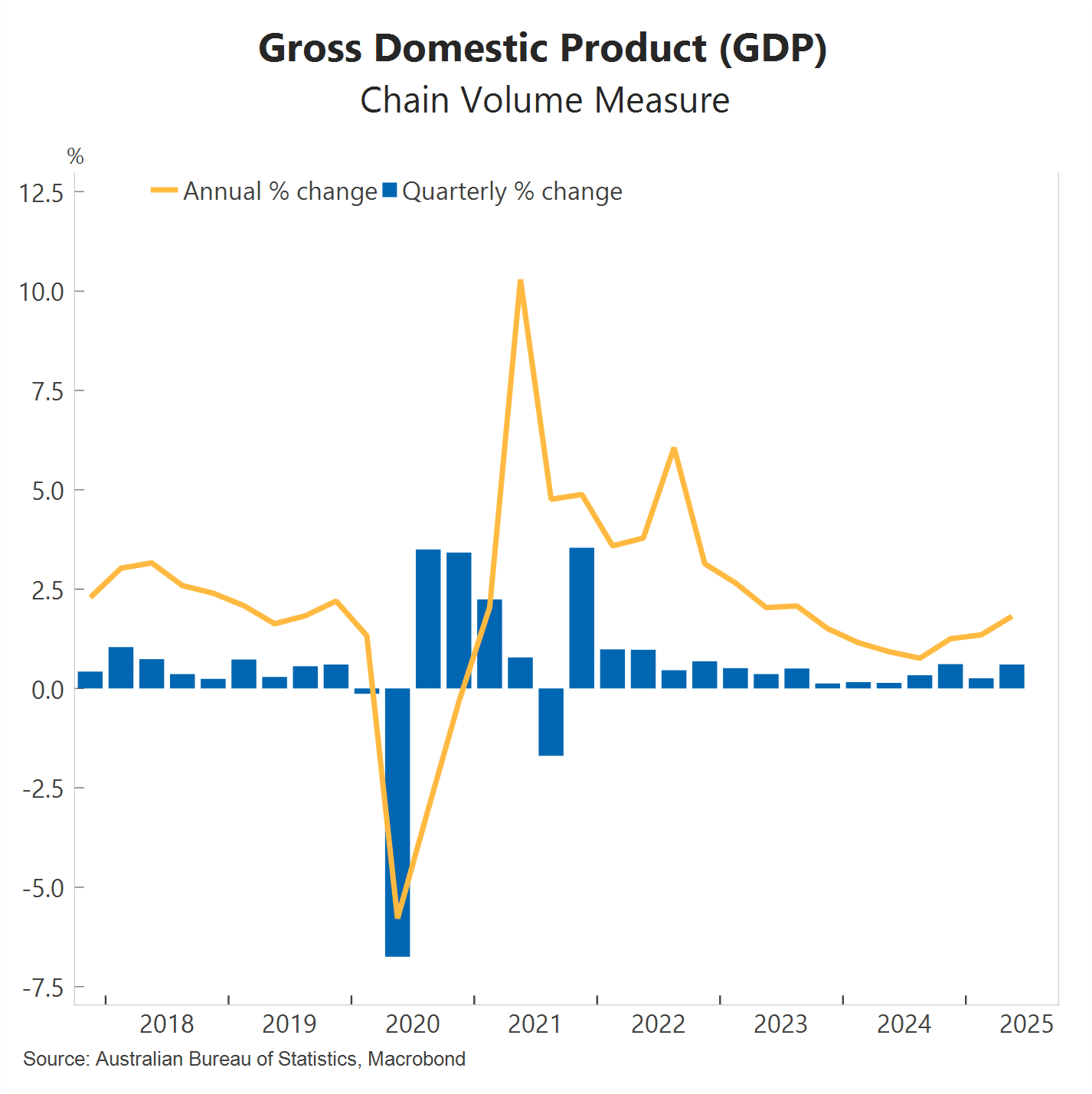

I’ve recently been describing the Australian economy as a toddler learning to walk. The economy had been picking up, but it was fragile, like a toddler needing the furniture nearby or a parent’s hand for support. Today’s data suggests the toddler has had a growth spurt and moved on to preschool, with strengthening activity pointing to a recovery that is on firmer footing.

