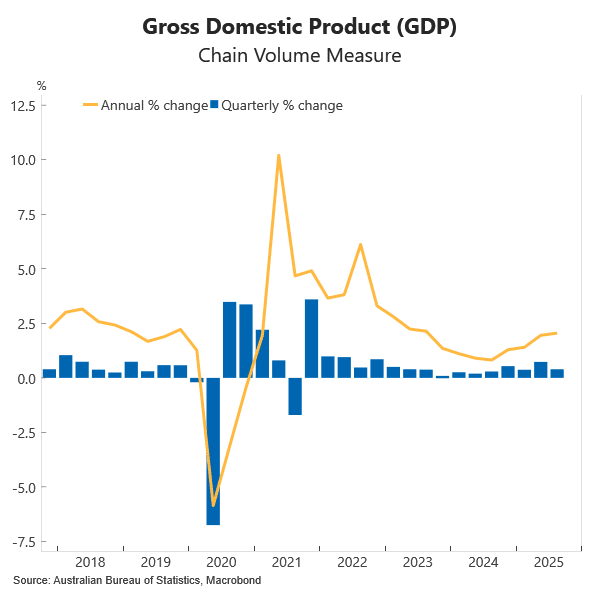

The economy expanded by 0.4% in the September quarter, coming in slower than consensus expectations for a brisk 0.7% pace. Year-on-year, gross domestic product (GDP) stepped up from 2.0% in the June quarter to 2.1% in the September quarter, with the economy growing around its potential growth rate. That means the economy is at its speed limit and there may not be much room to expand further without pushing up prices. Recently, the Reserve Bank Deputy Governor pointed to low productivity resulting in a lower potential rate of around 2%.

A few things stood out. First, the drivers of economic activity encouragingly broadened in the September quarter. Private demand, comprising household spending and business investment, picked up strongly and was further supported by public demand, which contributed 0.4 percentage points to growth for the quarter. Offsetting some of this domestic momentum was a drag from net exports, which subtracted 0.1 percentage point from growth. Inventories also weighed on the result, subtracting 0.5 percentage points, as miners reduced stock to meet increased demand for coal and retailers reduced stock levels as they extended discounting. Indeed, domestic demand jumped 1.2% for its strongest result since the June quarter of 2023.

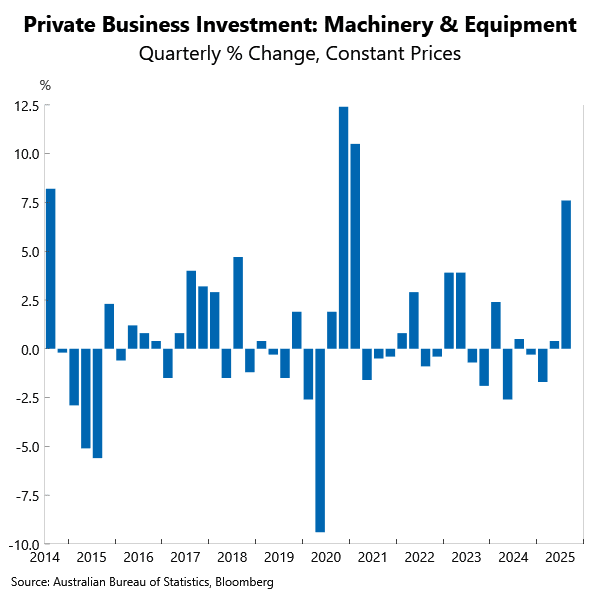

Second, business investment recorded a solid increase of 2.9% in the September quarter, driven by a surge in machinery and equipment related to an expansion of data centres in NSW and Victoria. In fact, the spike in investment in machinery and equipment of 7.6% in the quarter was the fastest recorded in 4½ years.

Third, whilst household consumption supported growth, spending was focussed on essentials – the things people need, rather than want. The pace of household spending eased from 0.9% in the June quarter to 0.5% in the September quarter (and adding 0.3 percentage points), as the household savings ratio rose to 6.4%. These trends may signal that recent inflationary pressures are starting to be felt.

Fourth, population growth remains firm, though it continues to ease from its recent peak. On a per capita basis, GDP was flat in the September quarter, meaning GDP per capita hasn’t shrunk for four consecutive quarters after nearly two years of declines.

The RBA remains focused on unit labour costs, productivity, and the broader inflation outlook. Unit labour costs in the non-farm sector, adjusted for inflation, rose only 0.1% in the September quarter – an encouraging development. However, productivity, measured by GDP per hours worked recorded only a modest improvement in the quarter. And measures of inflation in the national accounts also showed a lift in price pressures, which will keep the Reserve Bank on alert. The GDP and domestic demand implicit price deflators jumped 1.3% and 0.9% in the September quarter, taking the annual rates of growth to 3.2% and 3.0%, respectively.

The RBA meets next week and a hold on rates is virtually assured. Today’s data does little to knock the RBA off its on-hold position in the near term, but it keeps the RBA vigilant and monitoring the path of inflation intently. With the economy growing at around potential, there’s not a lot of room for further expansion without adding to price pressures.

The RBA is expecting underlying inflation to move back into the inflation target band in the second half of next year. The RBA will stay watchful to the possibility that inflation may not return to target as expected and respond if needed. Equally, they’ll monitor how growth transpires with an on-hold rates position likely to start to hurt households, as wages adjusted for inflation goes south. Our view is the RBA will also stay on hold over next year.