Inflation now joins employment in signalling an economy that is running hotter than policymakers expected. A rate hike next week is now the most probable outcome. It also prompts us to revise our 2026 outlook. We had one rate rise in our forecasts since late last year. We now expect two rate hikes this year with the first to be handed down next week.

Underlying inflation is the focus of RBA policy. It rose by 0.9% in the quarter, a tad slower than the 1.0% gain in the previous quarter, but still strong. It took the annual rate up from 3.0% in the September quarter to 3.4% in the December quarter. This is above the RBA’s own forecast published in November for a 3.3% outcome. The pick up began over the second half of last year and over this period, trimmed mean inflation grew 3.9%!

The lift in inflation follows stronger labour-market outcomes. Data last week revealed the unemployment rate averaged 4.2% in the December quarter, below the RBA’s forecast of 4.4%. This mix of stronger price pressures and a firmer jobs market points to an economy that is outperforming the RBA’s expectations.

Headline inflation increased by 0.6% in the quarter and the annual rate rose from 3.2% to 3.6%. Electricity prices continue to contribute strongly as government energy rebates unwind.

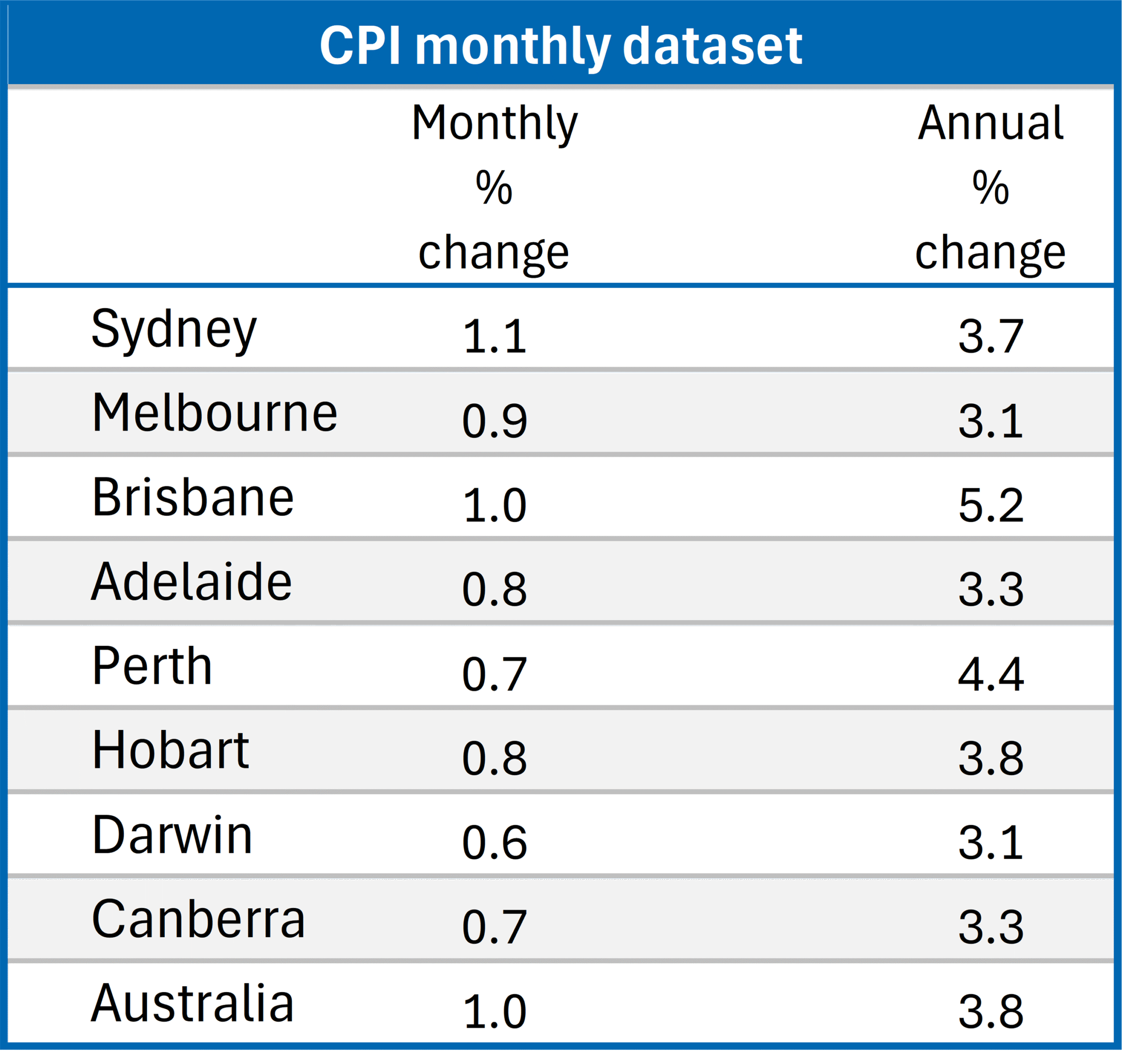

The monthly data series showed headline inflation at 3.8% in the year to December and underlying inflation growth of 3.3% year-on-year.

One deliberation for policymakers next week will be the impact of the escalation in geopolitical tensions and the increase in uncertainty since the start of the year. These developments have contributed to a sharp selloff in the US dollar and to joint intervention by the United States and Japan in the currency market to support the yen. It has also spurred the spot gold price to new all-time highs. The US dollar index fell overnight to its lowest level since February 2022.

This backdrop together with the prospect of a near-term rate hike in Australia has helped propel the Australian dollar to a near three-year high of 0.7023 during today’s trade.

For policy making, the more important measure is the trade-weighted index (TWI). The TWI measures the value of the Australian dollar against the currencies of our major trading partners. The weights reflect each partner’s share in Australia’s trade. The TWI has appreciated. If this appreciation is sustained, it should help contain the prices of imported goods and services and ease tradables inflation.

The global economy demonstrated a degree of resilience last year, despite ongoing uncertainty. The question now is how long that resilience can continue as geopolitical risks and uncertainty stay high. Policymakers will need to weigh these risks carefully. We think it won’t be enough to keep policy on pause.

Services inflation remains a key challenge. It rose by 4.1% in the year to December. Goods inflation increased by 3.4%. Both remain above the top of the target band. Services prices tend to be sticky. I often describe this as the ‘toothpaste effect’. Once the toothpaste is out of the tube, it is hard to get it back in.

Across the states and territories, Brisbane recorded the fastest inflation rate at 5.2% in the year to December, followed by Perth at 4.4%. The softest annual outcomes were in Melbourne and Darwin at 3.1%, which notably were still above the RBA’s target range. The only capital city to see a slowing in the annual growth rate in December from November was Darwin.