Employment in November unexpectedly retreated by 21,300, marking the sharpest monthly decline in nine months. The fall was driven by a steep drop in full-time jobs of 56,500, the largest monthly fall in almost two years. Part-time employment cushioned the blow, rising by 35,200 in the month. This shift toward part-time work contributed to an increase in the underemployment rate, which measures part-time workers who are willing and available to work more hours. It rose from 5.7% in October to 6.2% in November, its highest level in about a year.

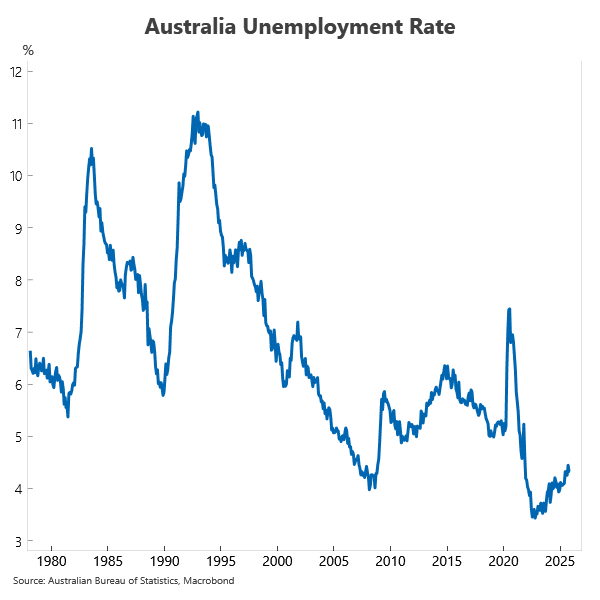

Two key themes emerged from the latest jobs data. First, the labour market remains healthy. The national unemployment rate held steady at 4.3% for the second consecutive month and has stayed in a remarkably narrow range of 4.3% to 4.4% since June. This stable, low rate of unemployment is consistent with the RBA’s assessment that the labour market remains “a little tight.”

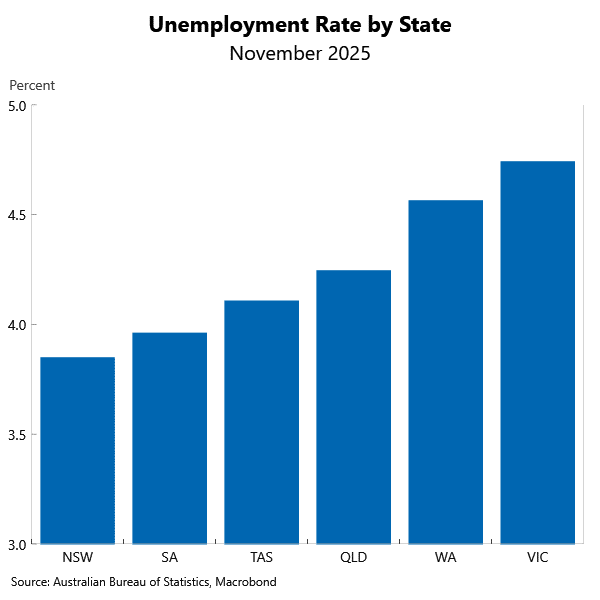

Across the states, Victoria has the highest unemployment rate (4.7%), although it added the most jobs of +19.0k in the month.

Second, momentum in the jobs market is slowing, but only gradually. Annual employment growth has eased from 3.0% at the start of the year to 1.3% in November. The employment-to-population ratio has also slipped from a record high of 64.5% to 63.8%, signalling softer labour demand. However, what perhaps matters most is the change since the last policy move by the RBA in August. The economy has added an average of 10,300 jobs per month since then, representing a modest acceleration compared with August.

The bottom line is that this data will not prevent the RBA from hiking the cash rate if inflation remains persistent. It certainly reinforces the view that the RBA is done cutting rates in this cycle. We maintain an on-hold view for 2026, but the risk is growing that the RBA may come off the sidelines and begin tightening policy.