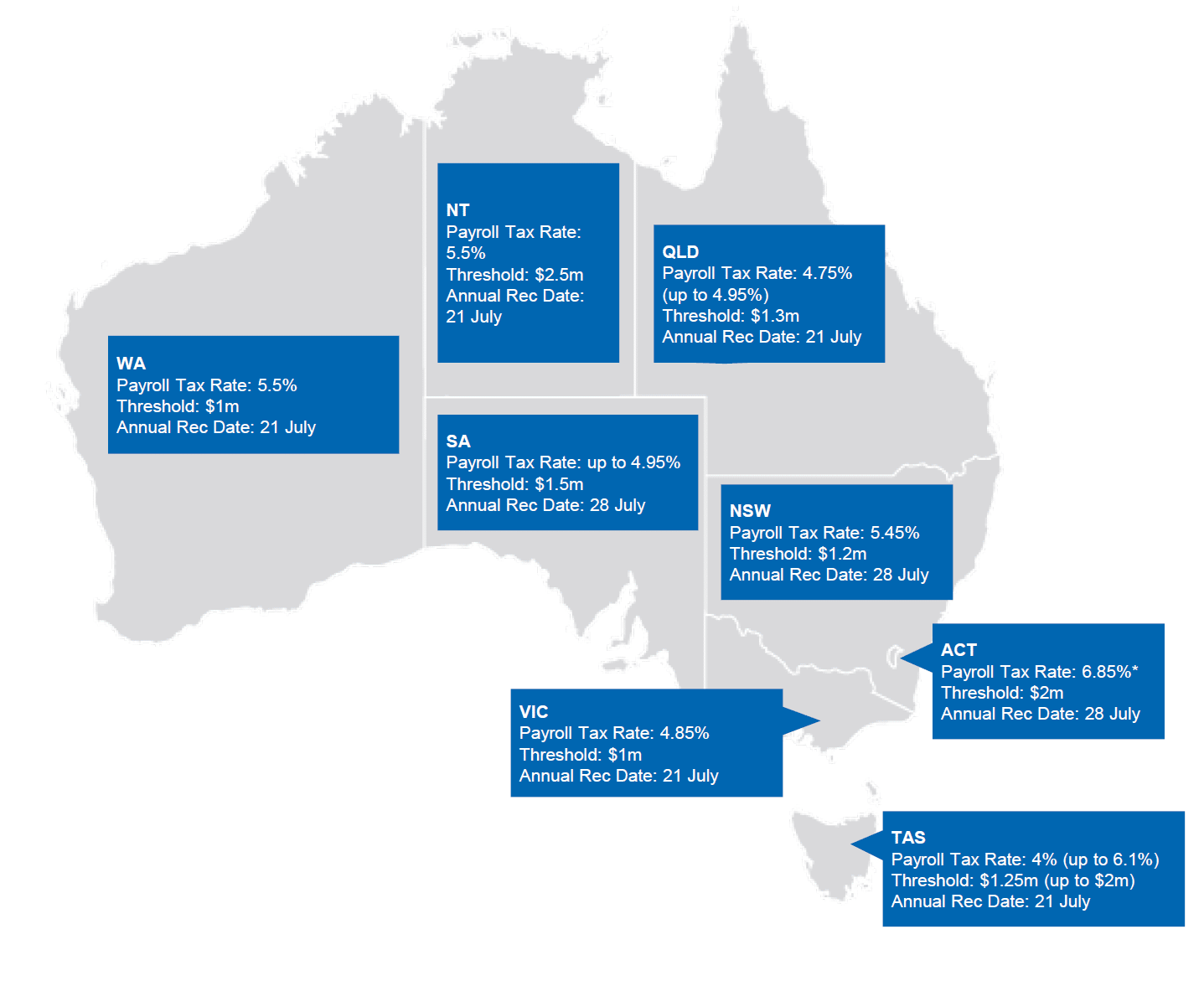

Each jurisdiction has its own rules, although many of the rules are now harmonised. Below we summarise some of the current thresholds, rates and annual due dates across Australia.

* ACT Payroll Tax Rate changes to 8.75% from 1 January 2026 where annual Australian wages exceed $150 million. Surcharge rates between 0.5% to 1% apply for annual Australian wages between $50 million and $100 million.

