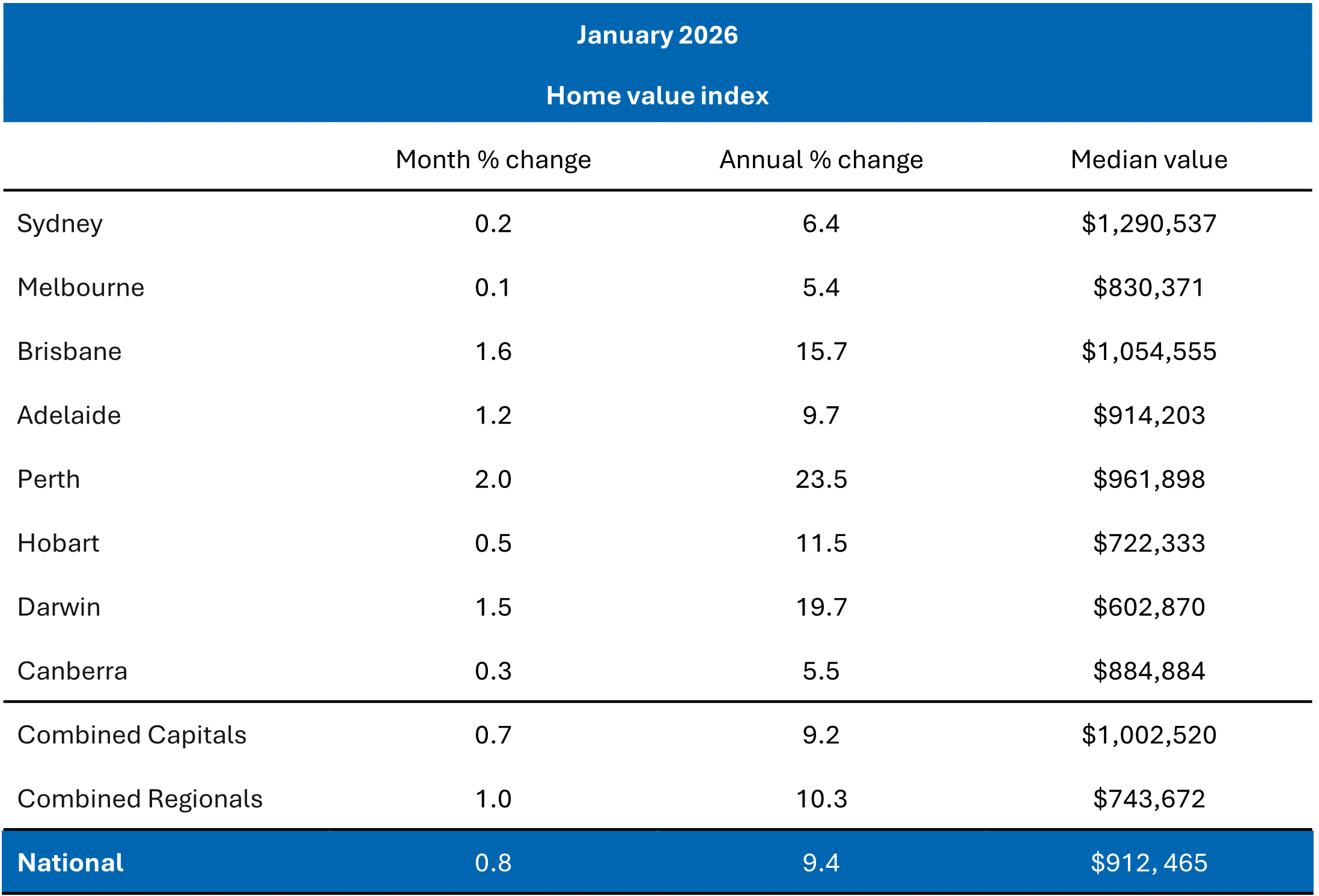

Dwelling prices climbed further in January, despite rising expectations that the RBA had finished a rate‑cutting cycle and was set to raise rates in early 2026. Cotality’s national home value index jumped 0.8% in January to a new record high. In year‑on‑year terms, growth stepped up to 9.4%, the fastest pace in almost two years. The growth was led by WA and QLD, which rose 2.0% and 1.4% last month, respectively, and recorded blistering annual growth rates of 18.4% and 14.4%, respectively.

Lower‑priced homes also led the growth in January, as first‑home buyers continued to take advantage of the expansion of the first‑deposit scheme and buyers chased a cheaper entry point. It underscores how stretched affordability has become. The data showed that across the combined capitals, lower‑quartile house values were up 1.3% in January, compared with a 0.3% rise across the upper quartile.

Across states and territories, the home value index rose to a new all‑time high everywhere except Victoria and the ACT. Across the metropolitan cities, the outcome was more mixed. The metropolitan areas of Perth, Brisbane, Adelaide and Darwin recorded new highs in their indexes.

We see a high risk of a rate rise from the RBA tomorrow, placing the probability at around 75%. It is not a done deal, as the RBA could choose to wait and leave rates on hold on the expectation that underlying inflation will ease into the target band over the medium term. The difficulty is that both the labour market and underlying inflation pressures are starting from a higher base and have not met the RBA’s forecasts published late last year. If the RBA does keep rates on hold tomorrow, it will be only a matter of time before it is compelled to tighten.

The new debt‑to‑income caps set by the Australian Prudential Regulation Authority (APRA) have now kicked in, and alongside anticipated RBA tightening, should take some heat out of housing price growth. Even so, demand remains firm and continues to outstrip housing supply. Building approvals have picked up since mid 2024, but listings remain low. The volume of advertised homes for sale is 25% below the five‑year average. That means strong population growth and a persistent shortage of dwellings should continue to prop up prices.

We expect some tempering in the pace of price growth and are forecasting dwelling price growth of 6–7% this year. This is slightly lower than our previous forecast, which assumed just one rate hike from the RBA. We’ve since added a second 2026 rate hike to our forecast profile for 2026. Growth of 6–7% is also slower than in calendar year 2025 when dwelling‑price growth was 8.6%.

Disclaimer

This report has been prepared for general informational purposes only and does not constitute personal financial advice. It does not take into account your specific objectives, financial situation, or needs. Before acting on any information in this report, you should consider its appropriateness in light of your circumstances and seek independent financial advice. The author holds, or may hold, positions in some of the securities mentioned in this report. These holdings may represent a potential conflict of interest. No representation or warranty is made as to the accuracy, completeness, or reliability of the information contained herein. Past performance is not a reliable indicator of future performance.