The RBA stayed steady at its July Board meeting and demonstrated they’re cautious cutters. The RBA were awaiting confirmation of their inflation forecasts and received it with today’s data.

The underlying measure of inflation, the focus of the RBA, rose by 0.6% in the quarter and by 2.7% in the year to the June quarter. These results are bang in line with the RBA’s forecasts. It almost certainly seals the deal for a rate cut at the next Board meeting on 11-12 August, taking the cash rate to 3.60%.

The annual rate of growth in the underlying inflation measure (i.e. the trimmed mean) has now slowed for ten straight quarters, from 6.8% in the December quarter of 2022 to 2.7% in the June quarter of 2025. Importantly, it is getting closer to the mid-point of the RBA’s 2-3% inflation target band.

The headline inflation measure receives less attention because, unlike the underlying measure, it does not dampen the effects of irregular or temporary price changes – such as from government subsidies. Headline inflation 0.7% in the quarter and 2.1% over the year.

The quarterly gain in headline inflation was slightly stronger than the underlying measure, partly due to the unwinding of electricity subsidies from some state governments. Electricity prices jumped 8.1% in the quarter.

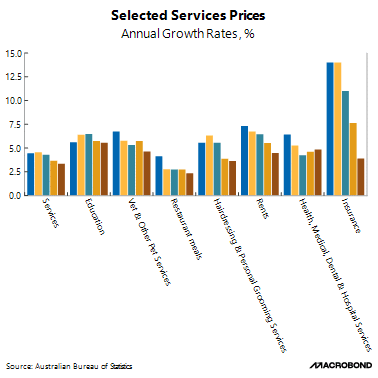

A breakdown of prices by goods and services reveals that services inflation continued to ease across most categories in recent quarters. It rose 0.7% in the quarter and 3.3% over the year, marking the third consecutive quarter of slowing annual growth.

Goods inflation remains subdued and softened further in the June quarter. It rose just 1.1% over the year, with falling fuel prices helping to keep it low. It’s the softest annual growth rate in four years if we exclude the final quarter of last year.

Goods inflation may face further downward pressure, as U.S. tariffs prompt other countries to discount goods in search of alternative markets. It’s too early to see a clear impact from these tariffs in today’s data, but tradables inflation recorded only a modest gain – likely supported by a stronger Australian dollar in trade-weighted terms this quarter compared to the previous one. The stronger Australian dollar partly reflects a sell-off in the U.S. dollar during the quarter, driven by market sentiment around tariffs.

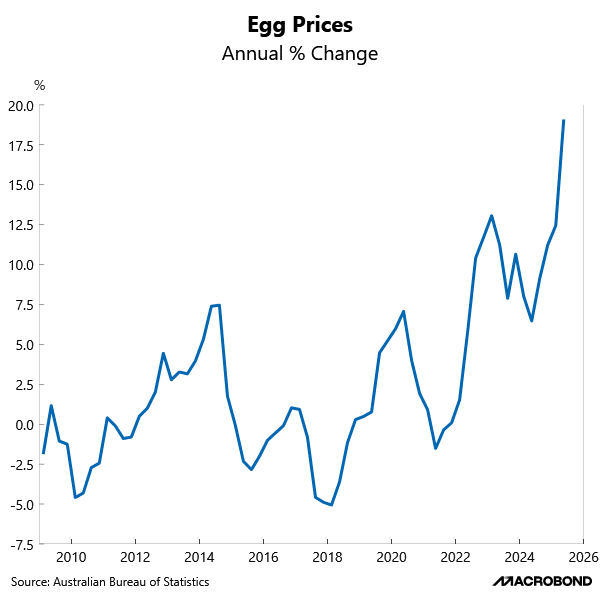

Key contributors to higher inflation in the quarter were health, which rose 1.5%, housing up 1.2%, and food up 1.0%. Food prices were affected by weather-related events earlier this year, particularly in fruit and vegetables. Egg prices continued to climb, rising 19.1% over the year, which is the fastest pace in 29 years, as last year’s bird flu outbreak led to herd reductions and supply shortages. Snacks & confectionery and coffee (my favourites) also posted strong gains. On the downside, lower fuel prices exerted downward pressure on overall inflation.

We believed the RBA should have cut in July. Data on monthly inflation and economic activity are showing the economy is merely toddling along and in need of less restrictive cash-rate settings. Today’s data gives the RBA more confidence to shift its focus toward supporting growth.

Financial markets are fully priced for an August rate cut. Two more cuts are likely – in November 2025 and February 2026. This timing is consistent with the RBA’s cautious and gradual approach. The risk is that this pace may prove too slow and the cash rate may need to fall further to put economic growth on a firmer recovery.

The information in this article is general in nature, intended for informational purposes only and does not constitute financial, investment, legal or professional advice; readers should seek guidance from qualified professionals before making decisions based on its content.