Where things can go wrong for hospitality businesses

The definition of ‘Australian taxable wages’

One of the common things we come across in hospitality businesses is payroll teams not fully understanding what is captured as ‘wages’ for payroll tax purposes. Rather than just salaries and wages, it is broad enough to include things such as:

- Super contributions

- Allowances and bonuses

- Fringe benefits

- Certain contractor payments

- Certain termination payments

Therefore, hospitality businesses need to properly understand their structure and remuneration strategy, as this also impacts taxable Australian wages and implications for any grouping when dealing with employees across different states.

For example, a bar in Melbourne operated in Victoria by itself may not reach the Victorian threshold, but if its owners also operate a café in Brisbane and a restaurant in Sydney, the combined wages could trigger payroll tax across all three states. This means the business may not be able to apply the full threshold in each jurisdiction, even if on a stand-alone basis the thresholds in each state are not breached. Instead, each state’s deductible threshold is reduced proportionately, often leading to a payroll tax liability in more than one state.

Given the hospitality industry is seasonal and largely reliant on transient or casual staff, we have seen unexpected or unforecasted payroll spikes cause unplanned liabilities for businesses operated across Australia.

Grouping

Many hospitality businesses operate through family groups, shared ownership structures or separate legal entities for different locations. While this setup often makes sense commercially, it can unintentionally trigger payroll tax grouping rules, adding complexity to staying compliant.

From our experience working with hospitality businesses, some common signs that grouping rules might apply include:

- Shared directors or ownership across entities

- Centralised payroll or HR management for multiple venues

- Using the same branding or marketing across locations

- Inter-entity loans or shared financial resources

- Staff working across multiple venues (e.g., a chef splitting time between restaurants)

Under payroll tax grouping rules, state revenue authorities can treat related entities as a single employer. This has two key implications:

- The payroll tax threshold is shared across the group, not calculated separately for each entity.

- Each entity in the group is jointly responsible for the group’s total payroll tax liability.

State revenue offices often target group compliance during audits and the consequences can be significant. If payroll tax liabilities are backdated, penalties can quickly add up.

The interaction between tax-free thresholds and Australian wages

From 1 July 2025, in Victoria, the tax-free payroll tax threshold is $1 million ($83,333 for monthly lodgers). Where Australian taxable wages are between $3 million and $5 million, the tax-free threshold is reduced under a phase out model by 50%, as illustrated below.

Example 1: Full-year employment with Victorian wages only

A commonly owned chain of Melbourne restaurants operates in Victoria for the entire 2026 financial year and pay $4.2 million in wages. Since the payroll tax threshold phases out for wages over $3 million, the tax-free threshold is reduced.

| Full threshold amount | Phase-out cap | Phase-out reduction | Tax-free threshold |

|---|---|---|---|

| $1 million (as the employer operated for the full year and paid all wages in Victoria). | $3 million (the point at which the threshold begins to phase out). | ($4.2 million – $3 million) x 50%

= $600,000 |

$1 million – $600,000

= $400,000 |

This means the hospitality business is entitled to a reduced payroll tax-free threshold of $400,000 for the year, instead of $1 million.

Example 2: Full-year employment with Victorian and interstate wages

Now, let’s consider the same business, but this time it paid $1.5 million in Victorian wages and $2 million in interstate wages (totalling $3.5 million in taxable Australian wages). Since the business has interstate wages, the payroll tax-free threshold is adjusted proportionally based on the share of Victorian wages.

| Full threshold amount | Phase-out cap | Phase-out reduction | Tax-free threshold |

|---|---|---|---|

| $1 million × ($1.5 million ÷ $3.5 million) = $428,571 | $3 million × ($1.5 million ÷ $3.5 million)

= $1,285,714 |

($1.5 million – $1,285,714) × 50%

= $96,429 |

$428,571 – $96,429

= $332,142 |

In this case, the hospitality business is entitled to a reduced payroll tax-free threshold of $332,142 for the year due to the inclusion of interstate wages, when previously it would have been $428,571.

We have come across many businesses that do not understand their expected payroll tax bill, including how it can impact their monthly and year-end cash flow. If you’re unsure how payroll tax could affect you, seek professional advice to avoid unexpected liabilities.

What should hospitality business do?

If you operate multiple venues, share staff, or run your business through multiple legal entities, there is no better time to review your position and model the implications appropriately.

Understanding your obligations, including opportunities for exemptions or grouping exclusions, can make a material difference to your payroll bill at the end of the financial year.

Get in touch with William Buck’s hospitality team for a tailored payroll tax risk review of your business.