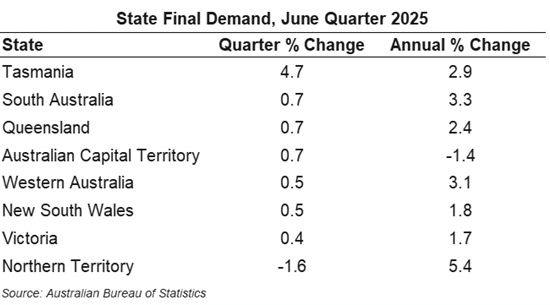

The upswing that began in late 2024 has continued. The economy grew 0.6% in the June quarter, lifting annual growth to 1.8%. The annual pace has now improved for three consecutive quarters, after bottoming out at 0.8% in the September quarter of last year. The GDP outcome was stronger than market consensus and above the RBA’s forecasts published just last month – 0.5% in the quarter and 1.6% in the year to the June quarter, respectively.

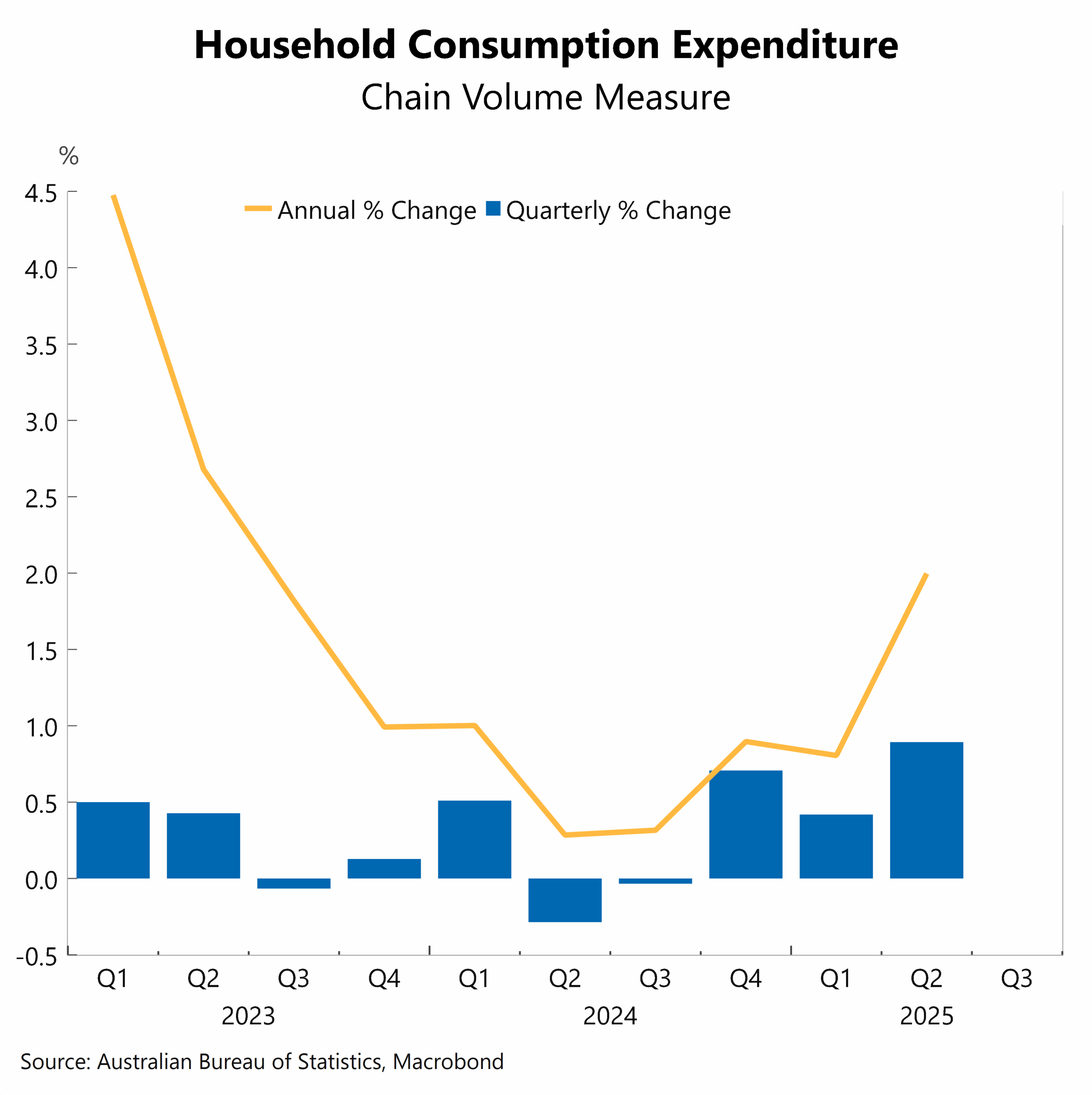

The main driver was consumer spending, which has been on the RBA’s watchlist due to the sluggishness of the economic recovery. Household consumption increased 0.9% in the June quarter – the fastest pace since late 2022. In year-on-year terms, household spending lifted 2.0%. Discretionary spending led the gains in the quarter (up 1.4%) with strong contributions from recreation and culture (up 2.0%), transport services (up 1.7%) and hospitality (up 0.7%). In comparison, essential spending rose a more modest 0.5%.

That said, several one-off factors boosted the result, making it harder to gauge the true strength and durability of the recovery in household consumption. The proximity of Anzac Day and Easter distorted seasonal adjustments and likely boosted spending on hospitality and travel. The Rugby Union Lions tour, which began in late June, drew around 40,000 international visitors, some of whom likely arrived earlier and boosted retailing. We have previously estimated the tour’s economic impact at $430 million. Mid-year sales drove heavy discounting and retailing volumes. Meanwhile, residents in QLD and NSW also experienced stronger sales as consumers replaced items damaged from the extreme weather events of the previous quarter.

