Victorian Treasurer Tim Pallas has handed down a budget focused on the government “taking responsibility” for the state’s mounting debt burden after $31.5 billion was borrowed for COVID-19 recovery.

Big businesses and landlords will be hit with both new and higher taxes over the next ten years to pay back the debt Victoria borrowed during the COVID-19 pandemic.

These measures are in addition to the Windfall Gains Tax set to come in on 1 July 2023.

Land Tax increase

As part of the COVID Debt Levy, Victorian land tax will increase significantly for many landowners. It is expected to raise $4.74b of additional revenue over the next four years.

The Victorian government has stated the average land tax increase is expected to be $1,300 per property per year. The table below will assist to understand the impact on your Victorian property portfolio.

The measure will work as follows

- reducing the land tax-free threshold

- adding a fixed charge and

- increasing the land tax rate by 0.1 percentage points

The measure has been labelled ‘temporary’ and will be in place for 10 years. It will not affect the family home.

COVID Debt Levy for general taxpayers with property holdings above $300,000:

| Land Value | Calculation | Addition cost per year |

| $500,000 | $975 plus 0.1 per cent of $200,000 ($200) | $1,175 |

| $750,000 | $975 plus 0.1 per cent of $450,000 ($450) | $1,425 |

| $1 000 000 | $975 plus 0.1 per cent of $700,000 ($700) | $1,675 |

| $1,500,000 | $975 plus 0.1 per cent of $1,200,000 ($1,200) | $2,175 |

Key takeaway

Taking the above property with a $1m land value, the property owner will pay an additional 56% in land tax per annum ($2,975 land tax + $1,675 COVID Debt Levy) as a result.

While it is not yet known, it raises the question of whether this levy will have a material impact on holiday home ownership and investment properties. At a time when rental affordability is a key issue, will this provoke landlords to stop renting their properties, thereby reducing supply and fanning the flames of the crisis?

Stamp Duty reform for Commercial & Industrial Property

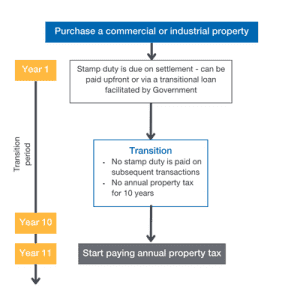

A transformational change for stamp duty on commercial and industrial properties has been put forward. The reform will transition away from stamp on these properties over the course of the next ten years and replace it with an annual property tax.

Importantly this ‘property tax’ is separate from and in addition to the existing land tax system.

Owners of commercial and industrial properties prior to 1 July 2024 will not be affected, so long as they own that property.

From 1 July 2024, when a commercial or industrial property is transacted it will trigger a 10-year transition period for that property, where the purchaser has the choice to either:

- pay the properties final stamp duty liability as an upfront sum; or

- pay an annual payment for 10 years plus interest, supported by a government transition loan.

Source: Treasurer Tim Pallas at Victorian Chamber of Commerce luncheon.

If the property is transacted again within the 10-year transition period, no stamp duty will be payable. Unless the initial purchaser opted into the transition loan, in which case they are obligated to make the outstanding payments.

The annual property tax will begin 10 years post the initial transaction and is set at 1% of the properties unimproved land value.

These changes will not apply to residential property.

Key takeaway

On a positive note replacing stamp duty with a property tax may provide an income tax benefit by replacing a capital expenditure with an annual deduction when the property tax kicks in.

When looking to purchase a commercial or industrial property you will need to ask the right questions to understand what your potential tax liability may be during the transition period. An important part of your cash flow planning.

Commercial and industrial property owners will also need to consider if this tax will be passed onto tenants and how their leases may deal with this. Is this just another cost that will be passed onto the business owner?

Windfall Gains Tax

While the windfall gains tax was not part of the 2023-24 budget (it was announced in the 2021-22 budget), it is a timely reminder this tax will apply from 1 July 2023.

This tax will apply to large windfall gains associated with planning decisions to rezone land that create an uplift in land valuations on a capital-improved value basis above $100,000.

| Value uplift | Tax payable |

| <$100,000 | $0 |

| $100,000 to <$500,000 | 62.5% of uplift above $100,000 |

| $500,000 and over | 50% of total uplift |

For example, if as a result of rezoning your property received a value uplift of $550,000 the tax payable would be $275,000 (= 550,000 x 50%).

Key takeaway

This tax will have a material impact on the feasibility, cashflow, margins and ultimately the decision to invest in a development moving forward.

If you own or are considering land that is likely to be rezoned in the future, it’s critical to seek advice on how this tax may apply to your transaction.

Devil is in the detail

Many questions remain, such as how will the recently announced property tax works for a property that is a mixture of both residential and commercial premises?

For now, Victorians will need to wait for the key details of each arrangement, which are set to be announced late in 2023, with the new property tax to come into effect from 1 July 2024. The revised land tax regime will take place from 1 January 2024.

If you need further information on the above please contact your local William Buck Advisor.