As part of the Government’s response to COVID-19, company directors now have a six-month relief from any personal liability for trading while insolvent.

These changes are designed to assist financially stressed businesses. In the current COVID-19 crisis, directors need to make swift decisions about incurring debt. Under the temporary safe harbour changes, directors can continue to trade without the pressure to enter their organisation into administration if there’s a chance it might be insolvent.

In short, the changes announced on 24 March 2020 mean:

- Directors receive a six-month reprieve from personal liability ‘any debts incurred in the ordinary course of the company’s business’.

- Increase in the threshold at which creditors can issue a statutory demand or bankruptcy notice from $2,000 to $20,000, applicable for six-months.

- The time frame that debtors will have to comply with Statutory Demands and Bankruptcy Notices has increased from 21 days to 6 months.

- All existing Corporations Act duties will continue to apply, and any cases of dishonesty and fraud will still be subject to criminal penalties, including illegal ‘phoenix’ activity.

It’s not a ‘free pass’ for Directors

Safe Harbour laws (introduced in 2017) are a defence for directors to continuing to trade, despite being insolvent. This can only be applied if there is a reasonable chance that the troubled business can be saved on the basis that employee entitlements can be protected and an insolvency plan has been signed off by a practitioner or lawyer.

If a director allows a company to trade past the point of rehabilitation they may incur personal liability. Under the new measures, directors can continue to trade even if there’s reasonable grounds that suggest the company could become insolvent (applicable for actions post 1 March 2020 for six months).

While this will help to temporarily relieve the pressure for recovery matters, it’s not a magic wand to erase debts and has its flaws. On a positive side, these changes encourage businesses that would otherwise be operating profitably to push through the current crisis.

On the flip side, the damages will be far worse for those that can’t continue to trade and keep running their business into the ground rather than appointing a voluntary administrator or liquidator when the company is nearing insolvency. There’s also a concern that directors could see this temporary reform as offering them carte blanche to neglect their general director’s duties.

Directors need to continue to oversee the solvency of their organisation. It’s critical that:

- Any debts incurred are still be payable by the company.

- Action plans are in place to mitigate risks to remain viable during and beyond 6 months.

- Ongoing assessments are conducted on the impact of incurring further debts and liabilities.

- Decisions are made in the best interests of the corporation (including the interests of creditors when approaching insolvency).

- That these changes are not used as an excuse to keep unviable businesses running, load up on unsustainable debt or dodge paying worker entitlements.

Tip: If debts are mounting and the business is no longer profitable, get on the front foot and seek advice from an external administrator. You can increase the chance of your business surviving with a turnaround strategy or restructure plans.

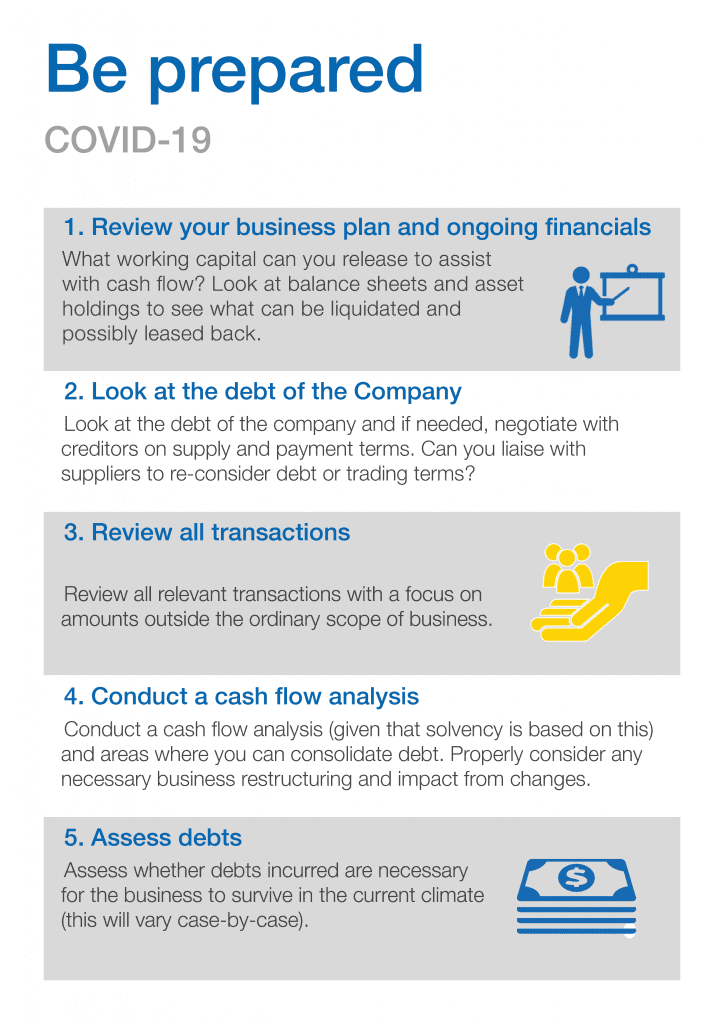

The six-month lifeline – what you can do

There’s still a need for businesses to continue to plan and act responsibly. This is an opportunity to use the breathing space to:

Voluntary Administration process

Voluntary Administration (“VA”) is a formal insolvency administration used by company directors to enable a potential restructure when it’s been resolved that their business is insolvent or likely to become insolvent. After appointing an administrator, the directors are no longer personally liable for debts incurred from that point on. VA’s can enable companies to extinguish debt, cancel onerous leases and restructure all facets of debt, equity and unprofitable business streams.

The VA process is strictly time bound and usually only operates for around 4-6 weeks. During this time, the first and second creditors meetings must be held whereby creditors have the option to place the company into liquidation or to accept a proposal to restructure the business via a Deed of Company Arrangement and thus avoid liquidation. The purpose of the second meeting is for the administrator/s to update creditors on whether they feel that the company can be rehabilitated and what measures that will entail, or whether it will need to enter liquidation and cease to operate.

If directors approach administrators early, there may be more options to restructure the sub-optimal elements of their business. Where insolvency is a possibility, despite the breathing room provided by the new measures, ensure you take appropriate business and legal advice.

Watch our COVID-19 Business Actions video on ‘When to Speak to an Insolvency Practitioner’.

We’re here for you

While the impact of COVID-19 is being felt in Australia and across the world, we’re well placed to help you through this challenging time. We’ve supported our clients and community through times of change for over 125 years. COVID-19 represents another seismic change; one we’re ready to tackle head on. With a history of evolution, William Buck continues to grow and adapt to provide the best advice and services we can to our clients in the middle market.

For the latest COVID-19 updates, visit our Resource Page.