RBA rate cuts and solid incomes growth have helped turn consumer spending around. Population growth remains firm, though easing from its peak. On a per capita basis, GDP grew by 0.2% in the June quarter, which is only the third time in three years this measure has not shrunk. The household saving ratio fell to 4.0% from 5.2%, as savings were drawn down to fund some of this spending.

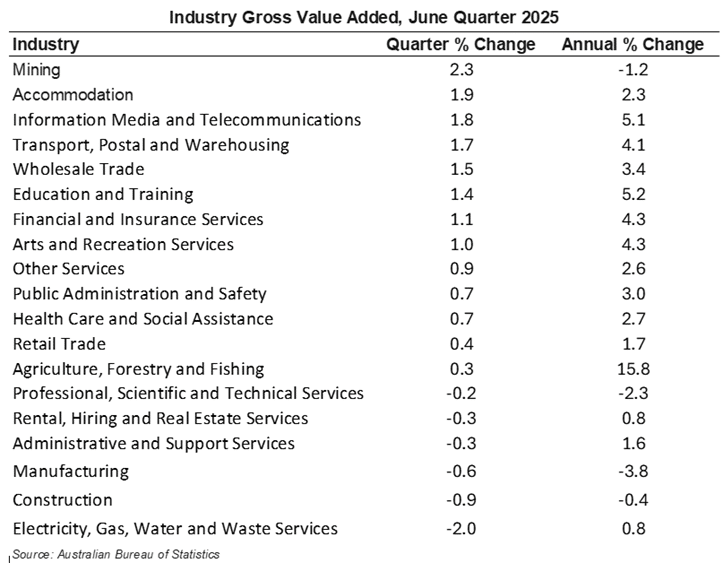

Elsewhere, new private business investment fell 0.4% in the quarter, making no contribution to growth in the quarter. Business-spending plans for 2025-26 should receive support from rate cuts and stronger consumer demand. Public investment was the largest drag, having passed its peak and now declining for a third consecutive quarter. Net exports made a modest positive contribution, but this was offset by a rundown in inventories.

Markets will be focused on what this means for the policy outlook. Our base case is still that the RBA remains a reluctant cutter, with two further moves in November 2025 and February 2026. Today’s stronger-than-expected data, led by consumers, casts some doubt on a November cut. Underlying inflation is trending towards the middle of the RBA’s target band and global growth risks remain skewed to the downside. However, the near-term likelihood of a rate cut from the US Federal Reserve may help stimulate global demand, even as supply chain disruptions and tariff uncertainty persist. It makes November a closer call.

The RBA will also be watching the labour market closely. July’s unemployment rate dipped slightly to 4.2%, and on most measures conditions remain tight. Still, business liaison suggests employers are becoming more selective in skills matching, which may point to a modest softening in employment growth ahead.

The information in this article is general in nature, intended for informational purposes only and does not constitute financial, investment, legal or professional advice; readers should seek guidance from qualified professionals before making decisions based on its content.